Learning crypto charts – Yo, crypto fam! If you’re ready to step up your crypto trading game, then learning how to read charts is a must. Crypto charts are like the secret decoder ring to understanding the wild world of cryptocurrencies, and they can help you make smarter trades and maximize your profits.

So buckle up, cuz we’re about to dive into the nitty-gritty of crypto charts and show you how to become a charting boss.

From spotting trends to identifying patterns, crypto charts are your roadmap to navigating the crypto markets. We’ll break down everything you need to know, from the basics of candlestick charts to advanced techniques like Fibonacci retracements. And don’t worry if you’re a newbie, we’ll keep it chill and easy to understand.

Understanding Cryptocurrency Charts

Cryptocurrency charts are like maps that help you navigate the wild world of crypto. They show you the price of a crypto over time, so you can see how it’s doing and make smart decisions.

Types of Cryptocurrency Charts

There are three main types of crypto charts:

- Line chartsshow the price of a crypto over time as a line. They’re simple and easy to read, but they don’t show you much detail.

- Bar chartsshow the price of a crypto over time as a series of bars. Each bar represents a specific period of time, like a day or a week. Bar charts show you more detail than line charts, but they can be harder to read.

Learning crypto charts is like the secret code to unlocking crypto investing. It’s the key to decoding the market’s secret sauce. But it’s not just about making sense of the squiggly lines on the screen. It’s about understanding the language of the market, the ups and downs, the bull and bear dances.

Once you’ve cracked that code, you’re ready to dive into the world of learning about crypto investing . And with that knowledge, you’ll be able to navigate the crypto jungle like a pro, reading the charts like a fortune teller and making the most of the market’s mood swings.

- Candlestick chartsare the most popular type of crypto chart. They show the price of a crypto over time as a series of candlesticks. Each candlestick represents a specific period of time, like a day or a week. Candlesticks show you more detail than line charts and bar charts, but they can be harder to read.

Yo, learning crypto charts can be a mind-bender. If you’re a crypto newbie, check out learning cryptocurrency for beginners . It’s like the cheat codes to understanding the crypto game. Once you’ve got that down, you’ll be able to slay those crypto charts like a pro.

Key Elements of a Cryptocurrency Chart

Cryptocurrency charts have a few key elements that you need to know about:

- Price axis: This is the vertical axis on the left side of the chart. It shows the price of the crypto in dollars or another currency.

- Time axis: This is the horizontal axis at the bottom of the chart. It shows the time period that the chart covers.

- Candlesticks: These are the individual bars or candles that make up the chart. Each candlestick represents a specific period of time, like a day or a week.

- Volume: This is a measure of how much of a crypto has been traded over a certain period of time. It’s shown as a line or a bar chart at the bottom of the chart.

Popular Cryptocurrency Charting Platforms

There are a lot of different cryptocurrency charting platforms out there. Some of the most popular ones include:

- TradingView

- CoinMarketCap

- Binance

- CryptoCompare

These platforms offer a variety of features, so you can choose the one that’s right for you.

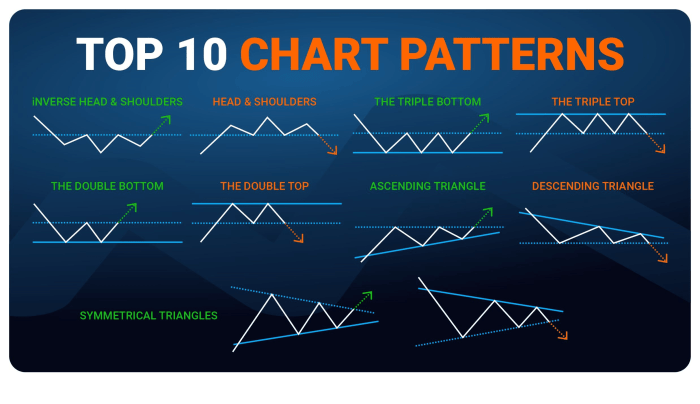

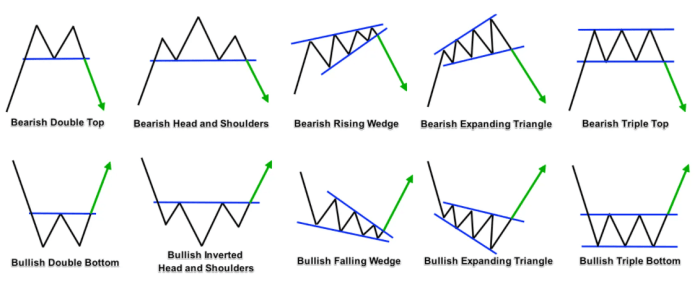

Analyzing Price Patterns

Yo, peeps! Check it, analyzing price patterns is like the secret sauce to slaying the crypto game. It’s all about recognizing the homies (candlestick patterns) that show you where the market’s headed.

