In the realm of personal finance, mortgage loan forbearance emerges as a beacon of hope for homeowners navigating financial storms. This lifeline, granted by lenders, offers a temporary reprieve from mortgage payments, providing a crucial breathing room to stabilize one’s financial situation.

Mortgage loan forbearance is not a mere suspension of payments; it is a carefully structured program designed to prevent foreclosure and preserve homeownership. By understanding the eligibility criteria, application process, and potential implications, homeowners can harness this valuable tool to weather financial challenges and secure their housing stability.

Mortgage Loan Forbearance Definition

In the realm of financial burdens, mortgage loan forbearance emerges as a beacon of hope, offering a lifeline to homeowners facing temporary financial hardships. It’s a temporary pause on mortgage payments, allowing borrowers to navigate challenging times without the fear of foreclosure.

The primary purpose of forbearance is to provide financial relief during periods of unemployment, medical emergencies, or other unforeseen circumstances that hinder a homeowner’s ability to meet their mortgage obligations. By granting this temporary reprieve, forbearance safeguards homeowners from losing their homes due to temporary financial setbacks.

Eligibility Criteria

Eligibility for mortgage loan forbearance is based on specific criteria set by the government or the lender. These criteria are designed to ensure that only those who are truly facing financial hardship are able to take advantage of this relief program.

One of the primary requirements for eligibility is that the borrower must have experienced a financial hardship that has made it difficult for them to make their mortgage payments. This hardship can be caused by a variety of factors, such as a job loss, a reduction in income, or a medical emergency.

Income and Financial Hardship Considerations

In order to qualify for mortgage loan forbearance, the borrower’s income must be below a certain threshold. The threshold varies depending on the program, but it is typically set at 80% of the area median income. In addition, the borrower must demonstrate that they are experiencing a financial hardship that is making it difficult for them to make their mortgage payments.

Mortgage loan forbearance has become a lifeline for many homeowners struggling to make ends meet during the pandemic. While it provides temporary relief, it’s crucial to remember that it’s not a long-term solution. For those considering buying a house in the next year, saving up enough cash to purchase outright can be a wise financial move.

This strategy eliminates the need for a mortgage loan and the associated interest payments, providing greater financial stability in the long run. However, mortgage loan forbearance can still be a valuable tool for those facing immediate financial hardship.

Process and Procedures: Mortgage Loan Forbearance

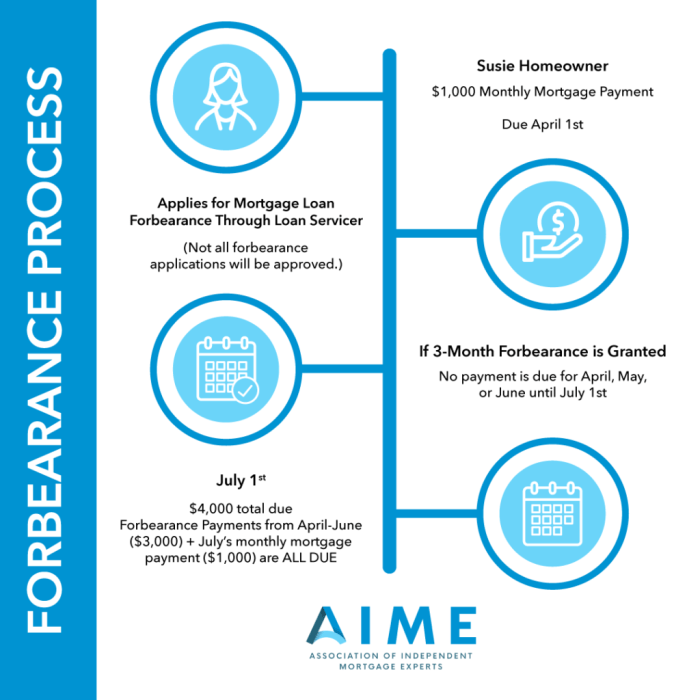

Applying for mortgage loan forbearance is a relatively straightforward process. Here’s a step-by-step guide to help you navigate it:

First and foremost, it’s crucial to contact your mortgage servicer as soon as you anticipate difficulty making mortgage payments. They will guide you through the application process and provide necessary assistance.

Documentation and Information Required

To apply for mortgage loan forbearance, you will typically need to provide the following information:

- Proof of financial hardship, such as a job loss notice, medical bills, or other documentation demonstrating your inability to make mortgage payments.

