The loan-to-deposit ratio (LDR) is a critical metric that measures the extent to which a bank or other financial institution lends out its deposits to borrowers. It plays a pivotal role in assessing a bank’s risk profile, profitability, and overall financial health.

Understanding the dynamics of LDR is essential for financial institutions to effectively manage their assets and liabilities, navigate regulatory requirements, and adapt to evolving market conditions.

This comprehensive guide will delve into the concept of LDR, exploring its calculation, the factors that influence it, and its impact on financial institutions. We will examine strategies for managing LDR effectively, analyze historical trends and global comparisons, and discuss the regulatory frameworks that govern it.

Case studies of successful LDR management strategies will provide practical insights, and frequently asked questions will address common queries.

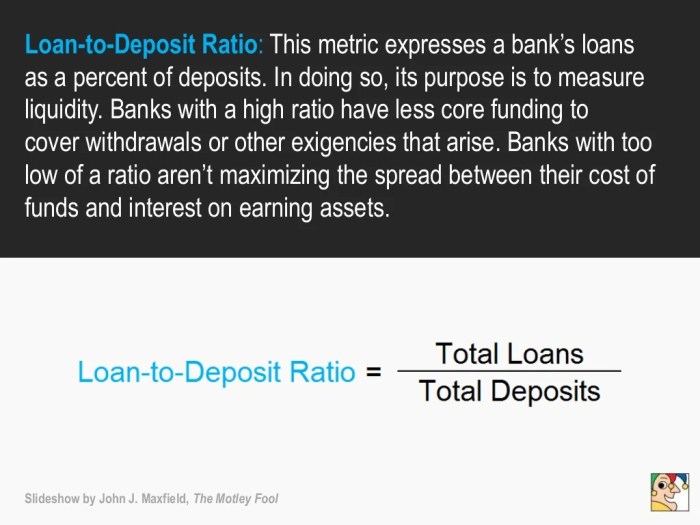

Loan-to-Deposit Ratio (LDR)

The Loan-to-Deposit Ratio (LDR) is a key indicator of a bank’s financial health. It measures the percentage of deposits that a bank has loaned out. A high LDR indicates that the bank is using a large portion of its deposits to make loans, while a low LDR indicates that the bank is holding a large portion of its deposits in reserve.

Calculating LDR

The LDR is calculated by dividing the total amount of loans made by a bank by the total amount of deposits held by the bank. The result is expressed as a percentage.

LDR = Total Loans / Total Deposits x 100%

For example, if a bank has $100 million in deposits and $70 million in loans, its LDR would be 70%.

Factors Influencing LDR

Loan-to-Deposit Ratio (LDR) is a dynamic measure influenced by a complex interplay of economic and regulatory factors. Understanding these factors is crucial for banks and financial institutions to effectively manage their lending practices and ensure financial stability.

Economic Factors

Economic conditions significantly impact LDR. During periods of economic expansion, increased business activity and consumer spending lead to higher demand for loans, pushing LDR upwards. Conversely, in economic downturns, loan demand may decline as businesses and individuals become more cautious, resulting in a lower LDR.

- Interest Rates: Changes in interest rates can affect LDR. Rising interest rates may discourage borrowing, reducing loan demand and lowering LDR. Conversely, falling interest rates can stimulate loan demand and increase LDR.

- Economic Growth: Periods of economic growth typically lead to increased lending activity, as businesses expand and consumers make purchases. This can result in a higher LDR.

- Inflation: Inflation can erode the value of deposits, reducing the overall liquidity of banks. This can prompt banks to increase lending to maintain their profit margins, potentially leading to a higher LDR.

Regulatory Factors

Regulatory policies also play a significant role in shaping LDR. Governments and central banks impose regulations to ensure financial stability and mitigate excessive risk-taking by banks.

- Capital Adequacy Requirements: Regulatory authorities impose minimum capital requirements for banks to ensure they have sufficient capital to cover potential losses. Higher capital requirements can limit banks’ lending capacity, potentially reducing LDR.

- Loan-to-Value (LTV) Ratios: Some regulations restrict the amount of loans that can be made against the value of collateral, such as real estate. Stricter LTV ratios can reduce the availability of loans and lower LDR.

- Reserve Requirements: Central banks may require banks to hold a certain percentage of their deposits as reserves. This can limit the amount of funds available for lending, potentially impacting LDR.

Impact of LDR on Financial Institutions

Loan-to-Deposit Ratio (LDR) plays a pivotal role in shaping the financial health and stability of banks. A high LDR can significantly impact a bank’s risk profile and profitability, as it reflects the balance between the loans it has issued and the deposits it holds.

Impact on Risk Profile

A high LDR indicates that a bank has extended a substantial portion of its deposits as loans. This can increase the bank’s exposure to credit risk, as it becomes more vulnerable to potential loan defaults. In the event of a downturn in the economy or an increase in interest rates, borrowers may struggle to repay their loans, leading to loan losses and reduced asset quality for the bank.

