Try trading for beginner – Welcome to the fascinating world of trading! Embark on an educational adventure with our comprehensive guide, tailored specifically for beginners. As you dive into the realm of trading, we’ll illuminate the basics, unravel the complexities of financial markets, and empower you with strategies to navigate the dynamic world of investments.

Throughout this journey, we’ll explore the psychological aspects of trading, unravel common pitfalls, and equip you with essential risk management techniques. Our goal is to provide a solid foundation that will ignite your passion for trading and set you on the path to success.

Getting Started

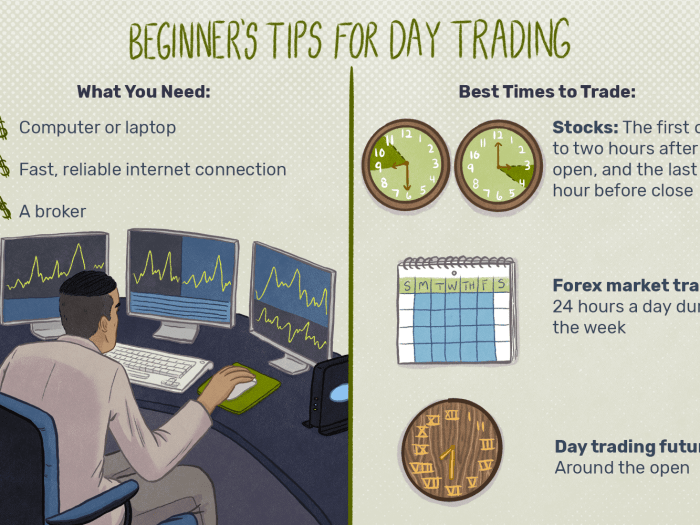

Trading can be a great way for beginners to get started in the financial markets. It’s a relatively simple concept to understand, and there are many resources available to help you learn how to trade. Plus, with the right broker, you can get started with a small amount of money.

When choosing a broker, it’s important to consider factors such as fees, trading platform, and customer service. You’ll also want to make sure that the broker is regulated by a reputable financial authority.

Once you’ve chosen a broker, you’ll need to set up a trading account. This typically involves providing some basic information, such as your name, address, and Social Security number. You’ll also need to fund your account with a deposit.

Choosing a Broker

- Consider fees, trading platform, and customer service.

- Ensure the broker is regulated by a reputable financial authority.

Setting Up a Trading Account

- Provide basic information (name, address, Social Security number).

- Fund your account with a deposit.

Understanding the Market

The financial markets are a vast and complex realm where fortunes are made and lost. To navigate these treacherous waters, it’s essential to have a firm grasp of the different markets and the forces that drive them.From the bustling stock exchanges to the intricate world of foreign exchange, each market has its own unique characteristics and challenges.

Understanding these nuances is crucial for making informed decisions and mitigating risk.

Technical and Fundamental Analysis

In the realm of trading, two primary approaches to market analysis stand out: technical and fundamental analysis. Technical analysis focuses on historical price data and chart patterns to identify potential trading opportunities. By studying these patterns, traders can make educated guesses about future price movements.Fundamental

analysis, on the other hand, delves into the underlying factors that influence a company’s or asset’s value. This includes examining financial statements, industry trends, and economic indicators. By understanding the fundamentals, traders can assess the intrinsic value of an asset and make informed decisions about whether to buy, sell, or hold.

Trying trading for beginners can be overwhelming. But don’t worry, understanding how trading crypto works is a great starting point. Read How Trading Crypto Works: A Beginner’ to learn the basics of crypto trading. With this knowledge, you’ll be well-equipped to navigate the exciting world of trading.

Trading Strategies

In the trading realm, devising a strategy is like charting a course through uncharted waters. It provides a roadmap for your actions, guiding you towards profitable opportunities and steering you clear of potential pitfalls.

For beginners setting sail in the financial markets, two prominent trading strategies emerge: trend following and range trading. Let’s delve into each, unraveling their intricacies and exploring how they can empower your trading journey.