Yo, check it. Crypto charts can be a drag, but if you wanna slay in crypto trading, you gotta learn ’em. Hit up this guide for beginners and get the lowdown. Then come back here and master those charts like a boss.

You got this, fam!

Candlestick Patterns

- Bullish patterns: These homies are like the cheerleaders of the market, signaling that the price is about to pump. Some examples are the Hammer, Bullish Engulfing, and Morning Star.

- Bearish patterns: These dudes are the buzzkills, warning you that the price is gonna crash. Think Doji, Bearish Engulfing, and Evening Star.

Technical Indicators

These are your homies that use math to give you the lowdown on trends. They’re like your squad of advisors, helping you see where the market’s going.

- Moving Averages: These homies show you the average price over a certain period, smoothing out the noise.

- Relative Strength Index (RSI): This dude tells you if the market is overbought or oversold, so you can avoid getting rekt.

- Bollinger Bands: These homies show you the range the price is likely to stay within, giving you a heads-up on potential breakouts.

Support and Resistance Levels

These homies are like the bouncers of the market. Support levels are the prices where buyers step in and stop the price from falling further. Resistance levels are where sellers show up and prevent the price from rising.

Knowing these levels is key for predicting price movements. If the price breaks through a support level, it’s a sign of weakness. If it breaks through a resistance level, it’s a sign of strength.

Identifying Market Trends

Yo, check it, identifying market trends is like the secret sauce in crypto trading. It’s all about spotting the big picture and figuring out where the market’s headed.

There are three main types of market trends:

- Upward trend:When the price keeps going up, making higher highs and higher lows.

- Downward trend:When the price keeps going down, making lower lows and lower highs.

- Sideways trend:When the price moves sideways, bouncing between support and resistance levels.

One of the best ways to identify trends is by using moving averages. These are like a smoothed-out version of the price chart, which helps you see the overall direction of the market.

For example, if the 200-day moving average is sloping up, it means the market is in an upward trend. If it’s sloping down, it means the market is in a downward trend.

There are a ton of different trading strategies you can use based on market trends. Here’s one example:

Buy when the price breaks above a resistance level in an upward trend.

This is a simple but effective strategy that can help you catch some nice profits.

Yo, check it, learning crypto charts is like, the bomb. It’s all about getting the lowdown on price movements and patterns. But wait, there’s more! Once you’ve got that on lock, you can dive into learning about cryptocurrency mining . That’s how you create new crypto, bruh.

It’s like, the next level of crypto knowledge. But don’t forget, after that, circle back to crypto charts and see how mining impacts the market. It’s all connected, man.

Risk Management

Yo, risk management in crypto trading is like your bodyguard in a mosh pit. It keeps you safe from getting crushed by the volatility.Different strategies got your back:

-

-*Stop-loss orders

These are like bouncers that automatically sell your coins if they drop below a certain price, limiting your losses.

-*Position sizing

This is like deciding how much to bet on a trade. You wanna go big when you’re confident, but don’t bet the farm if you’re not sure.

-*Risk-to-reward ratio

This is like weighing the potential profit against the potential loss. Aim for trades where you can make twice or three times as much as you could lose.

Calculating the risk-to-reward ratio is easy. Just divide the potential profit by the potential loss. For example, if you could make $100 if the price goes up, but lose $50 if it goes down, your risk-to-reward ratio is 2:1.

Trading Psychology

Cryptocurrency trading involves significant psychological factors that can influence decision-making. Understanding these factors and managing emotions is crucial for success.Emotions, such as fear and greed, can lead to impulsive trades and poor decision-making. Developing a trading plan and sticking to it helps control emotions and avoid impulsive trades.

The plan should include specific entry and exit points, risk management strategies, and clear trading goals.

Risk Management

Effective risk management is essential to protect capital and limit losses. It involves setting stop-loss orders to automatically exit trades when prices reach a predefined level, limiting position size relative to account balance, and diversifying investments across multiple assets.

Advanced Charting Techniques

Yo, what’s up traders? Ready to level up your chart game? Advanced charting techniques can be your secret weapon for slaying the crypto market. Let’s dive in and check out some sick moves.

