The loan to deposit ratio (LDR) is a crucial financial indicator that measures a bank’s lending activity relative to its deposit base. It provides insights into a bank’s risk exposure, liquidity, and overall financial health. Understanding the LDR is essential for investors, analysts, and policymakers.

This comprehensive guide will delve into the concept of LDR, its calculation, interpretation, and factors that influence it. We will also explore industry comparisons, risk management implications, regulatory considerations, forecasting methods, case studies, and emerging trends in LDR.

Loan-to-Deposit Ratio Overview

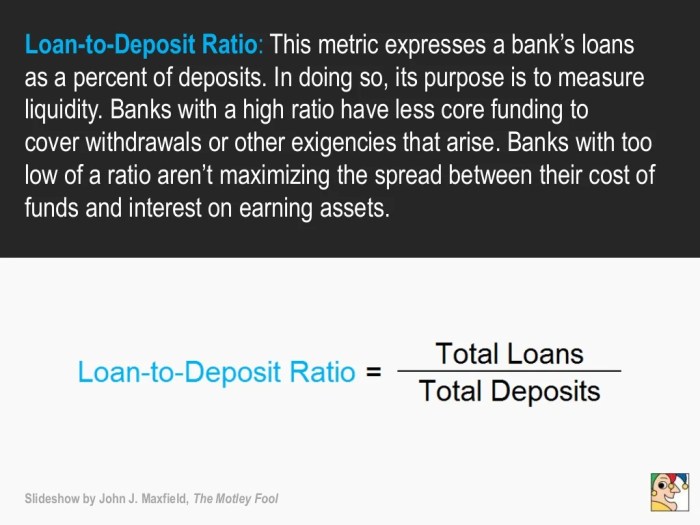

The loan-to-deposit ratio (LDR) is a key financial indicator that measures the proportion of a bank’s deposits that are loaned out. It is calculated by dividing the total amount of loans made by a bank by the total amount of deposits held by the bank.

A high LDR indicates that a bank is lending out a large portion of its deposits, while a low LDR indicates that the bank is holding onto a larger portion of its deposits.LDR is important because it provides insights into a bank’s risk profile.

A high LDR can indicate that a bank is taking on more risk, as it is lending out a larger portion of its deposits. This can make the bank more vulnerable to losses if borrowers default on their loans. A low LDR, on the other hand, can indicate that a bank is being more conservative in its lending practices.

This can make the bank less profitable, as it is earning less interest on its deposits.LDR is also used by regulators to assess the safety and soundness of banks. Regulators typically set limits on the LDR that banks can maintain.

This is to ensure that banks do not take on too much risk and become insolvent.

Calculation and Interpretation

Calculating the loan-to-deposit ratio is crucial for banks to assess their financial health and risk exposure. The formula is straightforward:

Loan-to-Deposit Ratio = Total Loans / Total Deposits

A high ratio indicates that the bank is heavily reliant on deposits to fund its lending activities. Conversely, a low ratio suggests that the bank has ample liquidity and is not heavily exposed to credit risk.

Interpreting Different Values

Interpreting the loan-to-deposit ratio depends on several factors:

- Industry norms: Banks within the same industry typically have similar loan-to-deposit ratios.

- Economic conditions: During economic downturns, banks tend to reduce lending, leading to a lower ratio.

- Bank’s risk appetite: Banks with a higher risk appetite may have a higher loan-to-deposit ratio.

Generally, a ratio below 80% is considered healthy, while ratios above 100% indicate potential liquidity issues.

Factors Affecting the Ratio

The loan-to-deposit ratio is not static and can fluctuate due to various factors, including economic conditions, bank policies, and regulatory requirements. Understanding these factors is crucial for banks to manage their risk and ensure financial stability.

Economic Conditions

Economic conditions play a significant role in determining the loan-to-deposit ratio. During periods of economic growth, businesses and individuals tend to borrow more, leading to an increase in the ratio. Conversely, in economic downturns, loan demand decreases, resulting in a lower ratio.

Bank Policies

Banks’ lending policies also impact the loan-to-deposit ratio. Banks with a more aggressive lending approach will have a higher ratio, while those with a more conservative approach will have a lower ratio. Banks may adjust their lending policies based on their risk appetite and the economic outlook.

Regulatory Requirements

Regulatory requirements can influence the loan-to-deposit ratio. Governments and central banks may impose limits on the amount of loans banks can make relative to their deposits. These regulations aim to ensure financial stability and reduce the risk of excessive lending.