Trend Following

Trend following, akin to riding the crest of a wave, involves identifying and capitalizing on prevailing market trends. This strategy assumes that trends, once established, tend to persist for a period of time, offering traders the chance to profit from their momentum.

To implement a trend following strategy, you’ll need to determine the trend’s direction. This can be done by analyzing price charts, identifying higher highs and higher lows for an uptrend, or lower lows and lower highs for a downtrend.

Once the trend is established, you can enter a trade in the direction of the trend. For instance, if the trend is up, you would buy the asset, aiming to sell it later at a higher price. Conversely, if the trend is down, you would sell the asset, anticipating its further decline.

Trend following strategies can be further refined based on the time frame you’re trading. Short-term trend followers may hold positions for a few hours or days, while long-term trend followers may hold positions for weeks or even months.

Range Trading

Range trading, on the other hand, is like navigating within a confined channel. This strategy capitalizes on the tendency of prices to fluctuate within a specific range, bound by support and resistance levels.

To implement a range trading strategy, you’ll need to identify the support and resistance levels of the asset you’re trading. Support is the price level at which the asset has historically found buyers, while resistance is the price level at which it has historically encountered sellers.

Once the support and resistance levels are established, you can enter a trade when the price approaches either level. For instance, if the price is approaching the support level, you would buy the asset, expecting it to bounce back up.

Conversely, if the price is approaching the resistance level, you would sell the asset, anticipating its decline.

Range trading strategies can be particularly effective in volatile markets, where prices tend to fluctuate within well-defined ranges. By identifying these ranges and trading within them, you can potentially mitigate risk and capitalize on price fluctuations.

Risk Management

Navigating the turbulent waters of trading requires a steadfast understanding of risk management. It’s the life preserver that safeguards your financial vessel from the treacherous currents of the market. By implementing effective risk management strategies, you can mitigate losses, protect your capital, and navigate the unpredictable waters with greater confidence.

Are you a novice trader looking to venture into the realm of crypto trading? Look no further! Dive into How to Profit Trading Crypto: A Comprehensive Guide for an in-depth exploration of the strategies and techniques that will empower you to navigate the volatile crypto market and maximize your profits.

After gaining valuable insights from this guide, return to the fundamentals of trading for beginners, armed with newfound knowledge and a roadmap for success.

Stop-Loss Orders

Stop-loss orders act as your trusty sentries, guarding your positions against excessive drawdowns. These automated orders instruct your broker to sell your assets once they reach a predetermined price level, limiting your potential losses. By setting stop-loss orders, you establish a clear boundary beyond which you’re unwilling to risk further capital.

Position Sizing

Position sizing is the art of allocating your trading capital wisely. It’s the key to ensuring that a single trade doesn’t sink your entire ship. By carefully calculating the appropriate size for each trade based on your risk tolerance and account balance, you can spread your risk across multiple positions, minimizing the impact of any single loss.

Common Mistakes

Every trader makes mistakes, but beginners are particularly prone to certain pitfalls. Recognizing and avoiding these common errors can significantly improve your chances of success in the financial markets.

Jumping In Without a Plan

A well-defined trading plan Artikels your strategy, risk tolerance, and money management rules. Without a plan, you’re more likely to make impulsive decisions based on emotions rather than sound judgment.

Trying trading for beginners can be a daunting task, but with the right guidance, it can be a rewarding experience. If you’re just starting out, I highly recommend checking out the comprehensive guide: How to Start Trading Crypto for Beginners . This guide covers everything you need to know, from choosing the right platform to managing your risk.

Once you’ve mastered the basics, you’ll be well on your way to becoming a successful trader.

Overtrading

Beginners often make the mistake of trading too frequently in an attempt to make quick profits. However, excessive trading can lead to increased risk and reduced profitability.

Ignoring Risk Management

Risk management is crucial for protecting your capital. Proper risk management techniques include setting stop-loss orders, limiting position size, and diversifying your portfolio.