Impact on Profitability

LDR also influences a bank’s profitability. While lending can generate interest income for the bank, it also involves the cost of funds, such as interest paid on deposits. A high LDR can lead to a narrowing of the spread between the interest income earned on loans and the interest expenses incurred on deposits, resulting in lower net interest income.

Additionally, high LDR can limit a bank’s ability to make new loans, as it may face regulatory restrictions or risk aversion due to its high exposure to credit risk.

Managing LDR

Effective LDR management is crucial for financial institutions to maintain stability and mitigate risks. Several strategies can be employed to ensure a healthy LDR.

One key strategy is asset-liability management (ALM). ALM involves matching the maturities and interest rate sensitivity of assets and liabilities to minimize interest rate risk and liquidity mismatches. By aligning the duration of loans with the maturity of deposits, institutions can reduce the impact of interest rate fluctuations on their LDR.

Diversification

Diversifying loan portfolios across different industries, sectors, and geographical regions can mitigate concentration risk and reduce the overall impact of defaults or economic downturns on the LDR.

Credit Risk Management

Implementing robust credit risk management practices, including thorough credit analysis, loan underwriting, and monitoring, helps identify and mitigate potential loan defaults that could adversely affect the LDR.

Deposit Growth

Encouraging deposit growth through attractive interest rates, innovative products, and marketing campaigns can increase the denominator of the LDR, thereby improving the overall ratio.

LDR in Different Industries

The LDR can vary significantly across different industries, reflecting the unique nature of their business models and risk profiles. Understanding these differences is crucial for effective LDR management.

In general, industries with higher levels of risk, such as banking and financial services, tend to have lower LDRs. This is because these industries must maintain a higher level of liquidity to meet potential withdrawals and other obligations. In contrast, industries with lower levels of risk, such as manufacturing and retail, can often afford to have higher LDRs, as they have a more stable cash flow and lower liquidity needs.

Banking and Financial Services

Banks and other financial institutions typically have the lowest LDRs among all industries. This is because they are subject to strict regulatory requirements that limit their ability to lend out too much of their deposits. The LDR for banks is typically around 70-80%, meaning that they lend out approximately 70-80% of the deposits they receive.

Manufacturing and Retail

Manufacturing and retail companies typically have higher LDRs than banks and financial institutions. This is because they have a more stable cash flow and lower liquidity needs. The LDR for manufacturing companies is typically around 80-90%, while the LDR for retail companies is typically around 90-100%.

Other Industries

The LDR for other industries can vary widely depending on the specific industry and its risk profile. For example, utilities typically have low LDRs due to their stable cash flow and low liquidity needs, while technology companies can have high LDRs due to their rapid growth and high cash flow.

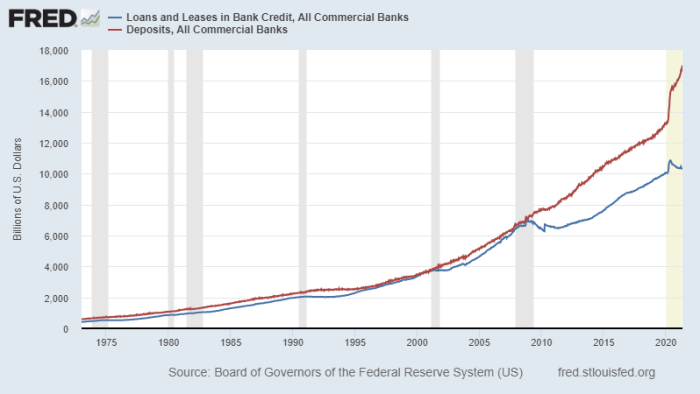

Historical Trends in LDR

Historically, LDR has fluctuated in response to economic conditions, regulatory changes, and industry practices. In the early days of banking, LDRs were typically high, as banks relied heavily on deposits to fund their lending activities.

However, in recent decades, LDRs have declined in many countries due to factors such as:

Changing Risk Appetite

- Increased risk aversion among banks and regulators

- Growth of alternative funding sources, such as securitization and wholesale funding

Regulatory Changes

- Implementation of Basel Accords, which impose capital requirements based on risk

- Restrictions on high-LDR lending in some jurisdictions

Economic Conditions

- Periods of economic growth and low interest rates tend to lead to higher LDRs

- Economic downturns and high interest rates can lead to lower LDRs

Global Comparisons of LDR

Loan-to-Deposit Ratio (LDR) varies significantly across countries and regions. This disparity can be attributed to a complex interplay of economic, regulatory, and cultural factors.

Developed economies typically exhibit lower LDRs compared to developing economies. This is because developed economies have well-established financial systems, characterized by a greater proportion of long-term deposits and a higher level of financial intermediation.

