In the realm of digital finance, cryptocurrencies have emerged as a captivating force, offering a decentralized and transformative approach to financial transactions. As more individuals seek to delve into the world of crypto trading, it becomes imperative to unravel the intricacies of this dynamic and often enigmatic market.

This comprehensive guide will provide a clear and concise overview of how cryptocurrency trading works, empowering you with the knowledge and strategies to navigate this ever-evolving landscape. From understanding the fundamentals of cryptocurrencies to exploring advanced trading techniques, we will delve into the intricacies of this rapidly growing industry.

Cryptocurrency Basics

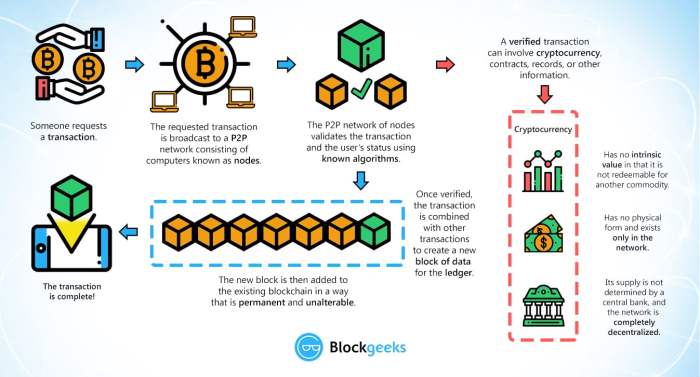

Cryptocurrency is a digital or virtual currency that uses cryptography for secure transactions. It operates on a decentralized network called blockchain, which records transactions in a transparent and immutable ledger. Unlike traditional fiat currencies controlled by central authorities, cryptocurrencies are not subject to government or financial institution interference.Different

types of cryptocurrencies exist, each with its unique features and applications. Bitcoin, the most well-known cryptocurrency, serves as a store of value and a medium of exchange. Ethereum, another popular cryptocurrency, enables the development of decentralized applications and smart contracts.Using

cryptocurrency offers several advantages. It provides anonymity and privacy, as transactions are recorded on the blockchain without revealing personal information. Cryptocurrencies are also global, allowing for borderless transactions without currency conversion fees. Furthermore, they are secure, as blockchain technology makes it virtually impossible to counterfeit or double-spend cryptocurrency.However,

there are also disadvantages to consider. Cryptocurrency markets can be volatile, with prices fluctuating rapidly. The anonymity associated with cryptocurrency can also attract illegal activities. Additionally, the regulatory landscape for cryptocurrency is still evolving, and legal uncertainties may exist in some jurisdictions.

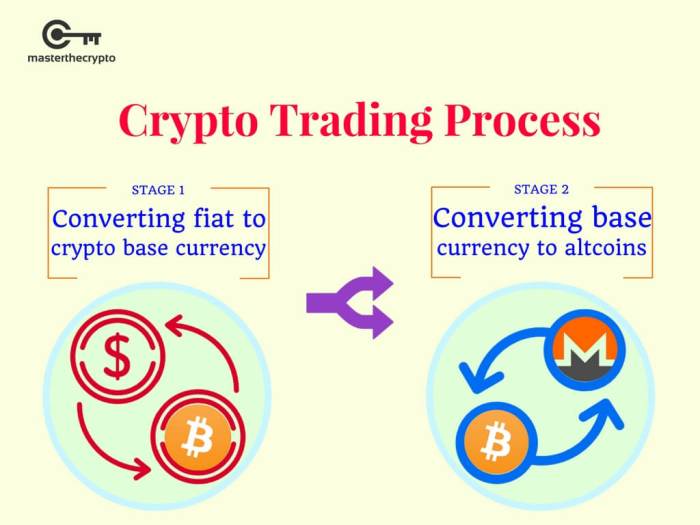

How Cryptocurrency Trading Works

Imagine a bustling marketplace where you can buy and sell digital assets known as cryptocurrencies. This is the realm of cryptocurrency trading, where savvy investors navigate the world of blockchain technology to seek potential profits.

