Embark on an enlightening journey into the world of mortgage house in Malaysia, where we unravel the intricacies of homeownership. From understanding mortgage interest rates to exploring government schemes, this comprehensive guide will empower you to make informed decisions and secure your dream home.

Our narrative delves into the types of mortgages available, eligibility criteria, and the application process, ensuring you navigate the complexities of mortgage financing with ease. We’ll shed light on mortgage repayment options, insurance, and the importance of financial planning. Whether you’re a first-time homebuyer or seeking to refinance, this guide serves as your trusted companion throughout your homeownership journey.

Mortgage Interest Rates in Malaysia

When it comes to securing a mortgage in Malaysia, understanding mortgage interest rates is crucial. These rates directly impact the monthly payments you’ll make and the overall cost of your home loan.

Mortgage interest rates in Malaysia vary depending on several factors, including the bank you choose, the type of loan you apply for, and the current economic climate. To provide a clearer picture, let’s delve into the current mortgage interest rates offered by different banks in Malaysia:

| Bank | Interest Rate (p.a.) |

|---|---|

| Maybank | 4.20% |

| CIMB | 4.25% |

| Public Bank | 4.30% |

| HSBC | 4.35% |

| Standard Chartered | 4.40% |

It’s important to note that these rates are subject to change based on market conditions and individual circumstances. To secure the best possible rate, it’s advisable to compare offers from multiple banks and negotiate with lenders to obtain the most favorable terms.

Factors Influencing Mortgage Interest Rates

Several factors play a role in determining mortgage interest rates in Malaysia:

- Base Rate (BR):The BR is set by Bank Negara Malaysia (BNM) and serves as the benchmark for all other interest rates in the country. When the BR increases, mortgage interest rates tend to follow suit.

- Overnight Policy Rate (OPR):The OPR is another key interest rate set by BNM. It influences the cost of borrowing for banks, which in turn affects the interest rates they offer on mortgages.

- Bank’s Funding Costs:Banks need to borrow funds to provide mortgages. The cost of these funds influences the interest rates they charge borrowers.

- Loan-to-Value (LTV) Ratio:The LTV ratio represents the percentage of the property’s value that is being financed. A higher LTV ratio typically results in a higher interest rate.

- Loan Tenure:The length of the loan term also affects the interest rate. Longer loan tenures generally come with higher interest rates.

- Credit Score:Your credit score is an important factor that banks consider when determining your mortgage interest rate. A higher credit score indicates a lower risk of default, which can lead to a lower interest rate.

Impact of Interest Rates on Monthly Mortgage Payments

Mortgage interest rates directly impact the amount of your monthly mortgage payments. A higher interest rate means higher monthly payments, while a lower interest rate results in lower monthly payments. The following formula illustrates this relationship:

Monthly Payment = Principal + Interest

Where:

- Principal:The amount of the loan borrowed

- Interest:The cost of borrowing the money, calculated as a percentage of the principal

For example, if you borrow RM500,000 at an interest rate of 4.20% per annum, your monthly mortgage payment would be approximately RM2,235. If the interest rate increases to 4.50%, your monthly payment would increase to approximately RM2,310.

Types of Mortgages in Malaysia

Purchasing a home is a significant financial decision, and understanding the various types of mortgages available in Malaysia is crucial. Mortgages can be broadly classified into three main categories: conventional, Islamic, and flexi mortgages. Each type offers unique features and benefits, catering to different financial needs and preferences.

Conventional Mortgages

- Fixed-Rate Mortgage:Interest rates remain constant throughout the loan tenure, providing stability and predictability in monthly repayments.

- Variable-Rate Mortgage:Interest rates fluctuate based on market conditions, leading to potential variations in monthly repayments.

- Hybrid Mortgage:A combination of fixed and variable rates, offering a balance between stability and flexibility.

Islamic Mortgages

Islamic mortgages, also known as Shariah-compliant mortgages, adhere to Islamic principles and avoid interest-based financing. Instead, they utilize alternative financing structures such as:

- Musharakah Mutanaqisah:A partnership-based financing where the bank and the borrower jointly purchase the property, with the borrower gradually increasing their ownership share over time.