- Your current income and expense statement.

- A hardship letter explaining your situation and why you are requesting forbearance.

- Any other documentation requested by your mortgage servicer.

Terms and Conditions

Understanding the terms and conditions of mortgage loan forbearance is crucial to make an informed decision. These conditions Artikel the duration of the forbearance period, interest accrual, and potential fees or penalties associated with it.

Duration

Typically, mortgage loan forbearance is granted for a period of 3 to 12 months. During this time, the borrower is allowed to temporarily suspend or reduce their mortgage payments.

Interest Accrual

Even though payments are suspended or reduced during forbearance, interest on the outstanding loan balance continues to accrue. This means that the total amount owed on the mortgage will increase over time.

Fees and Penalties

Some lenders may charge an administrative fee or a late payment fee for entering into forbearance. Additionally, if the borrower fails to make payments after the forbearance period ends, they may face late fees, penalties, or even foreclosure proceedings.

While mortgage loan forbearance can provide temporary relief, it’s crucial to explore long-term solutions. Investing in cryptocurrencies, with its potential for significant returns as highlighted in benefit of investment in crypto , can supplement your financial stability. By leveraging the power of blockchain and digital assets, you can potentially generate passive income and build a stronger financial foundation, enabling you to navigate mortgage loan forbearance challenges with greater confidence.

Impacts on Credit Score

Mortgage loan forbearance can have a significant impact on your credit score. When you enter forbearance, your lender will typically report it to the credit bureaus as a “missed payment.” This can cause your credit score to drop, which can make it more difficult to qualify for future loans or credit cards.

However, there are steps you can take to mitigate the negative effects of forbearance on your credit score. First, make sure to contact your lender as soon as you know you will be unable to make your mortgage payments. Your lender may be able to offer you a forbearance plan that will not be reported to the credit bureaus.

Amidst the financial uncertainties of today, mortgage loan forbearance has emerged as a lifeline for many homeowners. This temporary relief can provide a much-needed respite, allowing you to catch up on missed payments and regain financial stability. However, if you’re looking to make the most of this opportunity, consider exploring the exciting world of trading.

Try trading for beginner platforms offer a low-risk environment where you can learn the basics of trading and potentially supplement your income. With the right strategies and knowledge, you can create a solid financial foundation that will empower you to weather any financial storms in the future.

As you navigate the complexities of mortgage loan forbearance, remember that knowledge and exploration can be your most valuable allies.

If your lender does report your forbearance to the credit bureaus, you can dispute the information. You can do this by sending a letter to the credit bureaus explaining that you were in forbearance and that the missed payments were not due to a lack of effort on your part.

You may also be able to provide documentation to support your claim, such as a letter from your lender or a proof of income.

It is important to note that forbearance is not the same as foreclosure. Foreclosure is a legal process that can result in the loss of your home. If you are facing foreclosure, you should contact a housing counselor or attorney for help.

Alternatives to Forbearance

When facing financial hardship, homeowners have alternatives to forbearance that may be more suitable for their long-term financial goals. Loan modification and refinancing are two such options that offer different benefits and drawbacks.

Loan Modification

Loan modification involves working with your lender to permanently change the terms of your mortgage. This can include reducing your interest rate, extending your loan term, or converting your adjustable-rate mortgage (ARM) to a fixed-rate mortgage. Loan modification can be a good option for homeowners who expect their financial hardship to be long-term or who are at risk of foreclosure.

Advantages:

- Can lower your monthly mortgage payments

- Can provide long-term stability

- Can help you avoid foreclosure

Disadvantages:

- Can be difficult to qualify for

- May require you to pay closing costs

- Can extend the life of your loan

Refinancing

Refinancing involves taking out a new mortgage to replace your existing one. This can be a good option for homeowners who have improved their credit score or who want to take advantage of lower interest rates. Refinancing can also be used to consolidate debt or access home equity.

As the financial storm rages, mortgage loan forbearance has emerged as a beacon of hope for many homeowners. But what if you’re not ready to commit to a long-term housing situation? If you’re debating between buying a used car or renting a house, this article provides valuable insights to help you navigate this decision.

Whether you choose to hit the road or settle down in a new abode, mortgage loan forbearance can offer a lifeline during these turbulent times.