Buying and Selling on an Exchange

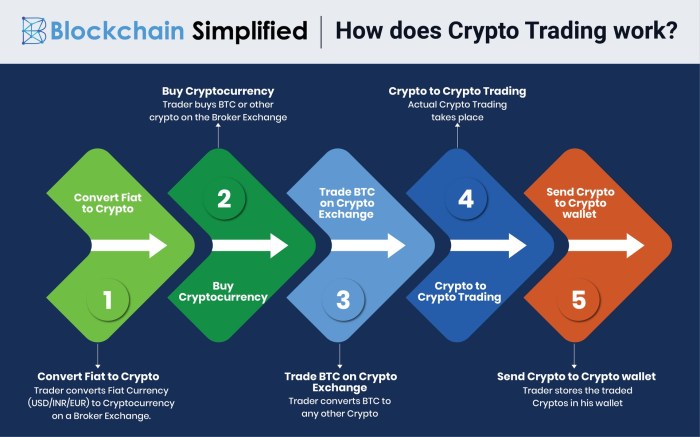

Just like any other marketplace, cryptocurrency trading takes place on specialized platforms called exchanges. These exchanges provide a secure environment for users to buy, sell, and hold their digital assets. The process is akin to visiting a stock exchange, where you can place orders to purchase or sell cryptocurrency at a desired price.

Types of Orders

When placing an order on an exchange, you have a range of options to choose from. Market orders execute immediately at the current market price, while limit orders allow you to specify a price at which you want your order to be filled.

Stop orders trigger a buy or sell order once a specific price point is reached.

Factors Affecting Cryptocurrency Price

The value of cryptocurrency is influenced by a myriad of factors, including supply and demand, news and events, regulations, and the overall sentiment of the market. As with any investment, it’s essential to conduct thorough research and understand the market dynamics before making any trades.

Cryptocurrency Trading Strategies

The realm of cryptocurrency trading presents a myriad of strategies, each promising to unlock the path to riches. From scalping to day trading, and from swing trading to holding, the choice of approach depends on your risk tolerance, time horizon, and market acumen.

Developing a Trading Plan and Managing Risk

Before embarking on the trading journey, it is imperative to craft a well-defined trading plan. This roadmap should Artikel your investment goals, risk tolerance, and entry and exit strategies. A clear plan helps you stay disciplined and avoid emotional decision-making in the face of market volatility.

Technical Analysis and Fundamental Analysis

In the world of cryptocurrency trading, two primary analytical approaches prevail: technical analysis and fundamental analysis. Technical analysis focuses on historical price data and chart patterns to identify trading opportunities, while fundamental analysis delves into the underlying value of a cryptocurrency, considering factors such as team, technology, and adoption.

Scalping

Scalping is a fast-paced trading strategy that involves profiting from tiny price movements. Scalpers enter and exit positions multiple times throughout the day, capturing small gains that accumulate over time. This strategy requires a high level of market awareness and lightning-fast execution.

Day Trading

Day traders buy and sell cryptocurrencies within the same trading day, aiming to capitalize on intraday price fluctuations. This approach demands constant monitoring of the market and a deep understanding of technical analysis.

Swing Trading

Swing traders hold positions for several days or weeks, seeking to profit from larger price swings. They use technical analysis to identify potential trend reversals and enter positions accordingly.

Holding

Holding, also known as buy-and-hold, is a long-term strategy where investors purchase and hold cryptocurrencies for an extended period, hoping for significant appreciation in value. This approach requires patience and a strong belief in the underlying technology.

Risk Management

Risk management is paramount in cryptocurrency trading. It involves setting stop-loss orders to limit potential losses, diversifying your portfolio to reduce exposure to any single asset, and adhering to your trading plan to avoid emotional decision-making.Remember, the cryptocurrency market is highly volatile and unpredictable.

