In the world of finance, understanding loan-to-value (LTV) is crucial for both borrowers and lenders. LTV plays a significant role in determining loan eligibility, interest rates, and risk assessment. This comprehensive guide will delve into the intricacies of LTV, exploring its calculation, influencing factors, limits, and impact on loan terms and real estate trends.

LTV is a financial metric that measures the relationship between the loan amount and the value of the underlying asset, typically a property. It is expressed as a percentage, providing insights into the borrower’s equity stake in the property and the lender’s risk exposure.

A higher LTV indicates a smaller down payment and greater reliance on borrowed funds, while a lower LTV suggests a more substantial down payment and reduced risk for the lender.

Loan to Value (LTV) Definition

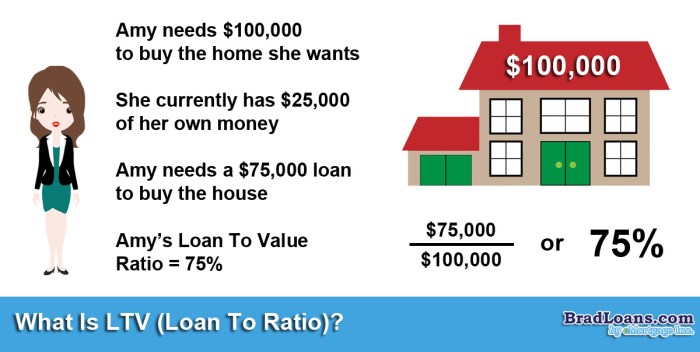

Imagine you’re applying for a loan to buy your dream home. The lender will ask for your loan amount and the value of the house you’re purchasing. This is where Loan to Value (LTV) comes into play.

LTV is a financial ratio that measures the amount of the loan you’re borrowing compared to the value of the property you’re using as collateral. It’s expressed as a percentage, and it helps lenders determine the risk associated with lending you money.

Calculating LTV

Calculating LTV is straightforward. Simply divide the loan amount by the appraised value of the property:

LTV = Loan Amount / Appraised Value of Property

For example, if you’re applying for a loan of $200,000 to buy a house appraised at $250,000, your LTV would be:

LTV = $200,000 / $250,000 = 0.8 or 80%

Importance of LTV

LTV plays a crucial role in loan applications because it indicates the amount of equity you have in the property. A lower LTV means you have more equity, which reduces the lender’s risk and makes you a more attractive borrower.

This can result in lower interest rates and better loan terms.

Factors Influencing LTV

Determining LTV involves a careful assessment of various factors that can influence its value. These factors include the property’s market value, the loan amount, and the down payment made by the borrower. Each of these components plays a crucial role in shaping the LTV ratio.

Property Value

The property value serves as the foundation for LTV calculation. A higher property value generally results in a lower LTV ratio. This is because the higher the property value, the greater the equity the borrower has in the property. For instance, if a property is valued at $200,000 and the loan amount is $150,000, the LTV ratio would be 75%.

Loan Amount

The loan amount is another critical factor that affects LTV. A larger loan amount typically leads to a higher LTV ratio. This is because a larger loan means the borrower is borrowing a greater portion of the property’s value. For example, if the property value remains at $200,000, but the loan amount increases to $180,000, the LTV ratio would rise to 90%.

Down Payment

The down payment made by the borrower also has a significant impact on LTV. A larger down payment results in a lower LTV ratio. This is because a larger down payment reduces the loan amount needed, which in turn lowers the LTV.

For instance, if the property value remains at $200,000 and the loan amount decreases to $120,000 due to a larger down payment, the LTV ratio would drop to 60%.

LTV Limits and Requirements

Lenders typically establish LTV limits to manage their risk exposure. These limits vary depending on the lender, the type of property, and the borrower’s financial profile.

LTV limits are primarily determined by the perceived risk associated with the loan. For instance, a lender may impose a lower LTV limit for a vacation home or an investment property than for a primary residence, as these properties tend to carry higher risk.

LTV Limits for Different Loan Programs

- Conventional Loans: Typically require an LTV of 80% or less, with a minimum down payment of 20%.

