Learning about crypto currency – Dive into the thrilling world of cryptocurrency! This comprehensive guide will equip you with everything you need to know about this groundbreaking technology, from its origins to its potential impact on the future of finance.

Buckle up and get ready to navigate the exciting landscape of digital currencies, blockchain, and the myriad opportunities that await you.

Definition and Overview

Cryptocurrency is like a digital money that you can use to buy stuff online or send to people. It’s not like regular money, though, because it’s not controlled by banks or governments. Instead, it uses a special technology called blockchain to keep track of all the transactions.Blockchain

is like a big, shared ledger that everyone can see. It records every single transaction that’s ever been made with a cryptocurrency. This makes it really hard for people to cheat or steal, because everyone can see what’s going on.

Types of Cryptocurrency

Yo, check it, there’s a whole squad of cryptos out there, each with its own swag and use cases. Let’s dive in and scope out the big dogs.

Bitcoin

- The OG, the OG, the first crypto to hit the scene. Think of it as the kingpin of the crypto world.

- Known for its scarcity and security, it’s like digital gold, perfect for holding value over time.

Ethereum

- The home of smart contracts and decentralized apps. It’s like the playground for developers to build dope stuff.

- It’s the second-largest crypto by market cap, and its use cases are expanding like crazy.

Litecoin

- The little bro of Bitcoin, Litecoin is faster and cheaper to transact. It’s like the everyday crypto for quick payments.

- It’s also used in point-of-sale systems, making it a convenient option for IRL purchases.

Market Analysis: Learning About Crypto Currency

Yo, let’s get real about crypto market analysis. It’s like dissecting a dope track, breaking down the beats and lyrics to see what makes it fire. We’ll study the past to predict the future, identify the factors that make prices go up or down like a rollercoaster, and stay woke on the latest news that could shake the market.

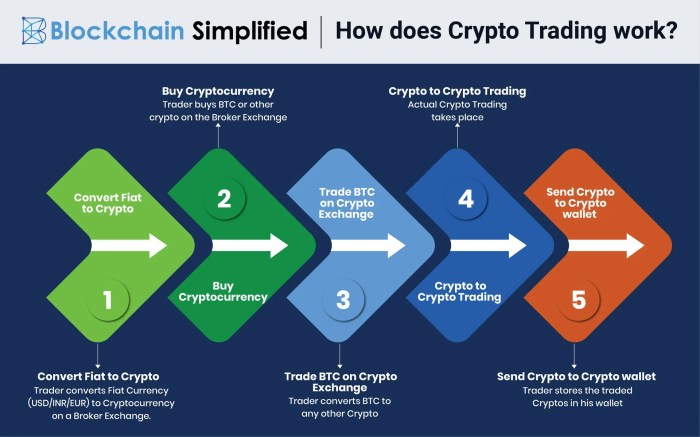

Yo, learning about crypto currency is tight, right? It’s like, the future of money and stuff. But if you wanna get real deep, you gotta check out learning about crypto trading . That’s where the real action is at. It’s like, learning how to make your crypto work for you, know what I mean? So, yeah, learning about crypto currency is cool, but learning about crypto trading is next level.

Historical Performance

Time to time travel, bruh. We’re gonna check out how crypto has been rocking in the past. We’ll look at price trends, seeing how they’ve boomed and busted, and track market cap, the total value of all the crypto out there.

This gives us a sick roadmap for what might happen in the future.

Yo, if you’re a crypto newbie, check this out: learning about cryptocurrency . It’s like the ultimate guide to understanding this digital cash thing. From basics to the nitty-gritty, you’ll be a crypto pro in no time.

Factors Influencing Prices

Now, let’s get into the nitty-gritty of what makes crypto prices move like a fidget spinner. We’ll talk about supply and demand, the basic economics of it all. We’ll also cover regulations, those pesky rules that governments make, and news events, the hype that can make prices go ballistic.

