In the ever-evolving realm of finance, cryptocurrency trading has emerged as a lucrative opportunity for investors seeking to capitalize on the volatility and potential growth of digital assets. This guide delves into the intricacies of crypto trading, empowering you with the knowledge and strategies to navigate this dynamic market and maximize your profits.

Embark on a journey to master the art of crypto trading, exploring fundamental and technical analysis, risk management techniques, and advanced trading strategies. Discover the secrets of identifying profitable opportunities, managing emotions, and harnessing the power of automation to enhance your trading performance.

Understanding Crypto Market Dynamics

The cryptocurrency market is a dynamic and ever-evolving landscape, characterized by high volatility, varying liquidity, and a diverse range of order types. Comprehending these dynamics is crucial for successful trading in this burgeoning market.Market volatility refers to the extent to which cryptocurrency prices fluctuate over time.

This volatility can be attributed to a multitude of factors, including news events, regulatory changes, and the actions of large-scale investors known as whales. Understanding the potential for price swings is essential for managing risk and maximizing profits.Liquidity measures the ease with which cryptocurrencies can be bought and sold.

Highly liquid markets, such as Bitcoin and Ethereum, offer tighter spreads and lower transaction costs, making them more attractive for traders. Order types, such as market orders, limit orders, and stop-loss orders, provide traders with the flexibility to execute trades at specific prices and minimize losses.

Technical Analysis for Crypto Trading

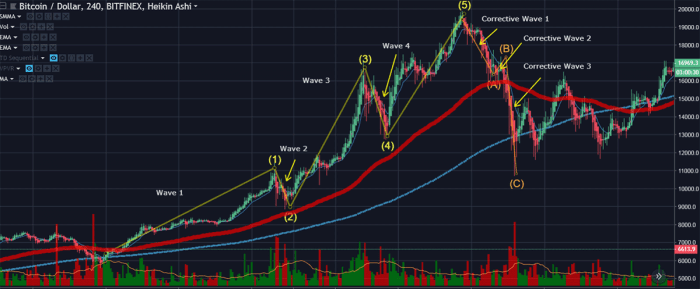

Technical analysis is a powerful tool that can help you identify trading opportunities and make informed decisions in the crypto market. By studying price charts and using technical indicators, you can gain insights into market trends, support and resistance levels, and potential price movements.

One of the most important aspects of technical analysis is identifying trends. A trend is a sustained movement in the price of an asset over time. Trends can be bullish (upward) or bearish (downward), and they can last for days, weeks, or even months.

To identify trends, you can use moving averages. A moving average is a technical indicator that shows the average price of an asset over a specified period of time. Moving averages can help you smooth out price fluctuations and identify the overall trend of the market.

Another important aspect of technical analysis is identifying support and resistance levels. Support is a price level at which the price of an asset has difficulty falling below. Resistance is a price level at which the price of an asset has difficulty rising above.

Support and resistance levels can be identified by looking at price charts. When the price of an asset repeatedly bounces off a certain price level, it is likely that there is a support or resistance level at that price.

Candlestick Patterns

Candlestick patterns are another important tool for technical analysis. Candlesticks are a type of price chart that shows the open, high, low, and close prices of an asset over a specified period of time.

Candlestick patterns can be used to identify potential trading opportunities. For example, a bullish candlestick pattern is one that indicates that the price of an asset is likely to rise. A bearish candlestick pattern is one that indicates that the price of an asset is likely to fall.

There are many different candlestick patterns, each with its own unique meaning. Some of the most common candlestick patterns include the following:

- Hammer

- Hanging man

- Bullish engulfing

- Bearish engulfing

- Doji

Candlestick patterns can be a powerful tool for technical analysis, but it is important to remember that they are not always accurate. It is always important to use multiple technical indicators and to consider the overall market conditions before making any trading decisions.

Chart Patterns

Chart patterns are another important tool for technical analysis. Chart patterns are formed by the price action of an asset over time. They can be used to identify potential trading opportunities and to predict future price movements.

There are many different chart patterns, each with its own unique meaning. Some of the most common chart patterns include the following:

- Triangles

- Flags

- Head-and-shoulders

- Double tops

- Double bottoms

Chart patterns can be a powerful tool for technical analysis, but it is important to remember that they are not always accurate. It is always important to use multiple technical indicators and to consider the overall market conditions before making any trading decisions.