Chasing Losses

When a trade goes against you, it’s tempting to try to recoup your losses by making additional trades. However, this is a dangerous strategy that can lead to even greater losses.

Emotional Trading

Emotions can cloud your judgment and lead to poor trading decisions. Learn to control your emotions and make decisions based on logic and analysis, not fear or greed.

Lack of Education

Trading is a complex and demanding profession. Beginners should invest time in educating themselves about the markets, trading strategies, and risk management techniques.

Ignoring the Trend

The trend is your friend. Beginners often try to trade against the trend, which is a losing proposition. Learn to identify and trade with the trend to increase your chances of success.

Building a Trading Plan: Try Trading For Beginner

A trading plan is your roadmap to success in the markets. It’s a set of rules and guidelines that you follow to ensure you make informed and disciplined trading decisions. Without a plan, you’re more likely to trade emotionally and make mistakes that can cost you money.

Your trading plan should include the following:

- Your trading goals

- Your risk tolerance

- Your trading strategy

- Your money management rules

- Your exit strategy

Setting Trading Goals

The first step in creating a trading plan is to set your trading goals. What do you want to achieve with your trading? Are you looking to make a quick profit, or are you in it for the long haul? Once you know your goals, you can start to develop a trading strategy that will help you achieve them.

Managing Emotions

Trading can be an emotional rollercoaster. It’s important to be able to manage your emotions so that they don’t cloud your judgment. One way to do this is to have a trading plan that you can stick to, even when the market is moving against you.

Tracking Progress

It’s important to track your progress so that you can see what’s working and what’s not. This will help you refine your trading plan and improve your results over time.

Psychological Aspects

Trading involves not just technical skills but also psychological fortitude. Emotions like fear, greed, and overconfidence can cloud judgment and lead to poor decisions.Understanding these psychological aspects is crucial for success. By managing emotions and staying disciplined, traders can mitigate the impact of irrationality and enhance their performance.

As you embark on your trading journey, it’s essential to grasp the fundamentals of calculating profit. How to Calculate Profit in Crypto Trading: A Comprehensive Guide provides an invaluable roadmap to understanding this crucial aspect of trading. With this knowledge, you can navigate the markets with confidence, maximizing your returns and minimizing your risks as you progress in your trading endeavors.

Managing Emotions

- Identify and acknowledge your emotions, both positive and negative.

- Don’t let emotions dictate your trading decisions.

- Develop strategies to manage emotions, such as taking breaks, setting stop-loss orders, or seeking support from a mentor.

Staying Disciplined

- Stick to your trading plan and avoid impulsive trades.

- Control the urge to overtrade or chase losses.

- Set realistic goals and don’t let emotions cloud your judgment.

Educational Resources

Igniting your trading journey requires a solid foundation. Seek knowledge from reliable sources to navigate the complexities of the market.

Try trading for beginner can be challenging, but it doesn’t have to be overwhelming. Our comprehensive guide, How to Day Trade Crypto: A Comprehensive Guide for Beginners , will walk you through the basics of day trading, from choosing the right platform to understanding the different types of orders.

Whether you’re a complete novice or have some experience under your belt, this guide will provide you with the knowledge and confidence you need to get started in the exciting world of try trading for beginner.

Embrace the wisdom shared in books, enroll in comprehensive courses, and tap into the wealth of information available on reputable online platforms. These resources will illuminate the path towards successful trading.

Books

- Trading for Dummies: A beginner-friendly guide that demystifies trading concepts and strategies.

- The Intelligent Investorby Benjamin Graham: A classic text on value investing, emphasizing the importance of patience and discipline.

- Technical Analysis of the Financial Marketsby John J. Murphy: An in-depth exploration of technical analysis, providing tools for identifying trading opportunities.

Courses

- Udemy’s Trading Academy: A comprehensive curriculum covering all aspects of trading, from beginner to advanced levels.

- Coursera’s Trading and Investing Specialization: A series of courses from top universities, offering a holistic understanding of financial markets.