Yo, check it, learning about crypto currency is like, super lit. It’s all about that digital money, like Bitcoin and Ethereum. And when you’re ready to step up your game, peep this guide on learning about crypto investing . It’ll drop some serious knowledge on how to make your crypto work for you.

But don’t forget, learning about crypto currency is still the bomb.

Cryptocurrency Exchanges

Yo, let’s talk about crypto exchanges, the spots where you can buy, sell, and trade crypto like a boss. There are two main types of exchanges:

- Centralized Exchanges (CEXs):These exchanges are like the big banks of crypto. They’re run by companies that hold your crypto and facilitate your trades. They’re easy to use and offer a wide range of coins, but they also have higher fees and can be less secure.

Yo, so you’re down to learn about crypto currency? That’s dope. Once you’ve got the basics down, check out learning about cryptocurrency mining . It’s the bomb for making some extra cash and getting in on the crypto game like a pro.

Keep on learning about crypto currency, yo!

- Decentralized Exchanges (DEXs):These exchanges are more like a free-for-all marketplace. They don’t hold your crypto, so you have full control over it. DEXs have lower fees and are more secure, but they can be more complicated to use and have a smaller selection of coins.

No matter which type of exchange you choose, the process of buying, selling, and trading crypto is pretty similar:

- Sign up for an account:Create an account with the exchange and go through their verification process.

- Deposit funds:Transfer some cash or crypto to your exchange account.

- Place an order:Decide which crypto you want to buy or sell and how much. Set your order type (market order, limit order, etc.)

Yo, check it out! If you’re all about learning about crypto currency, then you need to check out learning cryptocurrency . It’s like the bomb for anyone who wants to get their head around this whole crypto thing. From the basics to the latest trends, they got you covered.

So, hop on over and get your crypto education on, dude!

and submit it.

- Execute the trade:The exchange will match your order with another user’s order and complete the trade.

That’s the basics of crypto exchanges. Remember, always do your research and choose an exchange that’s reputable and secure. Happy trading!

Learning about crypto currency is a breeze these days, especially with all the free resources available online. I’ve been getting into it lately, and I’ve found learning about cryptocurrencies super interesting. It’s like a whole new world of finance, and I’m stoked to keep diving deeper into it.

Mining and Staking

Mining and staking are two processes used to verify and add new transactions to a blockchain network. Miners use specialized computers to solve complex mathematical problems, while stakers use their existing cryptocurrency holdings to validate transactions.

Mining

- Miners use powerful computers to solve complex mathematical equations to verify transactions and add new blocks to the blockchain.

- The first miner to solve the equation receives a reward in the form of cryptocurrency.

- Mining can be energy-intensive and requires specialized equipment.

Staking

- Staking involves holding a certain amount of cryptocurrency in a cryptocurrency wallet to validate transactions and earn rewards.

- The more cryptocurrency you stake, the greater your chances of validating a transaction and earning rewards.

- Staking is generally less energy-intensive than mining and requires no specialized equipment.

Rewards and Risks

- Mining:Rewards include cryptocurrency and transaction fees. Risks include high energy costs and competition.

- Staking:Rewards include cryptocurrency and staking rewards. Risks include the possibility of losing your staked cryptocurrency if the blockchain network is hacked.

Cryptocurrency Regulation

Cryptocurrency regulation is a complex and evolving landscape. Different jurisdictions have taken different approaches to regulating cryptocurrencies, ranging from outright bans to full-scale legalization. This has created a patchwork of regulations that can be difficult to navigate for businesses and investors.

- Challenges of Cryptocurrency Regulation:

- Lack of Global Standards:The absence of a unified regulatory framework for cryptocurrencies creates uncertainty and confusion for businesses and investors.

- Rapid Innovation:The rapid pace of innovation in the cryptocurrency space makes it difficult for regulators to keep up.

- Cross-Border Transactions:The decentralized nature of cryptocurrencies makes it difficult for regulators to enforce regulations across borders.