Industry Comparison

Banks and financial institutions have varying loan-to-deposit ratios, influenced by factors such as risk appetite, regulatory requirements, and market conditions. Comparing these ratios across different entities provides insights into industry trends and benchmarks.

Inter-Bank Comparison

Analyzing loan-to-deposit ratios of peer banks within the same industry segment allows for the identification of best practices and industry norms. Banks with higher ratios tend to have a more aggressive lending strategy, while those with lower ratios prioritize deposit growth or maintain a more conservative risk profile.

Cross-Industry Comparison

Comparing loan-to-deposit ratios across different industries, such as banking, insurance, and asset management, highlights the varying levels of risk tolerance and business models. For instance, banks typically have higher ratios due to their focus on lending, while insurance companies may have lower ratios as they prioritize investment activities.

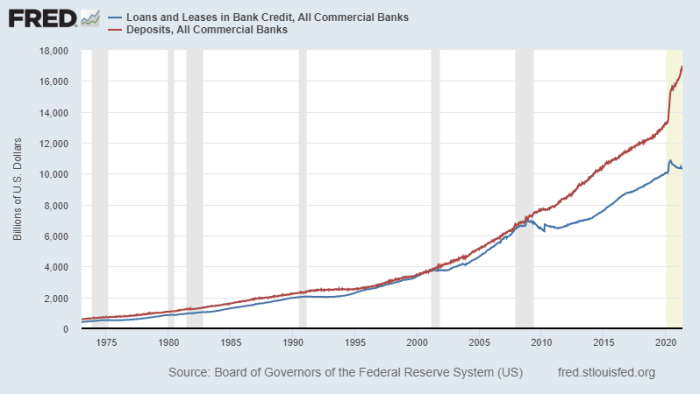

Time-Series Analysis

Tracking loan-to-deposit ratios over time provides valuable insights into the evolving risk appetite and market conditions within an industry. Rising ratios may indicate an increase in lending activity or a decrease in deposits, while falling ratios may suggest a shift towards deposit growth or a tightening of lending standards.

Benchmarking

Establishing industry benchmarks for loan-to-deposit ratios helps banks and financial institutions assess their own performance relative to their peers. Benchmarks can be set based on factors such as industry segment, size, and geographic location, providing a useful reference point for strategic decision-making.

Risk Management Implications

The loan-to-deposit ratio is a crucial indicator of a bank’s risk exposure. A high ratio suggests that the bank has lent out a significant portion of its depositors’ funds, leaving it vulnerable to loan defaults and liquidity issues.

When a bank’s loan-to-deposit ratio is high, it means that it has extended more loans than it has deposits. This can be risky because if borrowers default on their loans, the bank may not have enough cash on hand to cover the losses.

Additionally, if depositors withdraw their money from the bank, the bank may not have enough liquid assets to meet their demands.

Loan Defaults

A high loan-to-deposit ratio can increase the risk of loan defaults. This is because when a bank lends out a large portion of its deposits, it has less money available to cover losses if borrowers default on their loans.

Liquidity

A high loan-to-deposit ratio can also lead to liquidity problems. This is because when a bank has lent out a large portion of its deposits, it has less money available to meet the demands of depositors who want to withdraw their money.

Solvency

In extreme cases, a high loan-to-deposit ratio can even lead to solvency problems. This is because if a bank is unable to meet its obligations to depositors and other creditors, it may be forced to declare bankruptcy.

Regulatory Considerations

Financial regulators play a crucial role in shaping the lending practices of banks by establishing regulations and guidelines for loan-to-deposit ratios. These requirements aim to maintain financial stability, protect depositors, and ensure the sound functioning of the banking system.Regulatory bodies, such as central banks and financial supervisory authorities, typically set limits on the maximum loan-to-deposit ratio that banks can maintain.

This limit is designed to ensure that banks have sufficient deposits to cover their outstanding loans and maintain adequate liquidity. By limiting the amount of lending relative to deposits, regulators aim to reduce the risk of bank failures and protect depositors’ funds.

Impact on Banks’ Lending Practices

Regulatory requirements can significantly impact banks’ lending practices. Banks must carefully manage their loan-to-deposit ratio to comply with regulatory limits and avoid penalties. This may lead banks to adopt more conservative lending policies, such as requiring higher collateral or stricter credit standards for borrowers.

As a result, access to credit may become more restricted, especially for higher-risk borrowers.Moreover, regulatory requirements can influence the types of loans that banks offer. To maintain a lower loan-to-deposit ratio, banks may prioritize short-term loans with lower risk profiles.

