The world of cryptocurrency trading has become increasingly popular in recent years, offering traders the opportunity to profit from the fluctuations in the value of digital assets. Whether you’re a seasoned trader or just starting your journey into the crypto markets, understanding how to navigate this dynamic and ever-evolving landscape is crucial for success.

This comprehensive guide will provide you with a thorough understanding of cryptocurrency trading, from the basics of choosing an exchange and placing orders to advanced strategies and risk management techniques. We’ll also explore the psychological aspects of trading and delve into case studies of successful traders to help you develop your own trading mindset and approach.

Introduction to Cryptocurrency Trading

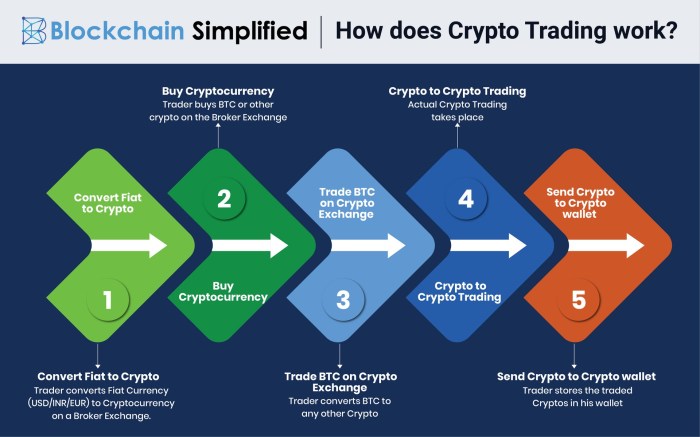

Cryptocurrency trading involves buying and selling digital currencies to make a profit. The market operates 24/7, allowing traders to capitalize on price fluctuations. There are numerous cryptocurrencies available, each with unique characteristics and values. Understanding the different types of cryptocurrencies and the dynamics of the market is crucial for successful trading.

Types of Cryptocurrencies

Cryptocurrencies can be classified into various categories based on their purpose and functionality:

- Bitcoin: The first and most well-known cryptocurrency, known for its decentralized nature and limited supply.

- Altcoins: All other cryptocurrencies besides Bitcoin, offering diverse features and use cases.

- Stablecoins: Cryptocurrencies pegged to a stable asset, such as the US dollar, to minimize price volatility.

- Utility Tokens: Cryptocurrencies designed for specific use cases within a particular platform or ecosystem.

- Security Tokens: Cryptocurrencies representing ownership or rights to an underlying asset, such as a stock or bond.

Overview of the Cryptocurrency Market

The cryptocurrency market is highly volatile, with prices fluctuating rapidly due to factors such as news, regulations, and market sentiment. Understanding market trends, analyzing technical indicators, and staying informed about industry developments are essential for successful trading.

- Market Capitalization: The total value of all cryptocurrencies in circulation, providing an indication of the market’s overall size and liquidity.

- Trading Volume: The amount of cryptocurrency bought and sold within a specific period, indicating market activity and liquidity.

- Exchanges: Platforms where cryptocurrencies are traded, offering different features, fees, and liquidity.

- Wallets: Digital storage solutions for holding cryptocurrencies, providing security and accessibility.

Getting Started with Cryptocurrency Trading

In the realm of cryptocurrency, where fortunes can be made and lost in a matter of clicks, embarking on a trading journey can be both exhilarating and daunting. To navigate this volatile landscape, it is crucial to equip yourself with the knowledge and tools to make informed decisions.

This guide will illuminate the path to getting started with cryptocurrency trading, empowering you to seize the opportunities and mitigate the risks that lie ahead.

Choosing a Cryptocurrency Exchange

The foundation of your trading endeavors lies in selecting a reputable and reliable cryptocurrency exchange. These platforms serve as marketplaces where buyers and sellers converge to execute trades. Factors to consider when choosing an exchange include:

- Security: Assess the exchange’s security measures, including encryption, cold storage, and regulatory compliance.