No trading strategy guarantees success, and it is essential to approach trading with caution, a sound understanding of the risks involved, and a realistic expectation of potential returns.

Cryptocurrency Trading Tools

Cryptocurrency trading involves a range of specialized tools designed to empower traders with insights, analysis, and automation capabilities. These tools provide a comprehensive suite of resources to navigate the dynamic and often volatile crypto markets.

Charting Software

Charting software forms the backbone of technical analysis, allowing traders to visualize price movements and identify patterns. These tools plot historical data on a graph, enabling traders to spot trends, support and resistance levels, and potential trading opportunities.

Technical Indicators

Technical indicators are mathematical formulas that analyze price data to identify potential trading signals. They can be used to measure momentum, volatility, trend direction, and other market conditions. Some popular technical indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

Order Books

Order books display the current buy and sell orders for a specific cryptocurrency. They provide valuable insights into market depth and liquidity. By analyzing the order book, traders can assess the strength of buy and sell pressure and make informed trading decisions.

Cryptocurrency Trading Bots

Cryptocurrency trading bots are automated software programs that execute trades based on predefined rules. They can monitor market conditions 24/7, identify trading opportunities, and execute trades without human intervention. Trading bots can help traders save time, reduce emotions, and improve trading discipline.

Cryptocurrency Trading Risks

The allure of substantial gains in cryptocurrency trading is undeniable, but it’s crucial to be aware of the inherent risks involved. These risks stem from the volatile nature of cryptocurrencies, market manipulation, and the possibility of fraud.To navigate these risks effectively, it’s essential to mitigate them by diversifying your portfolio, investing only what you can afford to lose, and using a reputable exchange.

Using a Reputable Exchange

Choosing a reputable exchange is paramount for minimizing risks in cryptocurrency trading. A reputable exchange should offer robust security measures, transparent trading practices, and a track record of reliability.By selecting an exchange that meets these criteria, you can reduce the chances of falling victim to fraud or market manipulation.

Furthermore, a reputable exchange will provide a secure platform for storing your cryptocurrencies, protecting them from unauthorized access.

Cryptocurrency Trading Regulations

Cryptocurrency trading is a rapidly growing industry, and governments around the world are still trying to figure out how to regulate it. In some countries, cryptocurrency exchanges are required to register with the government and follow strict anti-money laundering and know-your-customer (KYC) regulations.

In other countries, cryptocurrency trading is completely unregulated.The regulatory landscape for cryptocurrency trading is constantly evolving, and it is important to stay up-to-date on the latest regulations in your jurisdiction. Failure to comply with cryptocurrency regulations can result in fines, imprisonment, or both.

Impact of Regulations on Cryptocurrency Trading

Regulations can have a significant impact on cryptocurrency trading. For example, regulations that require cryptocurrency exchanges to register with the government can make it more difficult for new exchanges to enter the market. Regulations that require exchanges to follow KYC regulations can make it more difficult for users to trade cryptocurrencies anonymously.However,

regulations can also have a positive impact on cryptocurrency trading. For example, regulations that protect users from fraud and abuse can make it more attractive for people to trade cryptocurrencies. Regulations that provide clear guidance on how cryptocurrencies are taxed can make it easier for people to comply with their tax obligations.Overall,

the impact of regulations on cryptocurrency trading is complex and depends on a number of factors, including the specific regulations in question, the jurisdiction in which they are implemented, and the response of the cryptocurrency market.

Cryptocurrency Trading Platforms

Cryptocurrency trading platforms provide a secure and convenient way to buy, sell, and trade cryptocurrencies. There are numerous platforms available, each with its own unique features and fees. Choosing the right platform is crucial for a successful trading experience.Different platforms offer varying levels of security, liquidity, and trading tools.

Some platforms cater to beginners, while others are more suitable for experienced traders. It’s essential to compare the features and fees of each platform to find the one that best suits your needs.