- FHA Loans: Backed by the Federal Housing Administration, these loans allow for LTVs up to 96.5% with a minimum down payment of 3.5%.

- VA Loans: Offered to eligible veterans and active-duty military members, these loans generally do not require a down payment, resulting in LTVs of up to 100%.

LTV and Risk Assessment

LTV plays a crucial role in assessing the risk associated with a loan. Lenders use LTV to gauge the borrower’s equity in the property and their ability to repay the loan. A higher LTV indicates a higher risk for the lender, as the borrower has less financial stake in the property.

Relationship between LTV and Default Rates

Studies have shown a strong correlation between LTV and default rates. Higher LTVs are associated with higher default rates, as borrowers with less equity are more likely to walk away from the property if they encounter financial difficulties. This is because they have less to lose if they default on the loan.

Risk Mitigation Strategies Based on LTV

Lenders mitigate risk based on LTV by implementing various strategies. These include:* Setting LTV limits: Lenders establish maximum LTV limits for different loan types and property types.

Requiring private mortgage insurance (PMI)

For loans with LTVs above a certain threshold, lenders may require PMI, which protects the lender in case of default.

Adjusting interest rates

Loans with higher LTVs may come with higher interest rates, as lenders charge a premium for the increased risk.

Restricting loan terms

Lenders may limit the loan term for loans with high LTVs, reducing the total amount of interest paid and the potential loss in case of default.

Impact of LTV on Loan Terms

Loan-to-value (LTV) significantly influences the interest rates and terms of a loan. A higher LTV indicates a greater risk for the lender, leading to higher interest rates and stricter loan terms.

Conversely, a lower LTV signals a lower risk, resulting in more favorable loan terms, such as lower interest rates and more flexible repayment options.

Trade-offs between LTV and Loan Terms

Borrowers must carefully consider the trade-offs between LTV and loan terms. While a higher LTV may enable them to purchase a more expensive property, it may also lead to higher monthly payments and overall borrowing costs.

On the other hand, a lower LTV may result in a smaller down payment but can secure more favorable loan terms, ultimately saving money over the loan’s lifetime.

Examples of LTV Impact on Monthly Payments

For instance, a $200,000 loan with an 80% LTV (down payment of $40,000) and a 4% interest rate would have a monthly payment of approximately $1,024.

In contrast, the same loan with a 70% LTV (down payment of $60,000) and a 3.5% interest rate would have a monthly payment of around $917. This demonstrates how a lower LTV can lead to substantial savings on monthly payments.

LTV and Home Equity

Loan-to-value (LTV) ratio plays a crucial role in determining a homeowner’s equity in their property. Equity represents the portion of the home that is actually owned by the borrower, calculated as the difference between the home’s value and the outstanding mortgage balance.

A lower LTV indicates a higher equity stake, while a higher LTV means less equity. This relationship is important because it affects a borrower’s financial flexibility and options.

Impact on Equity

When a borrower has a lower LTV, they have more equity in their home. This equity can be used as collateral for additional loans, such as a home equity line of credit (HELOC) or a home equity loan. It can also be used to make home improvements or renovations without taking on additional debt.

Impact on Refinancing

A lower LTV can also make it easier to refinance a mortgage. Lenders typically offer better interest rates and terms to borrowers with higher equity stakes. This is because they are considered less risky.

Impact on Home Improvement Options

Borrowers with higher equity can also access home improvement loans or lines of credit more easily. These loans allow homeowners to make improvements to their property, which can increase its value and further build equity.

LTV in Commercial Lending

LTV plays a crucial role in commercial lending, influencing loan approvals, interest rates, and overall risk assessment. Unlike residential lending, commercial LTV calculations consider not just the property’s value but also its income-generating potential.

Differences between Residential and Commercial LTV Calculations

In residential lending, LTV is primarily based on the property’s appraised value. In contrast, commercial LTV considers the property’s net operating income (NOI) or projected cash flow. NOI is the property’s annual rental income minus operating expenses. By incorporating NOI, commercial LTV provides a more comprehensive assessment of the property’s ability to generate revenue and repay the loan.

