Bitcoin business risks pose unique challenges and opportunities for companies embracing this digital currency. From extreme price volatility to evolving regulatory landscapes, businesses must navigate a complex terrain to harness the potential of Bitcoin while mitigating associated risks.

Understanding these risks is crucial for informed decision-making, ensuring businesses can capitalize on the benefits of Bitcoin while safeguarding their operations and reputation.

Volatility and Price Fluctuations

Bitcoin’s value can experience extreme swings, both upwards and downwards, within short periods. This volatility poses significant risks for businesses that accept or hold Bitcoin as part of their operations.

Sudden price changes can disrupt business planning, affect cash flow, and lead to losses if the value of Bitcoin drops unexpectedly. For instance, in 2018, the value of Bitcoin plummeted by over 80% from its peak, causing substantial losses for businesses that had invested heavily in the cryptocurrency.

Impact on Business Operations

- Cash flow disruptions:Volatile Bitcoin prices can make it challenging for businesses to accurately forecast cash flow, as the value of their Bitcoin holdings can fluctuate rapidly.

- Operational uncertainty:Businesses that accept Bitcoin as payment may face uncertainty in their revenue streams due to price fluctuations, which can affect their ability to plan and budget effectively.

- Loss of value:If the value of Bitcoin drops significantly, businesses holding Bitcoin as an asset or investment may experience substantial losses.

Regulatory Uncertainty

The regulatory landscape for Bitcoin is constantly evolving, with different jurisdictions taking varying approaches. This uncertainty can create risks for businesses operating in this space.

When it comes to Bitcoin business risks, there’s a need to manage volatility and fraud. One way to mitigate these risks is by implementing robust enterprise resource planning (ERP) systems. For construction companies looking to streamline their operations, ERP for Construction: The Ultimate Guide to Streamlining Your Operations provides valuable insights on how to navigate these challenges effectively.

By integrating ERP solutions, businesses can gain greater control over their financial data, improve project management, and enhance overall operational efficiency, ultimately contributing to a more secure and sustainable Bitcoin business environment.

In jurisdictions with unclear or unfavorable regulations, businesses may face legal challenges, fines, or even criminal charges. They may also find it difficult to obtain insurance or banking services.

Legal Challenges

- Businesses operating in jurisdictions with unclear or unfavorable regulations may face legal challenges from regulators or law enforcement agencies.

- These challenges could include civil lawsuits, criminal charges, or regulatory investigations.

Financial Risks

- Businesses operating in jurisdictions with unclear or unfavorable regulations may find it difficult to obtain insurance or banking services.

- This can increase the cost of doing business and make it difficult to manage financial risks.

Reputational Risks

- Businesses operating in jurisdictions with unclear or unfavorable regulations may face reputational risks.

- This can damage the company’s brand and make it difficult to attract customers or partners.

Security Risks

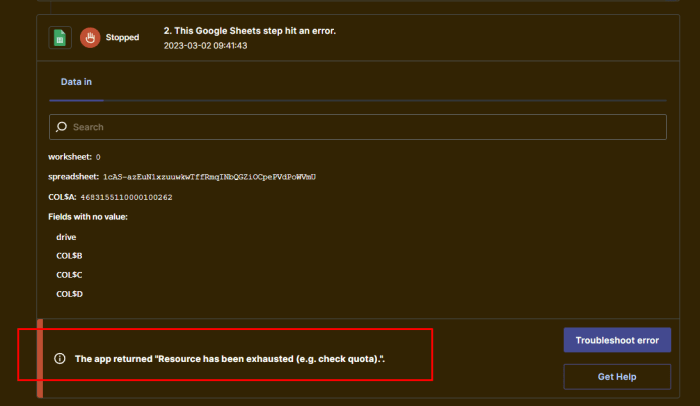

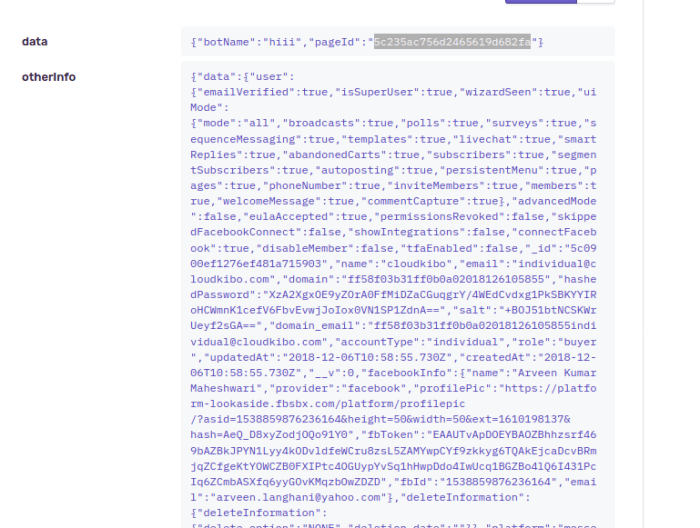

Bitcoin’s decentralized and digital nature poses unique security challenges that businesses need to be aware of. These include hacking, theft, and scams.

Hackers can target Bitcoin exchanges, wallets, or individual users to steal funds. They may use phishing attacks, malware, or other techniques to gain access to private keys or sensitive information.

Mitigating Security Risks

- Use strong security measures, such as two-factor authentication and encryption, to protect your Bitcoin wallets and accounts.

- Store your Bitcoin in a hardware wallet or a reputable exchange that offers robust security features.