- Investopedia Academy: Free online courses and tutorials on a wide range of trading topics, suitable for beginners and experienced traders alike.

Online Platforms

- TradingView: A social trading platform with real-time market data, charting tools, and educational resources.

- Babypips: A renowned online school for beginner traders, providing free courses and webinars on forex and CFD trading.

- Investopedia: A comprehensive financial dictionary and resource hub, offering articles, videos, and interactive tools on all aspects of investing and trading.

Community and Support

In the vast realm of trading, embarking on a solitary journey can be daunting. But fear not, for the trading community stands ready to offer a beacon of support and camaraderie. Joining online forums and social media groups dedicated to trading can unlock a wealth of benefits that will accelerate your learning curve and boost your chances of success.

Within these vibrant communities, you’ll find a diverse group of traders, from seasoned veterans to eager novices. Their collective knowledge and experience form an invaluable resource, fostering an environment where questions are answered, strategies are shared, and insights are exchanged.

This cross-pollination of ideas not only broadens your understanding of the markets but also provides a constant source of inspiration and motivation.

Peer Support and Encouragement

- Shared Experiences:Connect with traders who have faced similar challenges and triumphs, fostering a sense of camaraderie and belonging.

- Emotional Support:Trading can be an emotionally charged endeavor. Community members offer encouragement and support during turbulent times, helping you maintain a positive mindset.

- Accountability and Motivation:Share your trading goals and progress with the community, creating a sense of accountability and motivation to stay on track.

Access to Expert Insights, Try trading for beginner

- Seasoned Traders:Engage with experienced traders who have mastered the art of trading. Their insights and guidance can prove invaluable in navigating the complexities of the markets.

- Market Analysis:Community forums often feature in-depth market analysis, providing you with valuable perspectives and trade ideas.

- Webinars and Events:Many trading communities host webinars and online events featuring industry experts and thought leaders, offering exclusive access to cutting-edge knowledge.

Practice and Simulation

In the realm of trading, practice and simulation are your indispensable allies, guiding you towards mastery and minimizing costly missteps. Think of them as the training wheels that empower you to navigate the volatile market with confidence.

Trading simulators and demo accounts serve as virtual playgrounds where you can hone your skills without risking real capital. These tools mimic real-world trading conditions, allowing you to test strategies, explore different markets, and develop a deep understanding of market dynamics.

Trading Simulators

Trading simulators are sophisticated platforms that provide a highly realistic trading experience. They simulate market fluctuations, order execution, and even emotional reactions, immersing you in a true-to-life trading environment.

The beauty of trading simulators lies in their ability to fast-forward time, enabling you to witness market movements and test strategies over extended periods. This accelerated learning curve allows you to gain valuable experience in a compressed timeframe.

Demo Accounts

Demo accounts, offered by most online brokerages, provide a risk-free way to practice trading with virtual funds. These accounts allow you to execute trades, monitor market conditions, and track your progress without putting your real capital on the line.

Demo accounts are ideal for beginners seeking a safe and controlled environment to experiment with different trading techniques and build confidence before venturing into live trading.

End of Discussion

As you conclude this guide, remember that trading is a continuous learning process. Embrace the ever-evolving nature of financial markets, stay informed, and never cease to refine your skills. With dedication and a commitment to growth, you can unlock the potential of trading and achieve your financial aspirations.

User Queries

What is the best trading strategy for beginners?

Trend following and range trading are suitable strategies for beginners due to their simplicity and effectiveness.

How can I minimize risk in trading?

Implement stop-loss orders, manage position sizing, and adhere to a risk management plan.

What are the common mistakes made by beginner traders?

Overtrading, ignoring risk management, and emotional decision-making are prevalent mistakes.

Where can I find educational resources for trading?

Books, online courses, trading simulators, and webinars are valuable resources for learning about trading.

Is trading suitable for everyone?

While trading offers potential rewards, it also involves risk. It’s crucial to assess your financial situation, risk tolerance, and knowledge before venturing into trading.