- Trading fees: Compare the fees associated with trading, such as maker/taker fees and withdrawal fees.

- Liquidity: Opt for exchanges with high liquidity to ensure smooth and timely trade executions.

- Supported cryptocurrencies: Verify that the exchange supports the cryptocurrencies you intend to trade.

- User interface: Choose an exchange with an intuitive and user-friendly interface that suits your trading style.

Creating an Account and Funding It

Once you have selected an exchange, the next step is to create an account. This typically involves providing personal information, such as your name, email address, and phone number. Most exchanges also require identity verification to comply with anti-money laundering and know-your-customer regulations.To

fund your account, you can deposit fiat currency (e.g., USD, EUR) or transfer cryptocurrencies from another wallet or exchange. The available deposit methods vary depending on the exchange you choose.

Types of Trading Orders

Cryptocurrency trading involves placing orders to buy or sell assets. There are various types of orders available, each with its own purpose and execution strategy:

- Market order: Executes a trade at the current market price, ensuring immediate execution but potentially resulting in slippage.

- Limit order: Specifies a price at which you are willing to buy or sell, ensuring a desired execution price but potentially leading to delayed or unfulfilled orders.

- Stop order: Triggers a trade when the price reaches a specified level, protecting against losses or locking in profits.

- Trailing stop order: Automatically adjusts the stop price as the market moves in a favorable direction, allowing you to capture potential profits while managing risk.

- One-cancels-the-other (OCO) order: Places two orders simultaneously, with one canceling the other when executed.

Understanding these order types and their nuances is essential for navigating the complexities of cryptocurrency trading and making informed decisions that align with your trading goals and risk tolerance.

Understanding Cryptocurrency Charts

Cryptocurrency charts are a valuable tool for traders, providing insights into price movements and potential trading opportunities. Technical analysis, the study of these charts, can help you identify trends, patterns, and support and resistance levels.

Reading Candlestick Charts

Candlestick charts are a popular way to visualize price data. Each candlestick represents a specific time period, typically one hour, four hours, or one day. The body of the candlestick shows the opening and closing prices, while the wicks (lines extending above and below the body) show the highest and lowest prices during that period.

- Green candlesticks indicate a price increase, with the body above the open.

- Red candlesticks indicate a price decrease, with the body below the open.

- Long wicks suggest volatility and indecision in the market.

- Short wicks indicate a strong trend and less volatility.

Indicators and Oscillators

Indicators and oscillators are mathematical formulas applied to price data to identify trends, momentum, and overbought/oversold conditions. Some popular indicators include:

- Moving averages (MA): Calculate the average price over a specified period, smoothing out price fluctuations.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes, indicating overbought or oversold conditions.

- Bollinger Bands: Calculate an upper and lower band based on the standard deviation of price data, indicating potential breakout zones.

Advanced Trading Techniques

Experienced traders employ advanced strategies to maximize profits and mitigate risks. These techniques involve leveraging financial instruments and utilizing technology to enhance trading efficiency.

Leverage and Margin Trading

Leverage allows traders to amplify their trading positions with borrowed funds. This can significantly increase potential returns, but also magnifies risks. Margin trading is a specific type of leverage where traders borrow from their broker to increase their buying power.

Trading Bots and Algorithms

Trading bots are automated programs that execute trades based on pre-defined rules or algorithms. They can monitor markets 24/7, analyze data, and make decisions faster than human traders. Algorithms, on the other hand, are mathematical models that guide trading decisions based on historical data and market trends.

Cryptocurrency Market Analysis

Understanding market dynamics is crucial in cryptocurrency trading. Conducting fundamental analysis provides insights into a cryptocurrency’s underlying value, allowing informed trading decisions. This involves assessing factors like the project’s team, technology, adoption rate, and overall market sentiment.

News and Social Media Insights

Monitoring news and social media can reveal market-moving events and sentiment shifts. Breaking news, regulatory changes, and project updates can significantly impact cryptocurrency prices. Social media platforms offer real-time insights into community sentiment and potential trading opportunities.