Fibonacci Retracements and Extensions

Imagine this: You’re watching a coin that’s been on a tear, but it’s gotta cool off sometime. Fibonacci retracements can show you where it might take a breather. They use these magical ratios (like 0.382, 0.5, and 0.618) to predict potential support and resistance levels.

When the price bounces off these levels, it’s like hitting a trampoline.Now, Fibonacci extensions are the bomb for figuring out where the price might go after a retracement. They use the same ratios but in the opposite direction. It’s like having a crystal ball that shows you the potential upside and downside.

Elliot Wave Theory

Yo, check this out. Elliot Wave Theory is like a roadmap for the market. It says that the price moves in predictable waves, kinda like the ocean. Each wave has its own personality, and by studying them, you can catch the ride of the next big one.There

are five types of waves:

-

-*Impulse waves

Yo, learning crypto charts is like cracking the code to crypto trading. It’s the key to seeing the patterns and making smart moves. But if you’re a newbie, you might wanna start by learning about crypto first. That’ll give you the basics and make reading charts a breeze.

So, once you’ve got that down, come back to these charts and you’ll be a crypto chart master in no time.

These are the big boys, the ones that push the price up or down.

-*Corrective waves

These are the smaller ones that pull back against the trend.

Yo, wanna master crypto charts like a boss? Get in the game and learn the ins and outs of this digital currency scene. Check out this sick guide on learning about cryptocurrency and you’ll be charting like a pro in no time.

-*Leading diagonal

This is a special type of impulse wave that looks like a diagonal line.

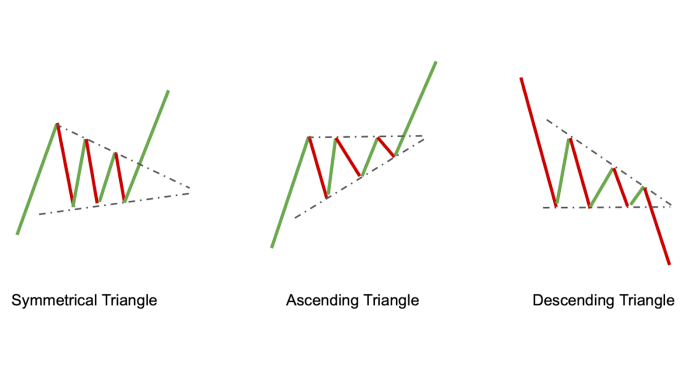

-*Triangle

Yo, check this out! I’m totally digging learning crypto charts, it’s like the key to understanding the wild world of crypto. Once you got the hang of that, it’s like you can hack into the matrix of learning cryptocurrency . Then, boom! You’re a crypto master, reading those charts like a boss.

So, get on it, homie, and unlock the secrets of crypto!

This is a corrective wave that forms a triangle pattern.

-*Zigzag

This is another type of corrective wave that looks like a zigzag.

By understanding these waves, you can spot market cycles and predict where the price might go next. It’s like having a cheat code for the crypto game.

Examples

Let’s say you’re watching Bitcoin. It’s been on a bull run, but you’re wondering if it’s gonna chill for a bit. You pull up the Fibonacci retracement tool and see that it’s approaching the 0.382 level. Boom, that’s a potential support level.Now,

let’s say the price bounces off that level and starts to climb again. You can use the Fibonacci extension tool to see where it might go next. If it reaches the 1.618 level, that’s a potential resistance level.Elliot Wave Theory can also help you predict where the price might go next.

Yo, I’m stoked about learning crypto charts. It’s like the cheat codes for trading crypto, right? Once you decode those wiggly lines, you’ll be able to predict when the market’s gonna pop like a champagne cork. And if you’re looking to take your crypto game to the next level, you gotta check out learning about crypto trading . It’s like the holy grail for understanding how to make serious bank with crypto.

Back to charts, they’re the key to spotting those golden opportunities to buy low and sell high. So, keep on crunching those charts and soon you’ll be a crypto trading boss.

If you see a completed impulse wave followed by a corrective wave, that’s a sign that the price might be about to start another impulse wave.Advanced charting techniques are like the secret sauce for successful trading. They can help you make better decisions, avoid losses, and maximize your profits.

So, get ready to step up your game and become a crypto charting ninja!

Backtesting and Optimization

Backtesting is lit for traders cuz it lets them check out how their strategies woulda played out in the past, like a time machine for your trades. By running your strat through historical data, you can see if it’s a banger or a dud.

