In the labyrinth of financial decisions, understanding loans is crucial. Whether you’re purchasing a dream home, investing in a business, or consolidating debt, loans empower you to achieve your goals. Enter the loan calculator, an indispensable tool that simplifies loan comprehension and empowers you to make informed choices.

Loan calculators unravel the complexities of loan calculations, providing transparency into monthly payments, interest rates, and loan terms. By harnessing their capabilities, you gain a competitive edge in loan negotiations, ensuring you secure the best possible terms and navigate the loan landscape with confidence.

Loan Calculator Overview

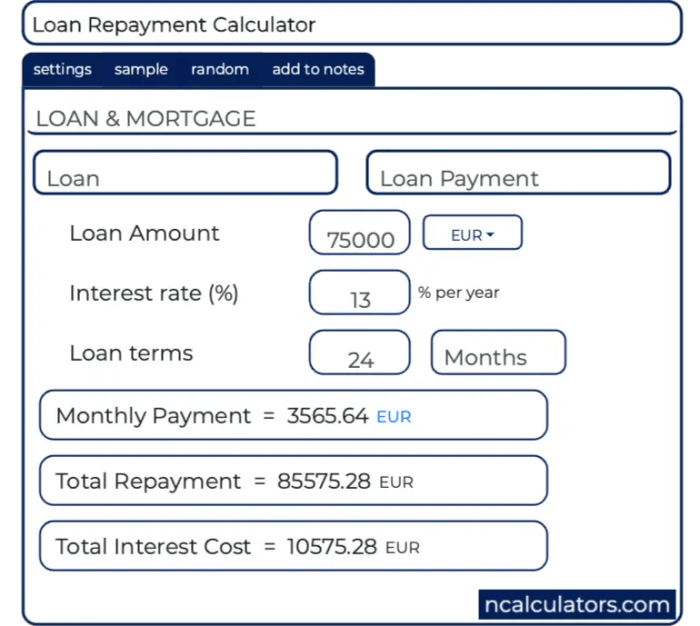

A loan calculator is a valuable tool that can help you make informed decisions about borrowing money. It can provide you with estimates of your monthly payments, total interest charges, and total cost of the loan.

There are many different types of loan calculators available, each designed for a specific type of loan. For example, there are calculators for mortgages, auto loans, personal loans, and student loans.

Mortgage Loan Calculator

A mortgage loan calculator can help you determine how much you can afford to borrow, what your monthly payments will be, and how long it will take to pay off your loan.

To use a mortgage loan calculator, you will need to provide the following information:

- The amount of money you want to borrow

- The interest rate on the loan

- The length of the loan term

- The type of mortgage loan you are getting

Auto Loan Calculator

An auto loan calculator can help you determine how much you can afford to borrow, what your monthly payments will be, and how long it will take to pay off your loan.

To use an auto loan calculator, you will need to provide the following information:

- The amount of money you want to borrow

- The interest rate on the loan

- The length of the loan term

- The make and model of the car you want to buy

Personal Loan Calculator

A personal loan calculator can help you determine how much you can afford to borrow, what your monthly payments will be, and how long it will take to pay off your loan.

To use a personal loan calculator, you will need to provide the following information:

- The amount of money you want to borrow

- The interest rate on the loan

- The length of the loan term

- The purpose of the loan

Student Loan Calculator

A student loan calculator can help you determine how much you can afford to borrow, what your monthly payments will be, and how long it will take to pay off your loan.

To use a student loan calculator, you will need to provide the following information:

- The amount of money you want to borrow

- The interest rate on the loan

- The length of the loan term

- The type of student loan you are getting

Loan Calculation Parameters

Loan calculation requires several key parameters to determine the monthly payment amount. These parameters can be obtained from loan documents or by consulting with lenders.

Principal Amount

The principal amount is the amount of money borrowed from the lender. It is the foundation for calculating the loan payment, as it determines the total amount of interest to be paid over the loan term.

Interest Rate

The interest rate is the percentage charged by the lender for borrowing the money. It is typically expressed as an annual percentage rate (APR), which reflects the total cost of borrowing, including interest, fees, and other charges.