Fundamental Analysis for Cryptocurrencies

To make informed investment decisions in the volatile crypto market, it’s crucial to go beyond technical indicators and delve into the underlying fundamentals of each cryptocurrency. Fundamental analysis involves assessing the technology, team, and market adoption of a project to identify its long-term potential.

One key aspect is evaluating the whitepaper, which Artikels the project’s vision, technology, and roadmap. A well-crafted whitepaper should clearly articulate the problem the project solves, its unique value proposition, and the team’s expertise.

Project Updates and Community Engagement

Regular project updates and roadmap revisions demonstrate the team’s commitment and provide insights into the project’s progress. A strong and engaged community is also a positive indicator, as it suggests the project has gained traction and has a loyal following.

Market Adoption and Partnerships

Market adoption is a crucial indicator of a cryptocurrency’s long-term viability. Partnerships with established companies, industry leaders, and influencers can enhance the project’s credibility and increase its potential for widespread use.

Crypto Trading Platforms

Navigating the crypto trading landscape requires a discerning eye for choosing the right platform. Different platforms offer varying features, fees, and security measures, catering to diverse trading needs and preferences. Understanding the nuances of these platforms empowers traders to make informed decisions and optimize their trading strategies.

Platform Features

Crypto trading platforms provide a range of features tailored to enhance the trading experience. These include:

-

-*Order Types

Platforms offer various order types, such as market orders, limit orders, and stop-loss orders, enabling traders to execute trades with precision and flexibility.

-*Trading Tools

Advanced platforms offer charting tools, technical indicators, and trading bots, empowering traders to analyze market trends and automate their trading strategies.

-*Liquidity

Platforms with high liquidity ensure that traders can buy or sell cryptocurrencies quickly and efficiently, minimizing slippage and maximizing profits.

-*User Interface

Intuitive user interfaces simplify the trading process, allowing both novice and experienced traders to navigate the platform seamlessly.

Trading Psychology

Emotions play a significant role in crypto trading, as they can cloud our judgment and lead to impulsive or irrational decisions.

It’s crucial to manage emotions effectively to succeed in crypto trading.Common psychological biases in crypto trading include:

-

-*Confirmation bias

Seeking information that confirms our existing beliefs.

-*FOMO (Fear of Missing Out)

Making hasty trades due to the fear of missing out on potential gains.

-*Overconfidence

Believing we know more than we do, leading to risky trades.

Automating Crypto Trading

In the fast-paced world of crypto trading, automation can be a powerful tool to enhance efficiency and profitability. Automated trading bots leverage sophisticated algorithms to execute trades based on predefined parameters, offering traders numerous advantages.

Benefits of Automated Trading Bots

- Round-the-clock Trading: Bots can trade 24/7, allowing traders to capitalize on market opportunities around the clock.

- Emotional Discipline: Bots remove the emotional element from trading, ensuring decisions are made objectively based on data rather than gut instinct.

- Backtesting and Optimization: Automated trading allows for rigorous backtesting and optimization of algorithms, helping traders refine their strategies for maximum performance.

- Reduced Time and Effort: Bots automate the trading process, freeing up traders to focus on other aspects of their portfolio or personal life.

Drawbacks of Automated Trading Bots

- Technical Complexity: Developing and deploying automated trading bots requires technical expertise and programming knowledge.

- Market Volatility: Automated bots may not be able to adapt quickly enough to sudden market fluctuations, potentially leading to losses.

- Lack of Human Insight: Bots lack the human intuition and experience that can be invaluable in certain trading situations.

- Dependence on Algorithms: The performance of automated bots is heavily dependent on the quality of the underlying algorithms, which can be challenging to develop and maintain.

Developing and Backtesting Trading Algorithms

To develop effective automated trading algorithms, traders should follow these steps:

- Define Trading Strategy: Establish a clear trading strategy based on market analysis and historical data.

- Create Algorithm: Code the trading strategy into an automated algorithm using a programming language like Python or R.

- Backtest Algorithm: Simulate the algorithm’s performance using historical market data to identify potential weaknesses and areas for improvement.

- Optimize Parameters: Adjust the algorithm’s parameters through iterative testing to maximize its profitability and reduce risk.

- Deploy Algorithm: Once the algorithm is optimized, deploy it on a live trading platform to execute trades automatically.

Tax Implications of Crypto Trading

Navigating the tax implications of cryptocurrency trading can be a complex task, varying across different jurisdictions. Understanding the specific regulations in your region is crucial to avoid any potential legal or financial consequences.

