In the rapidly evolving world of finance, cryptocurrencies have emerged as a captivating asset class, attracting both seasoned investors and curious newcomers alike. If you’re intrigued by the potential of crypto trading but unsure where to begin, this comprehensive guide will equip you with the essential knowledge and strategies to navigate this dynamic market.

From understanding the fundamentals of cryptocurrency to mastering advanced trading techniques, we’ll delve into every aspect of crypto trading, empowering you to make informed decisions and maximize your potential returns.

Understanding Cryptocurrency Basics

Cryptocurrency is a revolutionary form of digital currency that has gained immense popularity in recent years. It operates on a decentralized network, meaning it is not controlled by any central authority like a bank or government. Instead, transactions are verified and recorded on a distributed ledger called a blockchain.Cryptocurrencies

offer several key features that differentiate them from traditional currencies:

- Decentralization: No single entity controls the cryptocurrency network, making it immune to censorship or manipulation.

- Transparency: All transactions are recorded on the blockchain, providing a transparent and immutable record.

- Security: Cryptocurrencies use advanced encryption techniques to protect transactions and prevent fraud.

- Anonymity: While not all cryptocurrencies offer complete anonymity, many allow users to conduct transactions without revealing their identities.

Types of Cryptocurrencies

There are numerous types of cryptocurrencies available, each with its unique characteristics and use cases:

- Bitcoin: The original and most well-known cryptocurrency, designed as a peer-to-peer electronic cash system.

- Ethereum: A decentralized platform that allows developers to build and deploy decentralized applications (dApps).

- Stablecoins: Cryptocurrencies pegged to a fiat currency, such as the US dollar, to provide price stability.

- Altcoins: A collective term for all cryptocurrencies other than Bitcoin.

Popular Cryptocurrencies and Their Uses

Some popular cryptocurrencies and their uses include:

- Bitcoin: Used as a store of value and a medium of exchange.

- Ethereum: Facilitates the development and execution of smart contracts and dApps.

- Tether: A stablecoin pegged to the US dollar, providing a stable alternative to volatile cryptocurrencies.

- Binance Coin: The native cryptocurrency of the Binance exchange, used to pay trading fees and access exclusive features.

Choosing a Cryptocurrency Exchange

Selecting a cryptocurrency exchange is crucial for your trading journey. Consider factors like:*

-*Fees

Transaction, withdrawal, and deposit fees can vary. Choose an exchange with competitive rates.

-

-*Security

Look for exchanges with robust security measures, such as two-factor authentication, cold storage, and SSL encryption.

-*Supported Cryptocurrencies

Ensure the exchange offers the cryptocurrencies you wish to trade.

For beginners, reputable exchanges include Coinbase and Binance. Experienced traders may prefer exchanges like Kraken or Gemini for advanced features and a wider selection of cryptocurrencies.

Comparing Different Exchanges

Compare exchanges based on:*

-*Fees

Calculate the total cost of trading on each exchange, including fees for deposits, withdrawals, and transactions.

-

-*Security

Assess the exchange’s security protocols, insurance policies, and history of hacks or breaches.

-*Supported Cryptocurrencies

Determine which cryptocurrencies are available for trading on each exchange.

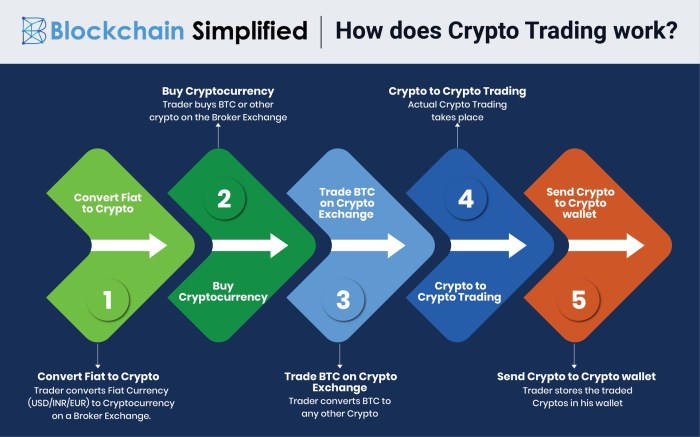

Funding Your Account

Funding your cryptocurrency exchange account is the first step towards trading cryptocurrencies. There are various methods to fund your account, each with its own advantages and limitations.

Depositing Fiat Currency

Fiat currency, such as USD or EUR, can be deposited into your exchange account through several methods:

-

-*Bank transfer

The most common method, bank transfers are generally slow but have low fees.

-*Credit/debit card

Convenient but often incurs higher fees than bank transfers.

-*Third-party payment processors

Services like PayPal and Skrill offer instant deposits but charge additional fees.

Depositing Cryptocurrencies

If you already own cryptocurrencies, you can transfer them to your exchange account from a personal wallet or another exchange.

The process involves providing the recipient address, which is unique to your exchange account, and sending the desired amount of cryptocurrency.