Types of Cryptocurrency Trading Platforms

There are two main types of cryptocurrency trading platforms: centralized and decentralized.*

-*Centralized platforms

These platforms are operated by a central authority, which manages the platform’s infrastructure and security. Centralized platforms typically offer a wider range of features and higher liquidity than decentralized platforms. However, they also pose a greater risk of censorship and hacking.*

-*Decentralized platforms

These platforms are not controlled by a central authority. Instead, they are operated by a network of computers spread across the globe. Decentralized platforms are less likely to be censored or hacked, but they may offer fewer features and lower liquidity than centralized platforms.

Choosing a Cryptocurrency Trading Platform

When choosing a cryptocurrency trading platform, consider the following factors:*

-*Security

The platform should have strong security measures in place to protect your funds from theft and hacking.*

-*Liquidity

The platform should have a high trading volume, which ensures that you can easily buy and sell cryptocurrencies without significant slippage.*

-*Fees

The platform should charge reasonable fees for its services.*

-*Features

The platform should offer a range of features to meet your trading needs, such as charting tools, order types, and stop-loss orders.*

-*Customer support

The platform should have responsive and helpful customer support in case you encounter any issues.By carefully considering these factors, you can choose a cryptocurrency trading platform that is safe, reliable, and meets your trading needs.

Cryptocurrency Trading Tax Implications

Cryptocurrency trading has become increasingly popular, but it’s important to be aware of the tax implications involved. Different countries have different laws regarding cryptocurrency taxation, so it’s crucial to understand the specific regulations that apply to you.

Reporting Cryptocurrency Gains and Losses

In most jurisdictions, cryptocurrency gains and losses are considered capital gains or losses and are taxed accordingly. This means that when you sell cryptocurrency for a profit, you may need to pay taxes on the capital gains. Similarly, if you sell cryptocurrency at a loss, you may be able to deduct the loss from your taxable income.It’s

important to keep accurate records of your cryptocurrency transactions, including the purchase price, sale price, and dates of each transaction. This information will be necessary when it comes time to file your taxes.

Different Tax Laws

The tax laws that apply to cryptocurrency vary from country to country. In some countries, cryptocurrency is treated as a commodity, while in others it’s considered a currency or a security. The tax treatment of cryptocurrency can also vary depending on how it’s used.

For example, cryptocurrency used for trading may be taxed differently than cryptocurrency used for investment purposes.It’s important to research the tax laws in your jurisdiction to understand how they apply to cryptocurrency. You may also want to consult with a tax professional to ensure that you’re meeting all of your tax obligations.

Cryptocurrency Trading Psychology

Psychology plays a crucial role in cryptocurrency trading, as it influences traders’ decision-making, risk tolerance, and emotional responses to market fluctuations. Understanding the psychological biases that can affect traders is essential for making rational and profitable trading decisions.

Managing Emotions

Emotions, such as fear and greed, can cloud judgment and lead to impulsive trading decisions. Traders must learn to manage their emotions by staying calm during market volatility, avoiding emotional trading, and developing a trading plan that aligns with their risk tolerance and trading goals.

Psychological Biases

Cognitive biases, such as the confirmation bias and the anchoring effect, can influence traders’ perceptions and decision-making. Confirmation bias leads traders to seek information that supports their existing beliefs, while the anchoring effect causes them to place too much weight on initial information.

Understanding these biases helps traders make more objective and informed decisions.

Tips for Rational Trading

To make rational trading decisions, traders should:

- Develop a trading plan and stick to it.

- Avoid emotional trading and stay calm during market volatility.

- Understand their risk tolerance and trade accordingly.

- Seek out objective information and avoid confirmation bias.

- Practice self-reflection and identify any psychological biases that may be influencing their trading decisions.

