Yo, check it! Learning cryptocurrency is like diving into a virtual treasure chest filled with digital gold. From blockchain to Bitcoin, we’ll break it down so you can slay the crypto game.

Cryptocurrency ain’t just some geeky internet thing anymore. It’s the future of money, dude. So buckle up and let’s get schooled on this crypto revolution.

Cryptocurrency Basics

Cryptocurrency, like, is a new type of money that’s totally digital. It’s not like regular money that you keep in your wallet or bank account; it’s stored on a computer network called a blockchain. This blockchain is like a big, unhackable ledger that keeps track of all the transactions that have ever happened with that particular cryptocurrency.Cryptocurrency

Yo, learning crypto is dope, but if you wanna level up your finance game, check out this sick guide: How to Learn Stock Business for Beginners . It’s got everything you need to trade like a pro. Plus, it’ll help you take your crypto game to the next level!

is decentralized, which means it’s not controlled by any government or bank. Instead, it’s run by a bunch of computers all over the world that work together to verify and record transactions. This makes it super secure and transparent, because there’s no central point of failure.To

use cryptocurrency, you need a digital wallet. This is a software program that lets you store, send, and receive cryptocurrency. There are different types of digital wallets, so you can choose one that fits your needs.

History of Cryptocurrency

The first cryptocurrency, Bitcoin, was created in 2009 by a mysterious person or group of people known as Satoshi Nakamoto. Since then, there have been thousands of other cryptocurrencies created, each with its own unique features.Cryptocurrency has become increasingly popular in recent years, as more and more people are starting to understand its benefits.

It’s still a relatively new technology, but it has the potential to revolutionize the way we think about money and finance.

Types of Cryptocurrency

Cryptocurrency comes in various flavors, each with its unique characteristics and applications. Let’s dive into the most common types:

- Bitcoin (BTC):The OG crypto, known for its decentralized nature and limited supply. It’s like the cool kid on the block, setting the standard for the crypto world.

- Ethereum (ETH):This crypto is a bit more versatile than BTC. It’s not just a currency; it’s a platform for building decentralized apps. Think of it as the Swiss Army knife of crypto.

- Altcoins:These are all the other cryptocurrencies that aren’t Bitcoin or Ethereum. They come in all shapes and sizes, each with its own unique features. It’s like a giant box of chocolates; you never know what you’re gonna get.

Cryptocurrency Markets: Learning Cryptocurrency

Yo, let’s dive into the crypto market, where the action happens. It’s like a giant playground where buyers and sellers meet to trade their digital coins.

The market is made up of exchanges, which are like the stock exchanges for crypto. They connect buyers and sellers and facilitate trades. Trading platforms are like online brokers that make it easy to buy and sell crypto. And liquidity providers are the peeps who make sure there’s enough crypto available for everyone to trade.

How Cryptocurrency Prices Are Determined

Crypto prices are like the tides, they go up and down. They’re determined by a bunch of factors, like supply and demand. When more people want to buy a coin than sell it, the price goes up. When more people want to sell than buy, the price goes down.

Other factors that influence prices include news and events, government regulations, and the overall economy. If there’s good news about a coin, the price might jump. If there’s bad news, the price might tank.

Investing in Cryptocurrency

Cryptocurrency is a rapidly evolving and potentially lucrative investment opportunity. To get started, you’ll need to choose a platform, select coins, and manage risk.

Yo, check this out! Learning crypto is dope, but if you’re broke AF and can’t afford a credit card, check out this guide . It’ll show you how to ball on a budget online without the plastic. Plus, once you’re back on your feet, you can use crypto to buy stuff too! Stay lit, fam.

Choosing a Platform

When choosing a platform, consider factors such as fees, security, and the variety of coins offered. Some popular platforms include Coinbase, Binance, and Kraken.

Selecting Coins

Research different coins before investing. Consider factors such as market capitalization, liquidity, and the team behind the project.

Managing Risk

Investing in cryptocurrency carries risk. Diversify your portfolio, invest only what you can afford to lose, and monitor your investments regularly.

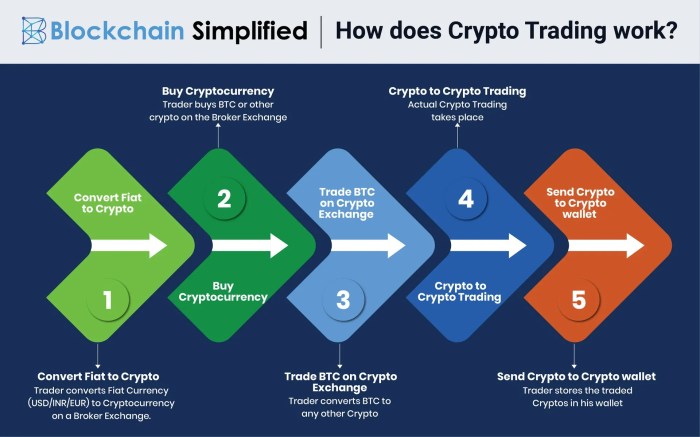

Cryptocurrency Trading

Yo, check it! Cryptocurrency trading is like the wild west of finance. It’s all about buying and selling digital currencies to make some dough. But before you dive in, you gotta learn the ropes.