- Bai Bithaman Ajil (BBA):A sale and leaseback arrangement where the bank sells the property to the borrower and then leases it back to them with a gradual purchase option.

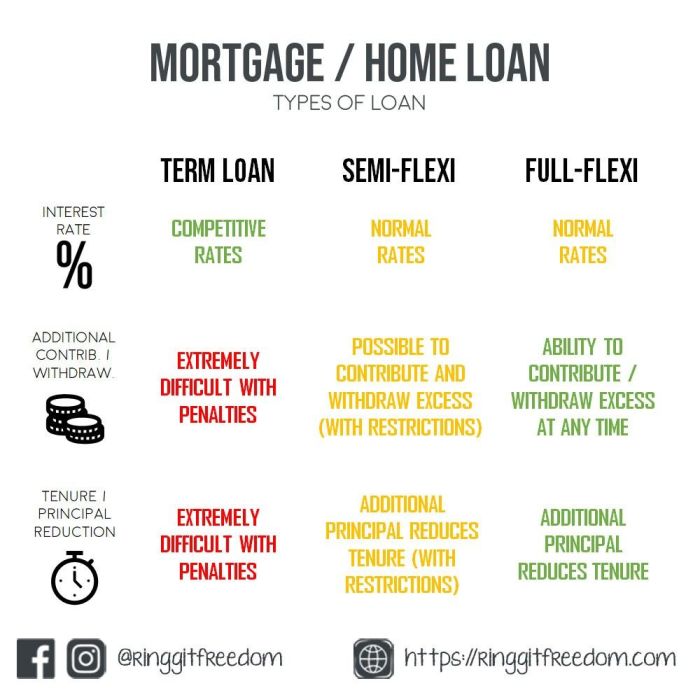

Flexi Mortgages

Flexi mortgages provide flexibility in managing mortgage repayments. They typically offer features such as:

- Flexi Repayment:Borrowers can adjust their monthly repayments within predefined limits, allowing for higher repayments when financially capable.

- Flexi Withdrawal:Borrowers can withdraw excess funds from their mortgage account without penalty, providing access to liquidity when needed.

Eligibility Criteria, Mortgage house in malaysia

Eligibility criteria for different types of mortgages may vary depending on the lender and the borrower’s financial profile. Common factors considered include:

- Credit score and history

- Debt-to-income ratio

- Loan-to-value ratio

- Employment stability

- Age and citizenship

Mortgage Eligibility and Application Process

Obtaining a mortgage in Malaysia is a significant step that requires careful planning and preparation. Let’s delve into the eligibility criteria and guide you through the application process to make your homeownership journey smoother.

Eligibility Criteria, Mortgage house in malaysia

To qualify for a mortgage in Malaysia, you need to meet certain criteria set by banks and financial institutions. These typically include:

- Malaysian citizen or permanent resident

- Stable income with a proven track record

- Good credit history with no major defaults

- Debt-to-income ratio (DTI) within acceptable limits

- Sufficient down payment, typically ranging from 10% to 20%

Application Process

Once you meet the eligibility criteria, the mortgage application process involves the following steps:

- Pre-approval:Determine your affordability by obtaining a pre-approval letter from a bank or financial institution. This will give you an idea of how much you can borrow.

- Property search:Find your dream home within your approved budget.

- Formal application:Submit a formal mortgage application to the lender along with the required documents (see below).

- Loan assessment:The lender will assess your application based on your financial situation, credit history, and property details.

- Loan approval:If your application is approved, you will receive a loan offer with the terms and conditions of your mortgage.

- Loan disbursement:Once you accept the loan offer, the lender will disburse the funds to purchase your property.

Required Documents

To support your mortgage application, you will need to provide the following documents:

- Identity card (MyKad or passport)

- Proof of income (e.g., payslips, bank statements)

- Credit report

- Property valuation report

- Sales and purchase agreement

Mortgage Repayment Options

In the journey of homeownership, choosing the right mortgage repayment option is crucial. Whether you opt for monthly, semi-monthly, or annual payments, each schedule comes with its unique advantages and considerations.

Monthly Payments

The most common repayment option, monthly payments provide consistency and predictability. They align with the typical monthly income cycle, making budgeting and tracking expenses straightforward. However, this option often results in a higher total interest paid over the loan term.