Factors Contributing to Variations in LDR Globally

- Economic Development: Developing economies often have higher LDRs due to a higher demand for credit to fuel economic growth. Conversely, developed economies with more mature financial systems have lower LDRs.

- Regulatory Framework: Government regulations can influence LDRs. Some countries impose limits on LDR to ensure the stability of financial institutions, while others adopt a more flexible approach.

- Cultural Factors: Cultural norms and preferences can also impact LDR. In some cultures, individuals may prefer to save a larger portion of their income, leading to lower LDRs.

Regulatory Frameworks for LDR

In the financial landscape, regulatory frameworks play a pivotal role in shaping the lending practices of institutions. LDR is no exception, as it is subject to various regulations and guidelines. These frameworks aim to ensure the stability and soundness of the financial system while balancing the need for credit availability.

Regulatory Changes and LDR Management

Regulatory changes can significantly impact LDR management. For instance, stricter capital requirements may prompt institutions to reduce their loan portfolios to maintain adequate capital ratios. Conversely, loosening regulations may encourage banks to expand their lending, leading to higher LDRs. Regulators constantly monitor LDR levels and adjust policies accordingly to mitigate systemic risks.

Data Analysis for LDR

Data analysis plays a crucial role in understanding and managing LDR. Tracking LDR over time helps financial institutions identify trends and patterns that can inform strategic decisions.

LDR Trends

A table or chart can be used to illustrate LDR trends over time. This visual representation provides a clear picture of how LDR has changed over different periods. For example, a bank may track its LDR over the past five years to identify seasonal fluctuations or long-term trends.

Statistical Techniques

Various statistical techniques can be employed to analyze LDR. One common method is regression analysis, which helps determine the relationship between LDR and other factors such as economic growth, interest rates, and loan demand. Time series analysis can also be used to identify patterns and forecast future LDR values.

Case Studies on LDR Management

The success of financial institutions heavily relies on their ability to manage their Loan-to-Deposit Ratio (LDR) effectively. Let’s explore case studies that showcase successful LDR management strategies and highlight the lessons learned from these experiences.

Case Study 1: Bank ABC’s Prudent LDR Management

Bank ABC faced challenges in maintaining a healthy LDR due to aggressive lending practices. To address this, they implemented a comprehensive LDR management strategy that involved:

- Setting realistic LDR targets based on market conditions and risk appetite.

- Enhancing credit risk assessment processes to reduce loan defaults.

- Diversifying loan portfolio across different sectors and industries.

- Improving deposit mobilization efforts through competitive rates and innovative products.

By adhering to these measures, Bank ABC successfully reduced its LDR, improved its financial stability, and enhanced its profitability.

Case Study 2: Bank XYZ’s Dynamic LDR Management

Bank XYZ operated in a volatile market where interest rates fluctuated significantly. To navigate these challenges, they adopted a dynamic LDR management approach that involved:

- Using sophisticated modeling techniques to forecast LDR changes based on market scenarios.

- Adjusting lending and deposit rates in response to market conditions to influence LDR.

- Establishing liquidity buffers to absorb unexpected deposit withdrawals.

Bank XYZ’s proactive LDR management allowed it to adapt quickly to market changes, maintain a healthy LDR, and minimize the impact of interest rate fluctuations on its profitability.

Lessons Learned from Case Studies

These case studies highlight the following key lessons for successful LDR management:

- Establish clear LDR targets and monitor them regularly.

- Implement robust credit risk assessment processes.

- Diversify loan portfolios to reduce concentration risk.

- Enhance deposit mobilization strategies.

- Use data analytics and modeling to forecast LDR changes.

- Adjust lending and deposit rates dynamically based on market conditions.

- Maintain liquidity buffers to mitigate deposit withdrawals.

By incorporating these lessons into their LDR management strategies, financial institutions can improve their financial stability, enhance profitability, and navigate challenging market conditions more effectively.

Summary

In conclusion, the loan-to-deposit ratio is a multifaceted metric that serves as a barometer of a financial institution’s financial health. By understanding the dynamics of LDR and implementing effective management strategies, financial institutions can optimize their risk-return profile, enhance profitability, and navigate regulatory requirements.

As the financial landscape continues to evolve, staying abreast of LDR trends and best practices will be crucial for institutions to maintain their stability and competitiveness.

Frequently Asked Questions

What is a healthy loan-to-deposit ratio?

A healthy LDR typically falls within a range of 70% to 90%. However, it can vary depending on the industry, regulatory environment, and economic conditions.

How does LDR impact a bank’s profitability?

A higher LDR generally leads to increased interest income for banks. However, it also elevates the risk of loan defaults, which can erode profitability.

What regulatory frameworks govern LDR?

LDR is subject to regulations imposed by central banks and other financial regulatory bodies. These regulations aim to ensure the stability of the financial system and protect depositors.

How can financial institutions effectively manage LDR?

Effective LDR management involves strategies such as asset-liability management, diversifying loan portfolios, and maintaining adequate capital buffers.