Reporting Crypto Profits and Losses

When filing your tax returns, it’s essential to accurately report both profits and losses incurred from crypto trading. Depending on the jurisdiction, these may be subject to capital gains tax, income tax, or other applicable levies.

Cryptocurrency Taxation in Different Jurisdictions

*

-*United States

Cryptocurrencies are treated as property for tax purposes, with capital gains tax applicable to profits.

-

-*United Kingdom

Crypto trading profits are subject to capital gains tax, while losses can be offset against future gains.

-*European Union

Cryptocurrency trading is generally subject to VAT and income tax, depending on the specific circumstances.

It’s highly recommended to consult with a qualified tax professional to ensure compliance with the regulations in your jurisdiction and minimize any potential tax liabilities.

Crypto Trading Tools and Resources

Cryptocurrency trading can be a complex and challenging endeavor, but it can also be highly rewarding. To increase your chances of success, it’s important to equip yourself with the right tools and resources. In this section, we’ll share a curated list of essential tools for crypto traders, along with explanations of how to use them effectively.

Market Data Aggregators

Market data aggregators collect and display real-time data from multiple exchanges, providing you with a comprehensive view of the crypto market. This information can be invaluable for making informed trading decisions. Some popular market data aggregators include:* CoinMarketCap

- CoinGecko

- CryptoCompare

Charting Platforms

Charting platforms allow you to visualize historical and real-time price data, identify trends, and perform technical analysis. They provide a variety of charting tools and indicators that can help you make better trading decisions. Some popular charting platforms include:* TradingView

- Binance TradingView

- Kraken Intelligence

Trading Signals

Trading signals are automated alerts that notify you when specific trading opportunities arise. They can be based on technical analysis, fundamental analysis, or a combination of both. While trading signals can be helpful, it’s important to use them with caution and never rely on them blindly.

Some popular trading signal providers include:* Cryptohopper

- 3Commas

- Bitsgap

By using the right tools and resources, you can significantly enhance your crypto trading strategies. Remember to approach trading with a sound understanding of the market, risk management principles, and your own trading goals.

Advanced Crypto Trading Techniques

Seasoned crypto traders employ sophisticated strategies to maximize their profits. Let’s delve into some of these advanced techniques:

Arbitrage

Arbitrage capitalizes on price discrepancies between different crypto exchanges. By simultaneously buying on one exchange and selling on another where the price is higher, traders can capture the difference in value.For example, if Bitcoin trades at $20,000 on Exchange A and $20,010 on Exchange B, an arbitrageur could buy Bitcoin on Exchange A and immediately sell it on Exchange B, netting a $10 profit per Bitcoin.

Scalping

Scalping involves making numerous small trades within a short timeframe, taking advantage of minor price fluctuations. Scalpers typically use technical indicators and charts to identify entry and exit points, aiming for quick profits on each trade.For instance, a scalper might buy Bitcoin when the price dips below a support level and sell it when it rises above a resistance level, capturing a few dollars of profit per trade.

Futures Trading

Futures contracts allow traders to speculate on the future price of cryptocurrencies. Traders can go long (betting on a price increase) or short (betting on a price decrease) using futures.For example, if a trader believes Bitcoin will rise in value, they could buy a futures contract that gives them the right to buy Bitcoin at a fixed price in the future.

If the price of Bitcoin increases, the trader can sell the contract for a profit.

Outcome Summary

As you delve deeper into the world of crypto trading, remember that knowledge is the key to unlocking success. Embrace the principles Artikeld in this guide, adapt them to your unique trading style, and continually refine your strategies. The path to crypto trading profitability lies in a combination of understanding, adaptability, and unwavering determination.

May this guide serve as your trusted companion on your journey towards financial empowerment.

Common Queries

What are the key factors influencing crypto prices?

News events, regulatory changes, whale activity, market sentiment, and supply and demand dynamics.

How can I identify profitable trading opportunities using technical analysis?

By utilizing technical indicators such as moving averages, support and resistance levels, and candlestick patterns to predict price movements.

What is the importance of risk management in crypto trading?

To minimize losses and protect your capital by setting stop-loss orders, diversifying investments, and hedging positions.

How can I select the best crypto trading platform for my needs?

Consider factors such as fees, security measures, trading features, and the availability of the cryptocurrencies you wish to trade.

What are the benefits of using automated trading bots?

They can execute trades 24/7, remove emotions from decision-making, and backtest strategies to optimize performance.