Fees and Limitations

Funding methods may incur fees, such as transaction fees or network fees. It’s important to compare fees and choose the most cost-effective option for your needs. Additionally, some exchanges may have deposit limits, which restrict the maximum amount of funds that can be deposited at once.

Placing Orders

Trading cryptocurrencies involves placing orders to buy or sell digital assets on a cryptocurrency exchange. Understanding the different types of orders and how to use them effectively is crucial for successful trading.

Order Types

- Limit Orders: Allow traders to specify the exact price at which they want to buy or sell a cryptocurrency. Limit buy orders are placed below the current market price, while limit sell orders are placed above it. These orders only execute when the market price reaches the specified price.

- Market Orders: Are executed immediately at the current market price. They are suitable for traders who want to enter or exit a position quickly, but may result in slippage, which is the difference between the expected price and the actual execution price.

- Stop-Loss Orders: Are used to protect against potential losses. They are placed at a predetermined price below (for sell orders) or above (for buy orders) the current market price. When the market price reaches the stop price, the order is triggered and becomes a market order, ensuring that the trader exits the position at a predefined price.

Managing Risk

Cryptocurrency trading involves inherent risks, including price volatility, exchange hacks, and regulatory uncertainties. To mitigate these risks, it’s crucial to implement a comprehensive risk management strategy.

Diversification

Diversifying your portfolio by investing in multiple cryptocurrencies reduces the impact of losses from any single asset. Research different cryptocurrencies, their underlying technologies, and market trends to make informed decisions about your investments.

Stop-Loss Orders

Stop-loss orders are essential tools for limiting potential losses. By setting a specific price level at which your order will be executed, you can automatically sell your cryptocurrency if it falls below that level, preventing further losses.

Tips for Minimizing Losses

-

-*Set realistic profit targets

Avoid getting carried away by market hype and setting unrealistic profit targets. Remember, the cryptocurrency market is volatile, and it’s important to take profits when you’re ahead.

-*Monitor your investments regularly

Keep a close eye on the performance of your investments and make adjustments as needed. Stay informed about market news and regulatory changes that may impact your investments.

-*Protect your private keys

Store your private keys securely and never share them with anyone. Private keys grant access to your cryptocurrency wallets, so it’s essential to keep them safe from hackers and malicious actors.

Technical Analysis

Technical analysis is a method of evaluating cryptocurrency prices by studying historical data, such as price charts and trading volume.

It helps traders identify patterns and trends that can indicate future price movements.

There are numerous technical indicators that traders use, each with its own strengths and weaknesses. Some of the most popular indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

Moving Averages

Moving averages are calculated by taking the average price of a cryptocurrency over a specified period of time. They can be used to identify trends and support and resistance levels.

Bollinger Bands

Bollinger Bands are a volatility indicator that consists of three lines: an upper band, a lower band, and a middle band. The upper and lower bands are set a certain number of standard deviations above and below the middle band, respectively.

Relative Strength Index (RSI)

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate whether a cryptocurrency is overbought or oversold.

Technical analysis can be a valuable tool for cryptocurrency traders, but it is important to remember that it is not an exact science. There are no guarantees that a particular technical indicator will accurately predict future price movements.

Fundamental Analysis

In the realm of cryptocurrency trading, fundamental analysis is a beacon of insight that illuminates the intrinsic value of digital assets. By scrutinizing the underlying factors that drive a cryptocurrency’s worth, traders can make informed decisions and navigate the volatile waters of the market with greater confidence.

Key Factors

When evaluating a cryptocurrency’s value, several key factors come into play:

Technology

Assess the underlying blockchain technology, its scalability, security, and potential for innovation.

Team

Examine the expertise, experience, and track record of the development team behind the cryptocurrency.

Adoption

Gauge the level of acceptance and usage of the cryptocurrency within its target market.

Use Case

Identify the real-world applications and utility of the cryptocurrency, as well as its potential for solving specific problems.

Financial Health

Analyze the financial statements and cash flow of the cryptocurrency’s underlying company or organization.

Techniques

Fundamental analysis employs a variety of techniques to uncover the true value of a cryptocurrency:

Market Capitalization

Calculates the total value of all outstanding coins, providing an indicator of the cryptocurrency’s overall market size.

Circulating Supply

Determines the number of coins currently in circulation, affecting the supply and demand dynamics.

Network Value to Transactions

Compares the value of the cryptocurrency’s network to the volume of transactions, offering insights into its usage and efficiency.

Price-to-Earnings Ratio

Similar to traditional stock analysis, this ratio assesses the value of a cryptocurrency relative to its earnings or revenue.By leveraging these techniques and considering the key factors Artikeld above, traders can gain a deeper understanding of the fundamental drivers behind cryptocurrency prices and make more informed trading decisions.

Trading Strategies

In the fast-paced world of cryptocurrency trading, developing a sound trading strategy is crucial for success. Whether you’re a seasoned veteran or a newcomer, understanding different trading strategies and their implications can empower you to make informed decisions.