Semi-Monthly Payments

By splitting your payments into two smaller installments made every two weeks, semi-monthly payments can reduce the overall interest charges. This is because you’re making extra payments towards your principal each year, effectively shortening the loan term.

Annual Payments

Annual payments, though less common, can be beneficial if you have a stable income and prefer to make a single large payment once a year. This option minimizes the number of transactions and can potentially lower interest charges, but it requires significant financial discipline.

Mortgage Insurance

Purchasing a home is a significant financial commitment, and protecting this investment is crucial. Mortgage insurance acts as a safety net, ensuring that your lender is compensated if you default on your mortgage payments.

In Malaysia, there are two main types of mortgage insurance:

Mortgage Reducing Term Assurance (MRTA)

- MRTA provides coverage for the outstanding loan amount, which decreases as you make mortgage payments.

- The cost of MRTA is typically lower than other types of mortgage insurance.

- MRTA does not provide coverage for the down payment or closing costs.

Mortgage Level Term Assurance (MLTA)

- MLTA provides coverage for the original loan amount, regardless of how much you have paid off.

- The cost of MLTA is typically higher than MRTA.

- MLTA provides coverage for the down payment and closing costs in addition to the loan amount.

The cost of mortgage insurance varies depending on factors such as your age, health, and the amount of coverage you need. It is typically calculated as a percentage of the loan amount and added to your monthly mortgage payment.

Stamp Duty and Legal Fees

When securing a mortgage in Malaysia, you will encounter additional costs beyond the loan amount, including stamp duty and legal fees. Understanding these expenses is crucial for budgeting and planning your mortgage expenses.

Stamp duty is a tax imposed by the government on legal documents, including mortgage agreements. It is calculated based on the loan amount and varies depending on the property’s location. Legal fees cover the services of a lawyer or conveyancer who handles the legal aspects of the mortgage transaction, such as preparing and reviewing documents.

Stamp Duty Rates

The stamp duty rates in Malaysia are as follows:

| Loan Amount | Stamp Duty Rate |

|---|---|

| Up to RM100,000 | 1% |

| RM100,001 to RM500,000 | 2% |

| RM500,001 to RM1 million | 3% |

| RM1 million and above | 4% |

For example, if you take out a mortgage of RM500,000, the stamp duty would be RM10,000 (2% of RM500,000).

Legal Fees

Legal fees for mortgage transactions typically range from RM1,500 to RM3, 000. These fees cover the lawyer’s services, such as:

- Preparing and reviewing the mortgage agreement

- Conducting title searches

- Attending to the signing of the mortgage documents

- Disbursing the mortgage funds

Impact on Mortgage Costs

Stamp duty and legal fees can significantly impact your overall mortgage costs. It is important to factor these expenses into your budget when planning for a mortgage. By understanding the rates and fees associated with these costs, you can make informed decisions and ensure that you have the necessary funds available.

Government Schemes for Mortgage Financing

The Malaysian government offers various schemes to assist first-time homebuyers and those seeking mortgage financing. These schemes aim to make homeownership more accessible and affordable for eligible individuals.

Each scheme has its own eligibility criteria and benefits, which we will explore in detail.

When considering a mortgage house in Malaysia, one may also explore alternative investment options like cryptocurrency. If you’re new to the world of digital assets, How to Start Trading Crypto for Beginners: A Comprehensive Guide provides valuable insights to help you navigate this exciting market.

Once you’ve gained some knowledge in cryptocurrency trading, you can return to your mortgage house plans in Malaysia with a broader financial perspective.

My First Home Scheme (My First Home Scheme)

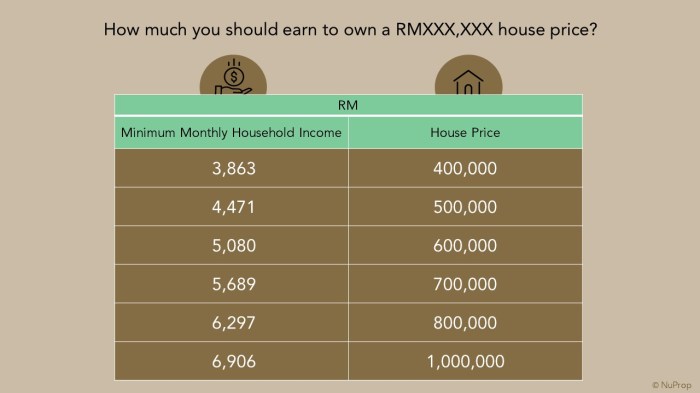

The My First Home Scheme is designed to help first-time homebuyers with a household income of less than RM5,000 per month purchase their first property.