Identifying Market Trends

Technical analysis involves studying price charts to identify patterns and trends. By analyzing historical data, traders can predict future price movements and make informed trading decisions. Common chart patterns include support and resistance levels, moving averages, and candlestick patterns. Advanced traders utilize indicators like Bollinger Bands and Relative Strength Index (RSI) to refine their market analysis.

Risk Management in Cryptocurrency Trading

Risk management is paramount in cryptocurrency trading. Volatility, market fluctuations, and the inherent risks associated with digital assets necessitate a well-defined strategy to mitigate potential losses. Understanding risk management techniques and implementing a robust trading plan can significantly enhance your chances of success in this dynamic market.

Understanding Risk Management Techniques

Various risk management techniques are available to cryptocurrency traders. Stop-loss orders, position sizing, and diversification are essential tools for controlling risk exposure. Stop-loss orders automatically sell your assets when they reach a predetermined price level, limiting potential losses. Position sizing ensures you allocate only a manageable portion of your capital to each trade, reducing the impact of adverse price movements.

Diversification involves spreading your investments across different cryptocurrencies and asset classes, minimizing the impact of volatility in any single asset.

Creating a Trading Plan

A well-structured trading plan serves as a roadmap for your trading activities. It Artikels your trading objectives, risk tolerance, and entry and exit strategies. By defining these parameters upfront, you can avoid impulsive decisions and maintain discipline in your trading approach.

Your trading plan should also incorporate risk management measures such as stop-loss orders and position sizing.

Monitoring and Adjusting Your Strategy

Risk management is an ongoing process that requires continuous monitoring and adjustment. Regularly review your trading performance, identify areas for improvement, and adjust your strategy accordingly. Stay informed about market news and trends to make informed decisions and respond effectively to changing market conditions.

Cryptocurrency Trading Tools and Resources

Embarking on your cryptocurrency trading journey, it’s crucial to equip yourself with an arsenal of essential tools and resources that will empower you to navigate the volatile markets and maximize your trading performance.These tools provide invaluable insights into market trends, technical analysis, and risk management strategies, enabling you to make informed decisions and optimize your trading outcomes.

Trading Platforms

A trading platform serves as your gateway to the cryptocurrency markets, allowing you to execute trades, monitor market movements, and manage your portfolio. Choose a platform that aligns with your trading style, offers competitive fees, and provides robust security measures.

Technical Analysis Tools

Technical analysis involves studying historical price data to identify patterns and trends that can help predict future price movements. Utilize charting software that enables you to overlay technical indicators, such as moving averages, Bollinger Bands, and Fibonacci retracements, to gain insights into market momentum and potential trading opportunities.

Market Analysis Tools

Market analysis tools provide a comprehensive view of the overall cryptocurrency market, including market capitalization, trading volume, and sentiment analysis. By understanding market trends and investor sentiment, you can make informed decisions about which cryptocurrencies to trade and when to enter or exit positions.

Trading Communities and Forums

Join online trading communities and forums to connect with other traders, share ideas, and learn from experienced professionals. These platforms offer a wealth of knowledge, support, and insights that can enhance your trading strategies and decision-making process.

Risk Management Tools

Risk management is paramount in cryptocurrency trading. Utilize stop-loss orders to limit potential losses, and consider using leverage cautiously to minimize your exposure to market volatility.By leveraging these tools and resources, you empower yourself with the knowledge and insights necessary to navigate the cryptocurrency markets with confidence and maximize your trading potential.

Cryptocurrency Trading Psychology

Trading in cryptocurrency requires a strong understanding of market dynamics and a sound trading strategy. However, one often overlooked aspect that can significantly impact your success is trading psychology.

Trading psychology encompasses the emotional and mental aspects of trading. It involves understanding and managing your emotions, biases, and cognitive processes that influence your trading decisions.