Scalping

Scalping involves making numerous small trades within a short time frame, typically within minutes or seconds. Scalpers aim to capitalize on small price fluctuations, profiting from the bid-ask spread or tiny price movements. This strategy requires high liquidity, rapid execution, and a sharp eye for market patterns.Advantages:

- High profit potential due to frequent trades

- Can be less risky than holding positions for longer periods

Disadvantages:

- Requires constant attention and monitoring

- Commissions and fees can eat into profits

Day Trading

Day traders open and close positions within a single trading day, avoiding overnight risk. They seek to profit from intraday price movements, using technical analysis and market sentiment to identify trading opportunities. Day trading requires a deep understanding of market dynamics and the ability to make quick decisions.Advantages:

- No overnight risk

- Can take advantage of intraday price swings

Disadvantages:

- Requires a significant amount of time and effort

- Can be emotionally draining

Swing Trading

Swing traders hold positions for a few days to weeks, aiming to capture larger price movements. They identify trends and momentum, using technical and fundamental analysis to determine entry and exit points. Swing trading allows for more flexibility and less active involvement than day trading.Advantages:

- Captures larger price swings

- Less time-consuming than day trading

Disadvantages:

- Can involve overnight risk

- Requires patience and the ability to tolerate drawdowns

Trend Trading

Trend traders seek to identify and trade with the prevailing market trend. They believe that prices tend to continue moving in the same direction, so they enter trades in line with the trend and hold positions until the trend reverses.

Trend trading is a less active strategy that can be suitable for both beginners and experienced traders.Advantages:

- Can ride long-term trends

- Relatively low maintenance

Disadvantages:

- May miss out on short-term price fluctuations

- Can be vulnerable to trend reversals

Importance of a Trading Plan

Regardless of your chosen strategy, developing a comprehensive trading plan is essential. Your plan should Artikel your trading goals, risk tolerance, entry and exit criteria, and position management strategies. Sticking to your plan helps maintain discipline, reduces emotional trading, and increases the likelihood of long-term success.

Trading Psychology

Cryptocurrency trading is a highly emotional endeavor, and it’s essential to understand the psychological aspects that influence trading decisions. The allure of quick profits and the fear of losses can cloud judgment and lead to irrational behavior.

Common Trading Mistakes

*

-*FOMO (Fear of Missing Out)

Acting impulsively based on the belief that others are making profits.

-

-*Confirmation Bias

Seeking information that confirms existing beliefs and ignoring contradictory evidence.

-*Overtrading

Trading too frequently without proper risk management, leading to losses.

-*Revenge Trading

Trying to recover losses by making larger or riskier trades, often resulting in further losses.

Advanced Trading Techniques

As you progress in your cryptocurrency trading journey, you may encounter advanced trading techniques that can enhance your potential returns but also introduce additional risks.

Margin trading and futures contracts are two such techniques that offer unique opportunities and challenges.

Margin Trading

Margin trading allows you to borrow funds from a cryptocurrency exchange to increase your trading power. By leveraging your capital, you can potentially amplify your profits. However, it’s crucial to understand that margin trading also magnifies your losses. Therefore, it’s essential to use margin with caution and only when you have a clear understanding of the risks involved.

Futures Contracts

Futures contracts are agreements to buy or sell a specific amount of cryptocurrency at a predetermined price on a future date. They provide a way to speculate on future price movements and can be used for hedging or locking in profits.

However, futures contracts can be complex and require a high level of understanding of the cryptocurrency market.

When using advanced trading techniques, it’s imperative to consider your risk tolerance, trading experience, and financial situation. Always conduct thorough research, consult with experts if necessary, and start with small positions until you become comfortable with the risks and rewards.

Final Conclusion

Whether you’re a seasoned trader seeking to refine your strategies or a novice eager to embark on your crypto trading journey, this guide has something to offer. By embracing the knowledge and insights presented here, you’ll gain the confidence and skills necessary to navigate the crypto market with purpose and profitability.

Answers to Common Questions

What are the key features of cryptocurrency?

Cryptocurrencies are digital or virtual currencies that utilize cryptography for secure transactions and control the creation of new units.

What are the different types of cryptocurrencies available?

There are numerous types of cryptocurrencies, each with unique characteristics. Bitcoin, Ethereum, and Litecoin are among the most well-known.

How do I choose a reputable cryptocurrency exchange?

Consider factors such as fees, security measures, supported cryptocurrencies, and user reviews when selecting an exchange.

What are the different order types in cryptocurrency trading?

Common order types include market orders (executed immediately at the current market price), limit orders (executed only when the price reaches a specified level), and stop-loss orders (used to limit potential losses).

What are the risks involved in cryptocurrency trading?

Cryptocurrency trading involves risks such as price volatility, hacking, and market manipulation. It’s crucial to manage risk effectively.