- Eligible individuals can obtain financing of up to 100% of the property’s value, subject to a maximum of RM500,000.

- The scheme offers a stamp duty exemption on the instrument of transfer and loan agreement.

- Additionally, first-time homebuyers are entitled to a 50% reduction on the legal fees for the purchase.

MyHome Scheme (MyHome Scheme)

The MyHome Scheme is another government initiative that assists first-time homebuyers and those with household incomes of less than RM10,000 per month.

To become a successful investor in mortgage houses in Malaysia, it’s crucial to understand the nuances of calculating profit. Whether you’re a seasoned pro or just starting out, our comprehensive guide to crypto trading, How to Calculate Profit in Crypto Trading: A Comprehensive Guide , provides invaluable insights into the complexities of this dynamic market.

By mastering these principles, you’ll gain the knowledge and confidence to make informed decisions that can lead to substantial profits in the realm of mortgage houses in Malaysia.

- Under this scheme, eligible individuals can obtain financing of up to 90% of the property’s value, subject to a maximum of RM400,000.

- The MyHome Scheme also provides a stamp duty exemption on the instrument of transfer and loan agreement, as well as a 50% reduction on legal fees.

PR1MA (PR1MA)

PR1MA (Program Perumahan Rakyat 1Malaysia) is a government-owned company that develops and sells affordable homes to middle-income earners.

- PR1MA homes are priced between RM100,000 and RM400,000, making them accessible to a wider range of buyers.

- To be eligible for a PR1MA home, applicants must meet certain income and household size criteria.

- PR1MA offers various financing options, including conventional loans, Islamic financing, and rent-to-own schemes.

Mortgage Calculators

Mortgage calculators are invaluable tools for homebuyers and homeowners alike. They provide a quick and easy way to estimate monthly mortgage payments and understand the factors that affect them.

The most important factors that influence mortgage payments are the loan amount, interest rate, and loan term. The loan amount is the total amount of money you borrow to purchase your home. The interest rate is the percentage of the loan amount that you pay each year in interest.

If you’re looking to buy a mortgage house in Malaysia, it’s important to do your research and understand the process. From getting pre-approved for a loan to finding the right property, there are many steps involved. To make the process easier, consider checking out How to Day Trade Crypto: A Comprehensive Guide for Beginners . This guide will provide you with everything you need to know about day trading crypto, including how to get started, how to choose the right platform, and how to manage your risk.

Once you’ve mastered the basics of day trading crypto, you can use your profits to invest in a mortgage house in Malaysia and start building your dream home.

The loan term is the length of time you have to repay the loan.

Using Mortgage Calculators for Financial Planning

Mortgage calculators can be used for a variety of financial planning purposes. For example, you can use them to:

- Estimate your monthly mortgage payment

- Compare different loan options

- Plan for future homeownership

Using a mortgage calculator is a great way to get a better understanding of your mortgage options and make informed financial decisions.

In the vibrant tapestry of Malaysia’s real estate market, where mortgage houses weave dreams into tangible homes, a whisper echoes from the realm of cryptocurrency. How to Profit Trading Crypto: A Comprehensive Guide unveils a roadmap to financial empowerment, inviting aspiring homeowners to explore the lucrative world of digital assets.

By harnessing the power of crypto trading, one can amplify their financial potential, unlocking the gateway to their dream mortgage house in Malaysia.

Tips for Getting a Mortgage

Obtaining a mortgage is a significant financial undertaking, and there are several strategies you can adopt to increase your chances of securing a favorable loan.

Enhancing your credit score is crucial. This entails paying your bills on time, maintaining a low credit utilization ratio, and limiting the number of new credit inquiries.