Loan Term

The loan term is the duration of the loan, expressed in months or years. It determines the number of payments to be made and influences the monthly payment amount.

Repayment Frequency

The repayment frequency specifies how often the loan payments are made, typically monthly, quarterly, or annually. This affects the number of payments made during the loan term and the size of each payment.

Loan Payment Calculation

Calculating loan payments is crucial for managing your finances effectively. The process involves determining the monthly or periodic payment required to repay the loan amount within the specified loan term. Understanding the formulas and steps involved in loan payment calculation empowers you to make informed decisions about your loan options and ensure timely repayment.

Loan Payment Formula

The fundamental formula used to calculate loan payments is:“`Monthly Payment = P

- (r

- (1 + r)^n) / ((1 + r)^n

- 1)

“`where:* P is the principal amount (loan amount)

- r is the monthly interest rate (annual interest rate / 12)

- n is the number of payments (loan term in months)

Step-by-Step Loan Payment Calculation

To calculate loan payments manually, follow these steps:

- Convert the annual interest rate to a monthly interest rate by dividing it by 12.

- Calculate the total number of payments by multiplying the loan term in years by 12.

- Plug the values of P, r, and n into the loan payment formula.

- Solve for the monthly payment.

Loan Payment Calculation Table

The following table illustrates the loan payment calculation process:| Variable | Value ||—|—|| Principal Amount (P) | $10,000 || Annual Interest Rate | 5% || Loan Term (Years) | 5 || Monthly Interest Rate (r) | 5% / 12 = 0.05 / 12 = 0.0042 || Number of Payments (n) | 5

12 = 60 |

| Monthly Payment | $10,000

- (0.0042

- (1 + 0.0042)^60) / ((1 + 0.0042)^60

- 1) = $215.04 |

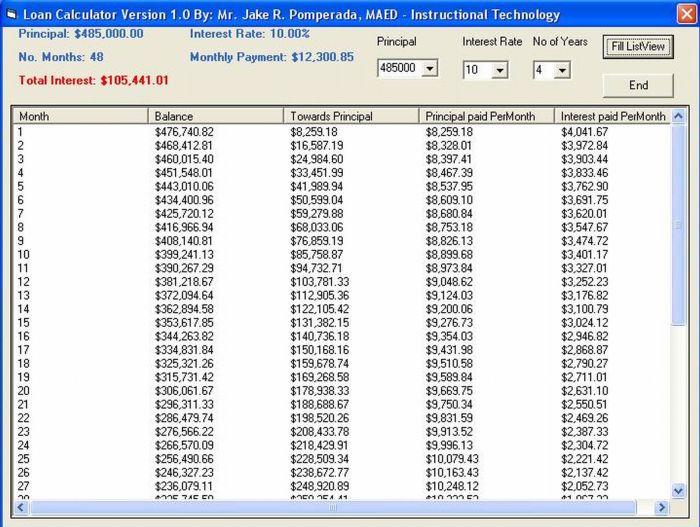

Loan Amortization Schedule

Loan amortization is the gradual repayment of a loan through regular payments over a fixed period. It’s crucial as it provides a structured plan for debt repayment, ensuring timely payments and avoiding penalties or default.

Creating an Amortization Schedule

Loan calculators automate the process of creating an amortization schedule. Simply input loan parameters (amount, interest rate, term) and it will generate a table showing each payment’s principal, interest, and remaining balance.

Example Amortization Schedules

Here are sample amortization schedules for different loan types:

- Fixed-Rate Mortgage: Payments remain the same throughout the loan term, with the majority of early payments going towards interest and gradually shifting towards principal.

- Adjustable-Rate Mortgage (ARM): Payments fluctuate based on changing interest rates, which can lead to varying monthly payments and a less predictable repayment plan.

- Auto Loan: Amortization schedules for auto loans typically have shorter terms (2-7 years) and higher monthly payments compared to mortgages.