Cryptocurrency Trading Case Studies

Cryptocurrency trading is a complex and ever-evolving field, and there is no one-size-fits-all approach to success. However, by studying the strategies and techniques of successful traders, we can learn valuable lessons that can help us improve our own trading results.One

of the most famous cryptocurrency traders is Changpeng Zhao, the founder and CEO of Binance, the world’s largest cryptocurrency exchange. Zhao started trading Bitcoin in 2014, and within a few years, he had become one of the most successful traders in the world.

Zhao’s success is due in part to his deep understanding of the cryptocurrency market and his ability to identify and capitalize on trading opportunities.Another successful cryptocurrency trader is Sam Bankman-Fried, the founder and CEO of FTX, the second-largest cryptocurrency exchange in the world.

Bankman-Fried started trading Bitcoin in 2017, and within a few years, he had become one of the most successful traders in the world. Bankman-Fried’s success is due in part to his ability to develop and implement sophisticated trading strategies.

Case Study: Changpeng Zhao

Changpeng Zhao is a Chinese-Canadian businessman who is the founder and CEO of Binance, the world’s largest cryptocurrency exchange. Zhao started trading Bitcoin in 2014, and within a few years, he had become one of the most successful traders in the world.Zhao’s

success is due in part to his deep understanding of the cryptocurrency market and his ability to identify and capitalize on trading opportunities. Zhao is also a skilled technical analyst, and he uses a variety of technical indicators to identify trading opportunities.One

of Zhao’s most famous trades was his purchase of Bitcoin in 2017. At the time, Bitcoin was trading at around $2,000. Zhao purchased a large amount of Bitcoin, and he held onto it as the price rose to over $20,000. Zhao’s trade netted him a profit of over $100 million.Zhao’s

success is not just due to his trading skills. He is also a visionary leader, and he has been instrumental in the growth of the cryptocurrency industry. Binance is now the world’s largest cryptocurrency exchange, and it is used by millions of people around the world.

Case Study: Sam Bankman-Fried

Sam Bankman-Fried is an American entrepreneur and investor who is the founder and CEO of FTX, the second-largest cryptocurrency exchange in the world. Bankman-Fried started trading Bitcoin in 2017, and within a few years, he had become one of the most successful traders in the world.Bankman-Fried’s

success is due in part to his ability to develop and implement sophisticated trading strategies. Bankman-Fried is a quantitative trader, and he uses a variety of mathematical models to identify trading opportunities.One of Bankman-Fried’s most famous trades was his purchase of Bitcoin in 2020. At the time, Bitcoin was trading at around $10,000. Bankman-Fried purchased a large amount of Bitcoin, and he held onto it as the price rose to over $60,000. Bankman-Fried’s trade netted him a profit of over $500 million.Bankman-Fried’s

success is not just due to his trading skills. He is also a visionary leader, and he has been instrumental in the growth of the cryptocurrency industry. FTX is now the second-largest cryptocurrency exchange in the world, and it is used by millions of people around the world.

Summary

Cryptocurrency trading presents a unique blend of opportunities and challenges, requiring a keen understanding of market dynamics, risk management, and emotional control. By embracing the insights and strategies Artikeld in this guide, you can embark on your crypto trading journey with confidence, equipped to make informed decisions and maximize your potential returns.

Answers to Common Questions

What are the advantages of using cryptocurrency?

Cryptocurrencies offer several advantages, including decentralized transactions, increased privacy, potential for high returns, and accessibility to a global market.

How do I choose a cryptocurrency trading platform?

When selecting a trading platform, consider factors such as security measures, trading fees, supported cryptocurrencies, user interface, and customer support.

What are some common cryptocurrency trading strategies?

Popular trading strategies include day trading, swing trading, scalping, and hodling. The choice of strategy depends on individual risk tolerance, time horizon, and market conditions.

How do I manage risk in cryptocurrency trading?

Effective risk management involves setting stop-loss orders, diversifying your portfolio, and maintaining a disciplined trading plan.

What are the tax implications of cryptocurrency trading?

Tax laws regarding cryptocurrency trading vary by jurisdiction. It’s crucial to understand the tax implications in your region to ensure compliance.