Importance of Saving for a Down Payment

Saving for a substantial down payment demonstrates your financial responsibility and reduces the amount you borrow. Aim to save at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI).

Benefits of Pre-Approval for Mortgages

Pre-approval from a lender strengthens your position as a buyer. It indicates to sellers that you are a serious and qualified candidate, increasing your chances of having an offer accepted.

Owning a home in Malaysia through a mortgage can be a daunting task, but it can also be a rewarding one. However, if you’re looking for a way to supplement your income and potentially increase your financial freedom, you may want to consider exploring the world of cryptocurrency trading.

How Trading Crypto Works: A Beginner’s Guide provides a comprehensive overview of this exciting and potentially lucrative field. Once you’ve gained a solid understanding of crypto trading, you can use your newfound knowledge to make informed decisions and potentially grow your wealth, which can then be used to pay off your mortgage faster or invest in other financial goals.

Mortgage Refinancing: Mortgage House In Malaysia

Mortgage refinancing is a financial strategy that involves replacing your existing mortgage with a new one, typically with different terms, interest rates, or loan amounts. Homeowners consider refinancing for various reasons, including lowering monthly payments, securing a lower interest rate, shortening the loan term, or accessing cash through a cash-out refinance.

Step-by-Step Guide to Mortgage Refinancing

The mortgage refinancing process typically involves the following steps:

- Assess your financial situation:Determine if refinancing is right for you by evaluating your current mortgage terms, financial goals, and market conditions.

- Shop around for lenders:Compare interest rates, fees, and loan terms from multiple lenders to find the best deal.

- Get pre-approved:Submit a loan application to a lender to determine your eligibility and secure a pre-approval letter.

- Lock in your interest rate:Once you find a suitable lender, lock in your interest rate to protect against market fluctuations.

- Appraisal and home inspection:The lender will order an appraisal and home inspection to determine the value of your property and ensure it meets their requirements.

- Closing:Attend the closing meeting to sign the new mortgage documents and finalize the refinancing process.

Foreclosure and Default

Defaulting on your mortgage payments can have serious consequences, including foreclosure. In Malaysia, foreclosure is a legal process that allows the lender to take possession of your property if you fail to meet your mortgage obligations.

Consequences of Mortgage Default

The consequences of mortgage default can be severe. You may lose your home, damage your credit score, and face legal action. Additionally, you may be responsible for paying the lender’s legal fees and other expenses incurred during the foreclosure process.

Foreclosure Process in Malaysia

The foreclosure process in Malaysia typically involves the following steps:

- The lender sends you a notice of default.

- You have a period of time to bring your payments up to date.

- If you fail to bring your payments up to date, the lender may file a foreclosure lawsuit.

- The court will issue a judgment of foreclosure, which gives the lender the right to sell your property.

- The lender will sell your property at a foreclosure sale.

- The proceeds from the sale will be used to pay off your mortgage and other expenses. Any remaining funds will be returned to you.

Resources for Homeowners Facing Foreclosure

If you are facing foreclosure, there are resources available to help you. You can contact your lender to discuss your options. You can also contact a housing counselor or legal aid organization for assistance.

Closing Notes

As we conclude our exploration of mortgage house in Malaysia, we hope you feel equipped with the knowledge and confidence to embark on this significant financial endeavor. Remember, homeownership is not merely a transaction; it’s an investment in your future and the foundation of lasting memories.

We invite you to embrace this journey with enthusiasm, knowing that the rewards of homeownership far outweigh the challenges.

FAQ Insights

What is the average mortgage interest rate in Malaysia?

As of [Date], the average mortgage interest rate in Malaysia ranges between 3.5% to 4.5%, depending on the type of mortgage, loan tenure, and individual credit profile.

What are the eligibility criteria for a mortgage in Malaysia?

To be eligible for a mortgage in Malaysia, you typically need to be a Malaysian citizen or permanent resident, have a stable income, a good credit score, and a debt-to-income ratio below 35%.

What are the different types of mortgages available in Malaysia?

There are various types of mortgages available in Malaysia, including conventional mortgages, Islamic mortgages, flexi mortgages, and graduate mortgages. Each type has its unique features and benefits, tailored to specific needs and financial situations.