Order Types

When you’re trading crypto, you can throw down different types of orders. Here’s the lowdown:

- Market Order:You’re like, “I need this crypto right now!” The exchange finds you the best price and fills your order ASAP.

- Limit Order:You’re like, “I’ll wait for a better price.” You set a specific price, and your order only gets filled if the price hits that mark.

- Stop-Loss Order:You’re like, “Don’t let me lose too much.” You set a price below the current market price, and if it gets hit, your order gets filled to minimize your losses.

Market Analysis

Before you start trading, you gotta do your homework. Check out charts, news, and social media to get a feel for the market. Look for trends, patterns, and anything that can give you an edge.

Technical Indicators

Traders use technical indicators to help them make sense of all the market data. These indicators are like little helpers that analyze charts and spit out signals. Some popular ones include:

- Moving Averages:Shows the average price over a certain period of time, smoothing out price fluctuations.

- Bollinger Bands:Creates upper and lower bands around the moving average, showing potential overbought or oversold conditions.

- Relative Strength Index (RSI):Measures the strength of a trend, indicating when it might be time to buy or sell.

Trading Strategies

Now that you’ve got the basics down, it’s time to choose a trading strategy. Here are a few popular ones:

- Scalping:Buying and selling crypto within a short time frame, making small but frequent profits.

- Day Trading:Buying and selling crypto within a single trading day, closing out all positions before the market closes.

- Swing Trading:Holding crypto for a few days or weeks, aiming to catch bigger price swings.

- Hodling:Buying and holding crypto for the long haul, believing in its potential for growth.

Cryptocurrency Mining

Cryptocurrency mining is the process of verifying and adding transactions to the blockchain. Miners use specialized computers to solve complex mathematical problems, and the first miner to solve the problem gets to add the block to the blockchain and earn a reward in cryptocurrency.

There are different algorithms used for mining, each with its own set of rules and requirements. The most common algorithm is the Proof of Work (PoW) algorithm, which requires miners to solve complex mathematical problems. Other algorithms include Proof of Stake (PoS), which requires miners to hold a certain amount of cryptocurrency in order to participate in mining.

Hardware Used for Mining

The hardware used for mining has evolved over time. In the early days of Bitcoin, miners could use regular CPUs to mine. However, as the difficulty of mining increased, miners began to use specialized hardware called ASICs (Application-Specific Integrated Circuits).

ASICs are designed specifically for mining and are much more efficient than CPUs.

Rewards and Risks of Mining

The rewards for mining can be significant. Miners who are able to solve the complex mathematical problems and add blocks to the blockchain are rewarded with cryptocurrency. The amount of cryptocurrency that a miner earns depends on the difficulty of the algorithm and the hashrate of the miner’s hardware.

However, mining can also be risky. The cost of electricity and hardware can be high, and there is no guarantee that a miner will be able to solve the complex mathematical problems and earn a reward. Additionally, the value of cryptocurrency can fluctuate, so miners may not always be able to sell their earnings for a profit.

Cryptocurrency Security

Cryptocurrency security is a crucial aspect of protecting your digital assets in the crypto space. With the increasing popularity of cryptocurrencies, so too have the threats and risks associated with them. It’s essential to be aware of the common security threats and to implement best practices to safeguard your crypto holdings.

Threats to Cryptocurrency Security

-

-*Phishing Scams

Cybercriminals create fake websites or emails that mimic legitimate platforms, tricking users into entering their login credentials or private keys.

-*Malware and Spyware

Malicious software can infect your devices and steal your crypto assets or sensitive information.

-*Hacking

Hackers may exploit vulnerabilities in exchanges or wallets to gain access to user accounts and steal funds.

-*Rug Pulls

Scammers create new crypto projects and hype them up, then suddenly abandon the project and take investors’ money.

-*Insider Trading

Employees of cryptocurrency exchanges or companies may use their privileged information to make profitable trades.

Best Practices for Cryptocurrency Security, Learning cryptocurrency

-

-*Use Strong Passwords and Two-Factor Authentication (2FA)

Create complex and unique passwords for all your cryptocurrency accounts. Enable 2FA for added security.

-*Store Crypto Assets in Secure Wallets

Keep your crypto assets in reputable and secure wallets, both hardware and software.

-*Be Cautious of Phishing Scams

Never click on suspicious links or open attachments from unknown senders. Verify the authenticity of websites before entering sensitive information.

-*Update Software Regularly

Keep your devices, operating systems, and software up to date to patch security vulnerabilities.

-*Beware of Shady Crypto Projects

Research new crypto projects thoroughly before investing. Be wary of projects that promise unrealistic returns or have no clear use case.

-*Consider a Cryptocurrency Security Audit

Have your cryptocurrency systems and practices audited by a reputable third-party to identify and address potential security risks.