Loan Comparison

When it comes to taking out a loan, it’s crucial to compare your options thoroughly before making a decision. By comparing loans, you can ensure you’re getting the best possible deal and avoiding unnecessary expenses or financial burdens.

Loan calculators are powerful tools that can help you compare loans side-by-side. These calculators allow you to input the loan amount, interest rate, and loan term for multiple loans and see how they stack up against each other.

Loan Comparison Table

To illustrate the benefits of comparing loans, let’s create a hypothetical scenario and compare three different loan options using a loan calculator:

| Loan Option | Loan Amount | Interest Rate | Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Loan A | $10,000 | 5% | 5 years | $215.09 | $1,284.61 |

| Loan B | $10,000 | 7% | 5 years | $234.16 | $1,929.58 |

| Loan C | $10,000 | 5% | 7 years | $178.38 | $1,248.64 |

As you can see from the table, Loan A offers the lowest monthly payment and total interest paid. This makes it the most affordable option in this scenario. However, it’s important to note that the loan term is shorter, which means you’ll pay off the loan faster.

If you’re looking for a longer-term loan with a lower monthly payment, Loan C might be a better choice.

Ultimately, the best loan option for you will depend on your individual circumstances and financial goals. By comparing loans using a loan calculator, you can make an informed decision and choose the loan that best meets your needs.

Loan Refinancing

When life throws financial curveballs, loan refinancing can be a lifesaver. It involves replacing an existing loan with a new one, typically with more favorable terms. Loan calculators play a crucial role in evaluating refinancing options and helping you make an informed decision.

Refinancing can bring several benefits. It can lower your monthly payments, reduce your interest rate, or shorten your loan term. Refinancing can also consolidate multiple loans into one, simplifying your financial management.

How Loan Calculators Can Help

Loan calculators are indispensable tools for assessing refinancing options. By inputting your current loan details and potential refinancing terms, you can compare the potential savings and benefits. Calculators can also help you determine if refinancing is right for you by considering factors such as:

- Loan Term: Will refinancing shorten or extend your loan term?

- Interest Rate: Will the new loan offer a significantly lower interest rate?

- Monthly Payments: Will refinancing reduce your monthly payments, freeing up cash flow?

- Closing Costs: Are the closing costs associated with refinancing worth the potential savings?

For example, if you have a $100,000 loan with a 6% interest rate and 15-year term, a loan calculator can show you how refinancing to a loan with a 4% interest rate and 10-year term could save you thousands of dollars in interest and shorten your loan by 5 years.

Loan Pre-Approval

Getting pre-approved for a loan is a crucial step in the homebuying process. It shows sellers that you’re a serious buyer and helps you negotiate the best possible terms on your loan.Loan calculators can assist in getting pre-approved by providing an estimate of the loan amount you qualify for and the monthly payments you can expect.

This information can help you narrow down your home search and make an informed decision about how much you can afford to borrow.

Factors Affecting Loan Pre-Approval

Several factors affect loan pre-approval, including:

- Credit score

- Debt-to-income ratio

- Income

- Assets

- Employment history

Lenders will review these factors to determine your creditworthiness and ability to repay the loan.

Loan Qualification

Qualifying for a loan is crucial for securing the necessary funds to achieve financial goals. Loan calculators play a vital role in helping individuals assess their loan qualification by providing insights into their financial standing and the likelihood of loan approval.

Loan Qualification Criteria

Lenders typically consider several factors when evaluating loan applications, including:*

-*Credit score

A measure of an individual’s creditworthiness, reflecting their history of timely payments and debt management.

-

-*Debt-to-income ratio (DTI)

The percentage of monthly income allocated to debt payments, including housing, car loans, and credit card balances.

-*Employment and income

Stable employment and sufficient income are essential for demonstrating the ability to repay the loan.

-*Down payment

The amount of money paid upfront when purchasing a home or other asset, reducing the loan amount and improving qualification chances.

-*Loan term

The length of time over which the loan will be repaid, affecting the monthly payment amount and overall interest costs.

Loan Calculators and Qualification Assessment

Loan calculators can help individuals assess their loan qualification by:*

-*Estimating monthly payments

Calculators determine the approximate monthly payment amount based on the loan amount, interest rate, and term.