Different Backtesting Methods

There’s a few ways to backtest your strategies:

-

-*Manual Backtesting

This is like doing it old school, where you manually go through historical data and apply your strategy, keeping track of the results. It’s time-consuming but gives you a deep understanding of your strat.

-*Automated Backtesting

This is where you use software or coding to run your strategy through historical data, saving you a ton of time. It’s more efficient but might not give you as much insight as manual backtesting.

Optimizing Trading Strategies

Once you’ve backtested your strategy, you can start tweaking it to make it even better. Here’s how:

-

-*Parameter Optimization

Yo, check it out! I’m gettin’ schooled on crypto charts. It’s like reading a foreign language, but it’s dope ’cause it’s crypto, right? And if you wanna take it to the next level, you gotta bone up on learning about cryptocurrencies . Then you’ll be able to decode those charts like a boss.

Crypto charts ain’t just for nerds, they’re the key to unlockin’ the crypto universe.

This is where you adjust the settings of your strategy to find the ones that give you the best results. For example, you might change the moving average period or the stop-loss level.

-*Rule Optimization

This is where you change the actual rules of your strategy. For example, you might add a new entry condition or remove an exit condition.

By backtesting and optimizing your strategies, you can increase your chances of success in the markets. It’s like having a secret weapon that gives you an edge over other traders.

Crypto-Specific Considerations

Cryptocurrency charts differ from traditional financial charts due to unique characteristics. High volatility, influenced by news, social media, and market sentiment, makes price movements unpredictable. Liquidity, or the ease of buying and selling, varies across cryptocurrencies and exchanges, affecting chart patterns.

Volatility and Liquidity Considerations

When analyzing cryptocurrency charts, consider the high volatility. Sudden price swings can occur, making it crucial to use technical indicators and risk management strategies that account for these fluctuations. Liquidity can impact the accuracy of chart patterns, especially during periods of low trading volume.

Yo, check this out. Learning crypto charts is like a whole other level, but it’s tight cuz it helps you see the market like a pro. Once you master those charts, you’re ready to jump into learning about cryptocurrency trading . It’s the next step to becoming a crypto king or queen.

But remember, even with all the knowledge, you gotta keep your eyes on those charts to stay on top of your game.

Crypto-Specific Trading Strategies

Certain trading strategies are designed specifically for cryptocurrencies. These include:

Scalping

Taking small profits from frequent trades within a short timeframe.

Range Trading

Trading within a defined price range, profiting from fluctuations within the range.

Trend Following

Identifying and riding price trends, entering trades in the direction of the trend.

Resources and Tools

Learning about cryptocurrency charts can be a daunting task, but there are a number of resources and tools available to help you get started. These resources can provide you with the information you need to understand the basics of charting, as well as more advanced techniques.

Charting Software, Learning crypto charts

There are a number of different charting software programs available, each with its own unique features. Some of the most popular charting software programs include TradingView, MetaTrader 4, and Coinbase Pro. These programs allow you to create and customize charts, add indicators, and place trades.

Trading Signals and Indicators

Trading signals and indicators can be a helpful way to identify trading opportunities. Trading signals are generated by software programs that analyze market data and identify potential trading opportunities. Indicators are technical analysis tools that can help you identify trends and patterns in the market.There

are a number of different trading signals and indicators available, each with its own unique strengths and weaknesses. It is important to do your research and find the signals and indicators that work best for you.

Final Wrap-Up: Learning Crypto Charts

So, there you have it, folks! Learning crypto charts is the key to unlocking the secrets of successful crypto trading. By understanding the language of charts, you can make informed decisions, predict price movements, and stay ahead of the curve in this ever-evolving market.

Remember, practice makes perfect, so keep studying those charts and you’ll be a crypto charting pro in no time. Now go forth and conquer the crypto world!

Essential FAQs

Q: What are the different types of crypto charts?

A: There are a few different types of crypto charts, including candlestick charts, line charts, and bar charts. Candlestick charts are the most popular and provide the most information, so we’ll focus on those in this guide.

Q: What are the key elements of a candlestick chart?

A: Candlestick charts have a few key elements, including the open, close, high, and low prices. The open price is the price at which the asset opened for trading, the close price is the price at which it closed, the high price is the highest price it reached during the period, and the low price is the lowest price it reached during the period.

Q: How do I identify trends in crypto charts?

A: There are a few different ways to identify trends in crypto charts. One way is to look for patterns in the candlesticks. For example, a series of green candlesticks indicates an uptrend, while a series of red candlesticks indicates a downtrend.