Cryptocurrency Regulation

Cryptocurrency regulation is a hot topic these days, as governments around the world grapple with how to handle this new asset class. The regulatory landscape is constantly evolving, and it can be difficult for investors and traders to keep up.

In this section, we’ll take a look at the current regulatory landscape for cryptocurrency and discuss the potential impact of future regulation on the market.

Yo, check it out! I’m all about learning crypto these days, it’s like the future of money or something. But hold up, I stumbled upon this fire guide on starting a credit server business. Click here if you wanna check it out.

Anyway, back to crypto. It’s the real deal, like, it’s gonna change the game. So, if you’re into making some serious dough, hop on the crypto train!

Current Regulatory Landscape

The current regulatory landscape for cryptocurrency is a patchwork of laws and regulations that vary from country to country. In some countries, cryptocurrency is treated as a commodity, while in others it is treated as a security. This lack of clarity has created a lot of uncertainty for investors and traders.

In the United States, the Securities and Exchange Commission (SEC) has taken the lead in regulating cryptocurrency. The SEC has classified some cryptocurrencies as securities, which means that they must register with the SEC and comply with all applicable securities laws.

This has made it more difficult for some cryptocurrency companies to operate in the United States.

Other countries have taken a more lenient approach to cryptocurrency regulation. In Japan, for example, cryptocurrency is treated as a legal form of payment. This has made Japan a popular destination for cryptocurrency businesses.

Potential Impact of Future Regulation

The future of cryptocurrency regulation is uncertain. However, it is likely that governments will continue to crack down on cryptocurrency in the coming years. This could have a significant impact on the cryptocurrency market, making it more difficult for investors and traders to operate.

One potential outcome of increased regulation is that cryptocurrency could become more centralized. This would mean that a few large companies would control a majority of the cryptocurrency market. This could lead to higher fees and less innovation.

Another potential outcome of increased regulation is that cryptocurrency could become less accessible to everyday investors. This would be a shame, as cryptocurrency has the potential to be a great way for people to save and invest their money.

It is important to note that the regulatory landscape for cryptocurrency is constantly evolving. It is impossible to say for sure what the future holds for cryptocurrency regulation. However, it is important to be aware of the potential risks and to make informed decisions about your investments.

Yo, peep this! If you’re into crypto and looking to level up, check out this article on cellphone service biz. It’s lit! It’ll show you how to unlock the cash flow and make some serious dough. Plus, you can use those earnings to invest even more in crypto.

Trust me, it’s a total game-changer.

Future of Cryptocurrency

Cryptocurrency has taken the world by storm, and it’s not going anywhere anytime soon. But what does the future hold for this revolutionary technology? Let’s take a look at some of the ways cryptocurrency is expected to impact the global financial system and explore emerging trends and developments in the cryptocurrency space.

Potential Impact on Global Financial System

- Decentralization:Cryptocurrency is based on the concept of decentralization, meaning it is not controlled by any central authority like a bank or government. This could lead to a more equitable and inclusive financial system where everyone has access to the same financial tools and services.

Yo, if you’re down to learn about crypto, check out this article Want to Buy a House But Don’ . It’s got some sick tips on how to stack your cash for a crib. Plus, crypto is the future, so you might as well get ahead of the curve.

- Cross-Border Transactions:Cryptocurrency can be sent and received anywhere in the world, making it much easier and cheaper to send money across borders. This could have a major impact on remittances, which are the money that migrant workers send back to their home countries.

- Financial Inclusion:Cryptocurrency could help to bring financial inclusion to people who do not have access to traditional banking services. This could include people in developing countries, people who are unbanked, and people who are underbanked.

Emerging Trends and Developments

- Central Bank Digital Currencies (CBDCs):CBDCs are digital currencies that are issued by central banks. They are similar to cryptocurrencies, but they are backed by the full faith and credit of the government. CBDCs could help to bring the benefits of cryptocurrency to a wider audience.

- Stablecoins:Stablecoins are cryptocurrencies that are pegged to a fiat currency, such as the US dollar. This makes them less volatile than other cryptocurrencies, which could make them more attractive to investors and businesses.

- DeFi (Decentralized Finance):DeFi is a new financial system that is built on blockchain technology. DeFi applications allow users to borrow, lend, and trade cryptocurrencies without the need for a middleman like a bank. DeFi is still in its early stages, but it has the potential to revolutionize the financial industry.

Summary

Whether you’re a newbie or a crypto OG, this guide has got you covered. We’ve covered everything from the basics to the latest trends, so you can navigate the crypto world like a pro. Stay tuned for more crypto knowledge bombs!

FAQ Guide

What’s the deal with blockchain?

Blockchain is like a super secure digital ledger that keeps track of all crypto transactions. It’s like a digital vault that can’t be hacked or messed with.

How do I buy cryptocurrency?

There are tons of crypto exchanges out there where you can buy and sell crypto. Just pick one that’s legit and has the coins you want.

Is cryptocurrency a good investment?

Crypto can be a risky investment, but it also has the potential for big returns. Do your research and invest wisely, my friend.