Common Psychological Biases in Trading

- Confirmation Bias: The tendency to seek out information that confirms your existing beliefs, ignoring evidence that contradicts them.

- FOMO (Fear of Missing Out): The fear of losing out on potential gains, leading to impulsive trading decisions.

- Greed: The desire for excessive profits, often leading to holding onto losing positions too long.

- Overconfidence: Believing you have superior knowledge or skills, leading to reckless trading.

Overcoming Emotional Trading

- Identify Your Biases: Recognize and acknowledge your psychological biases. This awareness can help you avoid making impulsive decisions based on emotions.

- Develop a Trading Plan: Having a clear trading plan and sticking to it can help reduce emotional decision-making and prevent you from deviating from your strategy.

- Practice Discipline: Enforce self-discipline by setting trading rules and adhering to them. This will help you stay focused and avoid emotional reactions.

- Manage Stress: Trading can be stressful. Find healthy ways to manage stress, such as exercise, meditation, or spending time in nature.

Case Studies of Successful Cryptocurrency Traders

The world of cryptocurrency trading is filled with stories of individuals who have achieved remarkable success. These traders have developed unique strategies, mastered risk management techniques, and cultivated a winning mindset. By examining their case studies, we can gain valuable insights into the art of cryptocurrency trading.

Jesse Livermore

Jesse Livermore, known as the “Boy Plunger,” was a legendary trader who made a fortune in the early 1900s. He was known for his bold bets and uncanny ability to predict market movements. Livermore’s trading strategy was based on identifying and following trends, while managing risk through strict stop-loss orders.

George Soros

George Soros is a Hungarian-born investor and philanthropist who is widely considered one of the greatest traders of all time. His Quantum Fund is known for its massive profits and its use of sophisticated trading techniques. Soros’s approach involves a deep understanding of macroeconomic trends and the use of leverage to enhance returns.

Bill Miller

Bill Miller is a legendary value investor who managed the Legg Mason Value Trust for over 20 years. He achieved remarkable returns by investing in undervalued companies with strong fundamentals. Miller’s success in cryptocurrency trading stems from his ability to identify emerging trends and invest in promising cryptocurrencies at an early stage.

Andreas Antonopoulos

Andreas Antonopoulos is a renowned cryptocurrency expert and advocate. He has played a pivotal role in educating the public about Bitcoin and other cryptocurrencies. Antonopoulos’s trading strategy is based on a long-term belief in the potential of cryptocurrencies. He advocates for a “buy and hold” approach, focusing on accumulating crypto assets over time.

Vitalik Buterin

Vitalik Buterin is the co-founder of Ethereum, one of the most successful cryptocurrencies in the world. Buterin is a brilliant programmer and a thought leader in the cryptocurrency space. His trading strategy involves a combination of technical analysis and fundamental research.

Buterin is known for his patience and willingness to hold onto crypto assets for the long term.

Final Thoughts

As you embark on your cryptocurrency trading journey, remember that knowledge, discipline, and emotional control are key. By embracing the concepts Artikeld in this guide, you’ll be well-equipped to navigate the complexities of the crypto markets and maximize your potential for success.

Remember, trading involves risk, so always trade responsibly and within your means.

Common Queries

What are the different types of cryptocurrency exchanges?

Cryptocurrency exchanges can be centralized or decentralized. Centralized exchanges are operated by a single entity, while decentralized exchanges are peer-to-peer networks that facilitate trading without an intermediary.

What is a cryptocurrency wallet?

A cryptocurrency wallet is a software or hardware device that stores your private keys and allows you to send, receive, and manage your digital assets.

What is a cryptocurrency trading bot?

A cryptocurrency trading bot is an automated software program that executes trades based on predefined rules and strategies.

What is the importance of risk management in cryptocurrency trading?

Risk management is crucial in cryptocurrency trading as it helps you mitigate potential losses and protect your capital. It involves setting stop-loss orders, managing your position size, and diversifying your portfolio.