Impact on Loan Approvals and Interest Rates

LTV significantly impacts loan approvals and interest rates in commercial lending. Higher LTVs indicate a higher risk to the lender, as the property’s value or income may not fully cover the loan amount in case of default. Consequently, loans with higher LTVs may require stricter underwriting criteria, higher interest rates, or additional collateral.

Conversely, lower LTVs represent less risk, potentially leading to easier loan approvals and lower interest rates.

LTV in International Markets

Loan-to-value (LTV) is a critical metric used in mortgage lending worldwide. However, its calculation, limits, and requirements vary significantly across different countries.

In many developed countries, LTV limits are set by government regulations or banking industry guidelines. For example, in the United States, the Federal Housing Administration (FHA) typically allows LTVs up to 96.5% for certain types of loans, while conventional loans typically have LTV limits around 80%.

Cultural and Economic Factors

Cultural and economic factors can also influence LTV practices. In countries with strong homeownership cultures, such as the United Kingdom and Canada, higher LTVs are often permitted, as homeownership is seen as a key part of financial stability.

In contrast, countries with high levels of household debt or economic uncertainty may have lower LTV limits to mitigate risk. For example, in South Korea, LTV limits are relatively low, around 60-70%, due to concerns about household debt and the potential for a housing bubble.

LTV and Real Estate Trends

Loan-to-value ratio (LTV) has played a significant role in shaping real estate market trends. Changes in LTV limits have influenced home prices, affordability, and even housing bubbles and market downturns.

Impact on Home Prices and Affordability

Higher LTV limits generally lead to increased home prices. When buyers can borrow more money relative to the value of the property, they have more purchasing power, which drives up prices. Conversely, lower LTV limits reduce affordability, as buyers need to come up with larger down payments, making it harder to qualify for a mortgage.

Housing Bubbles and Market Downturns

LTV has also contributed to housing bubbles and market downturns. In the lead-up to the 2008 financial crisis, for example, lenders loosened LTV requirements, making it easier for buyers to qualify for mortgages. This fueled a surge in home prices and a housing bubble.

When the bubble burst, many homeowners found themselves underwater, owing more on their mortgages than their homes were worth, leading to widespread foreclosures and a market downturn.

Future of LTV

The future of LTV holds exciting prospects as technology and regulations continue to evolve.Technological advancements like artificial intelligence (AI) and machine learning (ML) are enhancing LTV calculations by analyzing vast amounts of data to assess borrowers’ risk profiles more accurately.

This can lead to more tailored and dynamic LTV ratios, reflecting the unique circumstances of each borrower.

Alternative Lending Models

Alternative lending models, such as peer-to-peer (P2P) lending and crowdfunding, are gaining popularity. These models often use different criteria to assess borrowers’ creditworthiness, potentially leading to higher LTVs for non-traditional borrowers.

Future Role of LTV

LTV will continue to play a crucial role in loan underwriting and risk assessment. However, its application may evolve with the integration of new technologies and data sources. LTV will likely become more dynamic, reflecting the evolving risk profiles of borrowers and the changing lending landscape.

Last Word

In conclusion, LTV is a critical factor in loan underwriting and risk assessment. It influences loan terms, home equity, and real estate market trends. Understanding LTV empowers borrowers to make informed decisions about their financing options and enables lenders to assess the risk associated with each loan application.

As the financial landscape evolves, LTV will continue to play a pivotal role in shaping the lending industry and influencing real estate markets.

FAQ Summary

What is a good loan-to-value ratio?

A good LTV ratio is generally considered to be 80% or less. This means that the borrower has a 20% down payment and the lender is financing 80% of the property’s value.

How does LTV affect interest rates?

A higher LTV ratio typically results in a higher interest rate. This is because the lender is taking on more risk by lending a larger portion of the property’s value.

Can I get a loan with a LTV ratio of 100%?

In some cases, it is possible to get a loan with a LTV ratio of 100%. However, these loans are typically only available to borrowers with excellent credit and a strong financial history.

What are the benefits of a low LTV ratio?

A low LTV ratio can provide several benefits, including lower interest rates, more favorable loan terms, and increased equity in the property.

What are the risks of a high LTV ratio?

A high LTV ratio can increase the risk of default, especially if the property value declines. It can also lead to higher interest rates and less favorable loan terms.