This can limit the availability of long-term financing for businesses and individuals, potentially hindering economic growth.

Forecasting and Modeling

Banks employ various methods to forecast future loan-to-deposit ratios and manage their loan portfolios effectively.

Statistical Models

Banks use statistical models to predict future loan demand and deposit growth. These models consider historical data, economic indicators, and industry trends to estimate future ratios. By analyzing patterns and correlations, banks can develop predictive models that forecast changes in the loan-to-deposit ratio over time.

Scenario Analysis

Scenario analysis involves creating multiple hypothetical scenarios based on different economic conditions and market assumptions. Banks simulate different scenarios to assess the impact on their loan-to-deposit ratio and identify potential risks. This approach allows banks to develop contingency plans and adjust their lending strategies accordingly.

Stress Testing

Stress testing is a technique used to assess the resilience of a bank’s loan portfolio under extreme market conditions. Banks subject their loan portfolios to various stress scenarios, such as economic downturns or interest rate fluctuations, to evaluate their ability to withstand financial shocks.

Stress testing helps banks identify potential vulnerabilities and take proactive measures to mitigate risks.

Case Studies and Examples

The loan-to-deposit ratio is a critical metric that provides insights into a bank’s risk appetite and financial health. Banks with high loan-to-deposit ratios tend to be more aggressive in lending, while those with low ratios are more conservative.

High Loan-to-Deposit Ratio: Example

One example of a bank with a high loan-to-deposit ratio is XYZ Bank. As of 2023, XYZ Bank had a loan-to-deposit ratio of 95%, indicating that it had loaned out nearly all of its deposits. This high ratio was driven by strong demand for loans from businesses and consumers, as well as the bank’s aggressive lending strategy.

XYZ Bank’s high loan-to-deposit ratio allowed it to generate significant interest income, but it also increased its risk exposure in the event of a downturn in the economy.

Low Loan-to-Deposit Ratio: Example

In contrast, ABC Bank has a low loan-to-deposit ratio of 70%. This indicates that the bank is more conservative in its lending practices and has retained a larger portion of its deposits as cash or other liquid assets. ABC Bank’s low loan-to-deposit ratio provides it with a cushion against potential losses in the event of a recession or other economic downturn.

However, it also limits the bank’s ability to generate interest income from lending.

Data Visualization and Reporting

Effective data visualization and reporting are crucial for communicating the loan-to-deposit ratio effectively.

To present the ratio clearly, consider creating a table or graph that displays the data over time. The table should include columns for the date, loan amount, deposit amount, and the calculated loan-to-deposit ratio. A graph can visually illustrate the trend of the ratio over time, making it easier to identify patterns and fluctuations.

Visualizing the Ratio

When presenting the ratio, it’s important to provide context and explanations to help stakeholders understand its significance. The report should include a brief description of the ratio, its calculation method, and its implications for the financial institution.

Emerging Trends and Future Implications

The loan-to-deposit ratio (LDR) is constantly evolving, shaped by emerging trends in technology, fintech, and consumer behavior. These trends are reshaping the banking landscape and have significant implications for financial institutions.

Technology and Fintech

Technological advancements, such as mobile banking and online lending platforms, have made it easier for customers to access financial services. This increased accessibility has led to a surge in loan applications and a decrease in deposit growth, potentially impacting LDRs.

Changing Consumer Behavior

Consumers are increasingly turning to digital channels for banking and financial transactions. This shift has resulted in a decline in traditional brick-and-mortar branches, which are typically associated with higher deposit growth. As a result, banks may need to adapt their strategies to attract and retain deposits.

Closure

In conclusion, the loan to deposit ratio is a dynamic metric that offers valuable insights into a bank’s financial performance and risk profile. By understanding the factors that affect LDR and its implications, stakeholders can make informed decisions and assess the overall health of the banking sector.

Helpful Answers

What is a healthy loan to deposit ratio?

A healthy LDR typically ranges between 70% and 90%. However, it can vary depending on factors such as economic conditions, regulatory requirements, and bank policies.

How does a high LDR affect a bank?

A high LDR can increase a bank’s risk exposure, as it indicates that a significant portion of its deposits are being used for lending. This can lead to liquidity issues and loan defaults.

How can banks manage their LDR?

Banks can manage their LDR through various strategies, such as adjusting lending policies, raising capital, and managing their deposit base. Regulatory requirements also play a role in shaping banks’ LDR.