-

-*Analyzing debt-to-income ratio

Calculators compare the estimated monthly payment to income, providing insights into whether the loan fits within the DTI guidelines.

-*Evaluating credit score impact

Some calculators consider credit score ranges and provide estimates of potential loan terms and interest rates.

-*Comparing loan options

Calculators allow individuals to compare different loan scenarios, such as varying loan amounts, terms, and interest rates, to identify the most suitable option.

Improving Loan Qualification with Loan Calculators

Loan calculators can also assist individuals in improving their loan qualification:*

-*Managing debt

By calculating the impact of additional debt payments on DTI, calculators help individuals identify opportunities to reduce debt and improve their creditworthiness.

-

-*Increasing income

Calculators demonstrate how increasing income can lower the DTI and enhance loan qualification.

-*Exploring down payment options

Calculators show how a larger down payment can reduce the loan amount and improve loan terms.

-*Negotiating interest rates

Calculators help individuals understand the relationship between interest rates and monthly payments, empowering them to negotiate favorable loan terms.

By leveraging loan calculators, individuals can gain a clear understanding of their loan qualification, make informed decisions, and take steps to improve their chances of securing the financing they need.

Loan Budgeting

Creating a budget that includes loan payments is crucial for financial stability. Loan calculators simplify this process by providing an accurate estimate of monthly payments and total interest costs.

Budgeting for Loan Payments

A well-structured budget allocates funds for essential expenses, debt repayment, and savings. Loan payments should be prioritized to avoid late fees and damage to credit scores. Loan calculators help determine a realistic payment amount that fits within your income and other financial obligations.

Loan Impact on Credit

Loans can significantly impact your credit score, which is a numerical representation of your creditworthiness. A high credit score indicates a low risk of default, while a low credit score indicates a high risk of default. Lenders use credit scores to assess your eligibility for loans and other forms of credit and determine the interest rates and terms they will offer you.Understanding

the potential impact of loans on your credit score is crucial for making informed financial decisions. Loan calculators can be a valuable tool in this regard, as they allow you to simulate different loan scenarios and see how they might affect your credit score.

Strategies for Managing Loans to Minimize Credit Impact

To minimize the impact of loans on your credit score, consider the following strategies:

- Make timely payments: Payment history is the most important factor in determining your credit score. Even a single missed payment can negatively impact your score.

- Keep your credit utilization ratio low: Your credit utilization ratio is the amount of credit you are using compared to your total available credit. Keeping this ratio below 30% is ideal.

- Avoid taking on too many new loans in a short period: Applying for multiple loans in a short period can result in multiple credit inquiries, which can temporarily lower your credit score.

- Monitor your credit report regularly: Regularly reviewing your credit report allows you to identify any errors or suspicious activity that could negatively impact your score.

By following these strategies, you can manage your loans effectively and minimize their impact on your credit score.

Final Summary

The loan calculator is not merely a tool; it’s a financial compass that guides you through the loan maze. With its precise calculations and user-friendly interface, it empowers you to make well-informed decisions, plan your finances strategically, and achieve your financial aspirations.

Remember, knowledge is power, and when it comes to loans, the loan calculator is your ultimate source of enlightenment.

FAQ Corner

Can loan calculators be used for all types of loans?

Yes, loan calculators are versatile tools that can be utilized for various loan types, including personal loans, mortgages, auto loans, and student loans.

How accurate are loan calculators?

Loan calculators provide accurate estimates based on the information you input. However, it’s essential to note that they do not account for potential changes in interest rates or other factors that may affect your actual loan terms.

Can I use a loan calculator to compare different loan options?

Absolutely! Loan calculators enable you to compare multiple loan options side-by-side, allowing you to assess interest rates, monthly payments, and loan terms to make informed decisions.

What are some tips for using a loan calculator effectively?

Ensure you have accurate information about your loan parameters, such as the loan amount, interest rate, and loan term. Experiment with different scenarios by adjusting these parameters to see how they impact your monthly payments and overall loan costs.