- Opportunities of Cryptocurrency Regulation:

- Increased Legitimacy:Clear and consistent regulation can provide legitimacy to cryptocurrencies and make them more attractive to businesses and investors.

- Reduced Risk:Regulation can help to reduce the risk of fraud and manipulation in the cryptocurrency market.

- Increased Innovation:Regulation can provide a framework for innovation in the cryptocurrency space by setting clear rules and expectations.

Cryptocurrency Use Cases

Cryptocurrencies are not just digital currencies; they have a wide range of potential use cases beyond traditional financial transactions. They can be used for payments, remittances, decentralized finance (DeFi), and more.

Payments

Cryptocurrencies can be used to make payments for goods and services online and in physical stores. They offer several advantages over traditional payment methods, such as lower transaction fees, faster settlement times, and increased security.

Remittances

Cryptocurrencies can be used to send money across borders quickly and cheaply. They are particularly useful for remittances to countries with underdeveloped banking systems or where traditional methods are expensive.

Decentralized Finance (DeFi)

DeFi is a growing ecosystem of financial applications and services built on blockchain technology. It enables users to access a wide range of financial services, such as lending, borrowing, and trading, without the need for intermediaries like banks.

Yo, learning about crypto currency is tight. It’s like, the future of money and stuff. But if you’re looking to take it to the next level, you gotta check out learning about cryptocurrency trading . It’s the bomb. You’ll learn how to buy, sell, and trade crypto like a pro.

Plus, it’s super easy to understand. So, what are you waiting for? Hop on the crypto train and start learning about crypto currency today!

Investment Considerations

Investing in cryptocurrencies can be a risky but potentially rewarding venture. Before jumping in, it’s crucial to understand the risks and rewards involved and develop a solid investment strategy.

Risks of Investing in Cryptocurrencies

- Volatility:Crypto markets are known for their extreme price fluctuations, which can lead to significant losses if not managed carefully.

- Scams and Fraud:The crypto space is rife with scams and fraudulent schemes, so it’s essential to research and only invest in reputable projects.

- Regulatory Uncertainty:The regulatory landscape for cryptocurrencies is constantly evolving, which can create uncertainty and impact investments.

- Lack of Protection:Unlike traditional investments, crypto assets are not covered by government-backed insurance or protection schemes.

Developing an Investment Strategy for Cryptocurrencies, Learning about crypto currency

- Do Your Research:Thoroughly research different crypto projects, their teams, and underlying technology before investing.

- Diversify Your Portfolio:Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies and asset classes.

- Set Realistic Expectations:Don’t expect to get rich quick. Crypto investing is a long-term game with potential for both gains and losses.

- Manage Your Risk:Use stop-loss orders and other risk management tools to limit potential losses.

- Consider Dollar-Cost Averaging:Invest small amounts regularly over time to reduce the impact of market volatility.

Cryptocurrency Trends

The cryptocurrency industry is constantly evolving, with new trends and innovations emerging all the time. Some of the most notable trends to watch in the coming years include:

Decentralized Finance (DeFi)

DeFi is a rapidly growing ecosystem of financial applications built on blockchain technology. DeFi applications allow users to borrow, lend, trade, and invest in cryptocurrencies without the need for intermediaries like banks or brokerages. DeFi is still in its early stages of development, but it has the potential to revolutionize the financial industry.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets that can represent ownership of a wide range of items, such as art, music, and collectibles. NFTs are becoming increasingly popular as a way to invest in digital assets and support creators.

Stablecoins

Stablecoins are cryptocurrencies that are pegged to a fiat currency, such as the US dollar. Stablecoins offer the stability of fiat currencies with the benefits of cryptocurrencies, such as security and global accessibility.

Central Bank Digital Currencies (CBDCs)

CBDCs are digital currencies issued by central banks. CBDCs are still in the early stages of development, but they have the potential to change the way we think about money and the financial system.

Yo, check it out! Learning about crypto currency is mad hype these days. If you’re a total noob, I got you covered. Hit up learning cryptocurrency for beginners and start crushing it like a boss. Trust me, it’s gonna be lit!