Advantages:

- Can lower your monthly mortgage payments

- Can provide you with cash-out options

- Can consolidate debt

Disadvantages:

- Can be expensive

- May require you to pay closing costs

- May not be available to homeowners with poor credit

Government Assistance Programs

When facing financial hardship, homeowners may seek assistance from government-sponsored programs designed to provide relief with mortgage payments. These programs aim to prevent foreclosures and stabilize the housing market.

One notable program is the CARES Act, enacted in 2020 in response to the COVID-19 pandemic. The CARES Act offers forbearance options for federally backed mortgages, including those insured by the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the Department of Agriculture (USDA).

Eligibility Criteria

To qualify for government assistance programs, homeowners must meet specific eligibility criteria. These criteria typically include:

- Experiencing financial hardship due to job loss, reduced income, or other qualifying circumstances

- Having a mortgage that is current or only slightly delinquent

- Providing documentation to support the financial hardship

Application Process, Mortgage loan forbearance

Applying for government assistance programs typically involves contacting the loan servicer and submitting an application. The loan servicer will review the application and determine eligibility. If approved, the homeowner will enter into a forbearance agreement that Artikels the terms and conditions of the assistance.

Foreclosure Prevention

Mortgage loan forbearance plays a critical role in preventing foreclosure, a legal process that results in the loss of a home due to unpaid mortgage payments. When homeowners face financial hardship, forbearance provides them with temporary relief from their mortgage obligations, allowing them to stabilize their financial situation and avoid foreclosure.

Time to Stabilize

Forbearance offers homeowners a valuable opportunity to address the underlying financial issues that led to their mortgage delinquency. During the forbearance period, they can focus on rebuilding their income, reducing expenses, and exploring other financial assistance programs. By providing homeowners with time and flexibility, forbearance helps them regain financial stability and prevent the loss of their homes.

Legal Implications

Entering into a mortgage loan forbearance can have legal implications that impact the underlying mortgage agreement. Understanding these implications is crucial before signing any forbearance agreement.

Seeking Legal Advice

It’s highly recommended to consult with a qualified attorney who specializes in mortgage law before considering forbearance. They can review the terms of your mortgage agreement, explain your legal rights and responsibilities, and guide you through the forbearance process to protect your interests.

Mortgage loan forbearance provides a lifeline during financial hardships, allowing homeowners to pause payments temporarily. This relief measure has become increasingly relevant in Indonesia, where the demand for mortgage houses is rising. With a growing number of individuals seeking affordable housing options, understanding mortgage loan forbearance options can help ensure financial stability and secure their dream homes.

Financial Planning

Effective financial planning is crucial for navigating mortgage loan forbearance successfully. Creating a comprehensive budget that Artikels income and expenses is essential. This budget should prioritize essential expenses such as housing, food, and healthcare while reducing discretionary spending.

Debt Management Techniques

Managing debt effectively is paramount during forbearance. Consider consolidating high-interest debts into a lower-interest loan or balance transfer credit card. Exploring debt settlement or credit counseling may also provide relief. By reducing debt obligations, homeowners can free up more funds to cover essential expenses.

Resources and Support

Navigating the challenges of mortgage loan forbearance can be daunting. Fortunately, numerous resources and organizations are available to provide guidance and assistance.

Seeking professional guidance from HUD-approved housing counselors is crucial. These experts can offer personalized advice, explore alternative options, and help you develop a plan to manage your financial obligations.

HUD-Approved Housing Counselors

- Provide free or low-cost counseling services.

- Offer personalized guidance on mortgage loan forbearance options.

- Help you understand your rights and responsibilities as a homeowner.

- Assist in developing a budget and exploring alternative solutions.

Final Summary

Mortgage loan forbearance stands as a testament to the collaborative efforts between lenders and homeowners. It is a lifeline that can prevent foreclosure, preserve homeownership, and empower individuals to regain financial footing. By navigating the process with informed decision-making and seeking professional guidance when needed, homeowners can emerge from financial distress with their homes intact and their dreams alive.

Popular Questions

What is the purpose of mortgage loan forbearance?

Mortgage loan forbearance provides temporary relief from mortgage payments for homeowners facing financial hardship, preventing foreclosure and preserving homeownership.

How do I qualify for mortgage loan forbearance?

Eligibility requirements vary by lender, but typically include experiencing financial hardship due to job loss, medical expenses, or natural disasters.

What are the potential impacts of mortgage loan forbearance on my credit score?

Forbearance can negatively impact credit scores if payments are not made during the forbearance period. However, timely payments and effective financial management can minimize the negative effects.