- Be cautious of phishing emails and websites that attempt to trick you into revealing your private keys or other sensitive information.

- Educate your employees about Bitcoin security best practices and train them to recognize and avoid scams.

- Have a plan in place for responding to security breaches or theft, including procedures for recovering funds and notifying customers.

Scalability and Transaction Fees

The Bitcoin network’s scalability limitations can impact business transactions by leading to slower confirmation times and higher transaction fees during periods of high network activity. These limitations arise from the network’s block size limit, which restricts the number of transactions that can be processed per block.

High transaction fees can also impact business profitability, especially for businesses that process a high volume of transactions. These fees can eat into profits and make it challenging to remain competitive in the market.

Transaction Fees

- Transaction fees are paid to miners as an incentive to process and confirm transactions on the Bitcoin network.

- Fees vary based on network congestion and the size of the transaction.

- During periods of high network activity, fees can rise significantly, impacting business profitability.

Competition and Market Dynamics

The Bitcoin industry is highly competitive, with numerous businesses vying for market share. Key players include cryptocurrency exchanges, mining pools, and wallet providers. Intense competition drives businesses to innovate and offer competitive products and services to attract and retain customers.

Competitive Landscape

The cryptocurrency exchange market is particularly competitive, with established platforms like Coinbase and Binance dominating the landscape. New entrants face challenges in gaining market share and establishing a strong customer base. Mining pools also compete fiercely for block rewards, leading to consolidation and the emergence of large-scale mining operations.

Market Dynamics

The Bitcoin market is influenced by various factors, including:

Supply and Demand

As Bitcoin businesses face unique risks in managing their operations, adopting an Enterprise Resource Planning (ERP) system can be a valuable tool to streamline processes and mitigate these risks. ERP System Example: The Ultimate Guide to Transforming Your Business provides comprehensive insights into the benefits of implementing an ERP system for enhanced financial management, supply chain optimization, and risk mitigation.

By leveraging an ERP system, Bitcoin businesses can navigate the complexities of their operations more effectively and minimize potential risks.

The scarcity of Bitcoin, coupled with increasing adoption, drives its price.

Regulatory Environment

Uncertainties and evolving regulations can impact market sentiment and business operations.

Economic Conditions

Economic downturns can lead to decreased demand for Bitcoin, while positive economic indicators can boost its value.

Technological Advancements

Innovations in blockchain technology and the development of new applications can impact market dynamics.These factors create a dynamic and ever-evolving market, presenting both opportunities and challenges for businesses operating in the Bitcoin industry.

Legal and Tax Implications

Businesses must navigate the legal and tax implications of using Bitcoin. These include understanding the legal status of Bitcoin, its tax treatment, and potential liabilities and reporting requirements.

Legal Status

The legal status of Bitcoin varies by jurisdiction. In some countries, Bitcoin is recognized as legal tender, while in others, it is considered a commodity or an asset. Businesses must be aware of the legal status of Bitcoin in their jurisdiction to ensure compliance with local laws.

Bitcoin businesses face numerous risks, including price volatility, regulatory uncertainty, and cyber threats. To mitigate these risks, businesses need to implement robust risk management strategies and consider using enterprise resource planning (ERP) systems. ERP systems provide a centralized platform for managing all aspects of a business, from finance and accounting to supply chain management.

By integrating data from across the organization, ERP systems can help businesses identify and mitigate risks, improve efficiency, and make better decisions.

Tax Treatment, Bitcoin business risks

The tax treatment of Bitcoin also varies by jurisdiction. In some countries, Bitcoin is taxed as a capital gain, while in others, it is treated as a form of income. Businesses must understand the tax implications of using Bitcoin to avoid any potential liabilities.

Potential Liabilities

Businesses using Bitcoin may face potential liabilities, such as those related to fraud, theft, or hacking. They must implement robust security measures to protect their Bitcoin assets and mitigate these risks.

Reporting Requirements

Some jurisdictions may have specific reporting requirements for businesses using Bitcoin. These requirements may include reporting Bitcoin transactions or holding to regulatory authorities. Businesses must be aware of these reporting requirements to ensure compliance.

In the volatile world of Bitcoin, businesses face unique risks that demand proactive mitigation strategies. One crucial aspect to consider is the integration of robust enterprise resource planning (ERP) and customer relationship management (CRM) systems. As outlined in ERP vs.

CRM: A Comprehensive Guide to Unraveling the Key Differences , these systems can streamline operations, enhance customer engagement, and provide valuable insights to navigate the complexities of Bitcoin business risks.

Closure

Bitcoin business risks demand careful consideration and proactive risk management strategies. By staying abreast of regulatory changes, implementing robust security measures, and monitoring market dynamics, businesses can mitigate risks and unlock the potential of Bitcoin for growth and innovation.

FAQ Corner: Bitcoin Business Risks

What are the primary risks associated with Bitcoin for businesses?

Bitcoin businesses face risks related to price volatility, regulatory uncertainty, security breaches, scalability limitations, competition, reputational damage, and legal and tax implications.

How can businesses mitigate the risks of Bitcoin price volatility?

Businesses can hedge against price volatility by using hedging instruments, diversifying their portfolio, and implementing risk management strategies.

What are the key security measures businesses should implement to protect their Bitcoin assets?

Businesses should employ robust security measures such as cold storage, multi-factor authentication, and regular security audits to safeguard their Bitcoin holdings.