Challenges for the Future

While the cryptocurrency industry is growing rapidly, there are still a number of challenges that need to be addressed in order for it to reach its full potential. These challenges include:

- Regulation: The cryptocurrency industry is largely unregulated, which can make it difficult for investors to protect themselves from fraud and scams.

- Scalability: Many cryptocurrencies are not scalable, which means that they cannot handle a large number of transactions. This can lead to high transaction fees and slow transaction times.

- Security: Cryptocurrency exchanges and wallets have been hacked in the past, resulting in the loss of millions of dollars. This highlights the need for improved security measures.

Glossary

Cryptocurrency is a rapidly evolving field with its own unique set of terms and definitions. This glossary will help you understand the basics of cryptocurrency and its related concepts.

Addresses

-

-*Public Address

Yo, peep this out! Learning about crypto currency is all the rage. It’s like, the future or something. But if you wanna go deeper, check out learning about crypto . It’s got all the deets on blockchain, mining, and all that jazz.

So, get your crypto on, fam!

A unique identifier used to receive cryptocurrency. It’s like a bank account number, but it’s only used for cryptocurrency transactions.

-*Private Key

A secret code that allows you to access your cryptocurrency wallet and make transactions. It’s like the password to your bank account.

Blockchains

-

-*Blockchain

A decentralized, digital ledger that records cryptocurrency transactions. It’s like a giant, public spreadsheet that everyone can see.

-*Block

A collection of cryptocurrency transactions that have been verified and added to the blockchain.

-*Node

A computer that helps maintain the blockchain by verifying and adding new blocks.

Cryptocurrencies

-

-*Altcoin

Any cryptocurrency other than Bitcoin.

-*Bitcoin

The first and most well-known cryptocurrency.

Learning about crypto currency can be a bit confusing at first, but once you get the hang of it, it’s actually pretty sick. If you’re looking to take your crypto knowledge to the next level, check out this guide to learning crypto trading for beginners . It’ll teach you everything you need to know about buying, selling, and trading cryptocurrencies.

Trust me, it’s worth checking out. Once you’ve got the basics down, you’ll be a crypto pro in no time and you can continue to expand your knowledge about crypto currency.

-*Coin

A unit of cryptocurrency, like a dollar or a euro.

-*Token

A digital asset that represents a specific asset or service, like a stock or a loyalty point.

Mining

-

-*Mining

The process of verifying and adding new blocks to the blockchain.

-*Miner

A computer that performs mining.

-*Hash

A unique code that is generated by mining and used to verify transactions.

Wallets

-

-*Cryptocurrency Wallet

A software or hardware device that stores your cryptocurrency and private keys.

-*Hot Wallet

A cryptocurrency wallet that is connected to the internet.

-*Cold Wallet

A cryptocurrency wallet that is not connected to the internet.

Closing Notes

Congratulations! You’ve now gained a solid understanding of the fundamentals of cryptocurrency. Remember, the crypto-verse is constantly evolving, so stay curious and continue to explore its ever-changing landscape.

Whether you’re looking to invest, trade, or simply stay informed, this guide has laid the foundation for your crypto journey. Embrace the possibilities and seize the opportunities that this digital revolution has to offer.

Clarifying Questions

What’s the deal with cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank.

How does blockchain work?

Blockchain is a decentralized, distributed ledger that records transactions across a network of computers, making it secure and tamper-proof.

What’s the difference between Bitcoin and Ethereum?

Bitcoin is the original cryptocurrency, known for its store of value. Ethereum is a blockchain platform that allows for the creation of decentralized applications and smart contracts.

How can I buy cryptocurrency?

You can buy cryptocurrency through cryptocurrency exchanges, such as Coinbase or Binance, using fiat currency (e.g., USD, EUR).

Is cryptocurrency a good investment?

Cryptocurrency can be a volatile investment, but it also has the potential for high returns. It’s important to do your research and invest wisely.